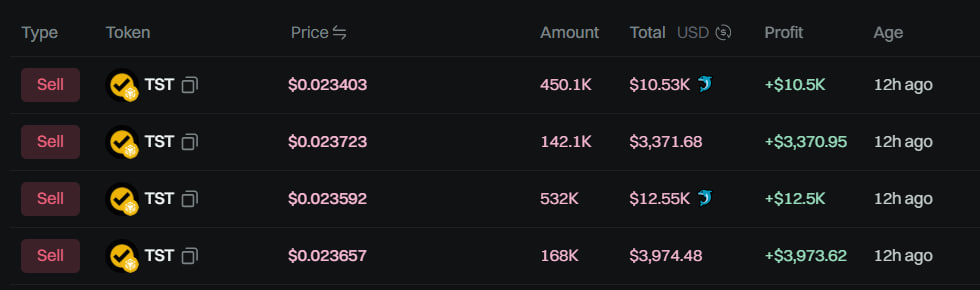

- A developer wallet has sold TST worth $30,400 in four transactions.

- The participant has fully exited his TST position, sparking concerns among the community.

- Data shows the alt’s open interest plunged 6.15%, highlighting emerging bearish sentiments.

Digital tokens performed well on Monday as the cryptocurrency market capitalization reclaimed $4 trillion, with Bitcoin surpassing $122,000.

While Ethereum’s jump past $4,300 renewed the altseason narrative, Test’s (TST) momentum weakened as transactions involving its creator dented sentiments.

Gmgn data shows the investor dumped his entire TST stash within 12 hours, offloading assets worth around $30,400.

The wallet executed the sell-off in four different transactions, leaving the portfolio without Test tokens.

While the amount might not sound staggering in the cryptocurrency industry, it’s enough to dent confidence in niche and smaller-cap tokens like TST.

Market players often perceive a full exit by an insider or developer as a negative gesture.

The altcoin is already flashing bearish signals. It has lost around 1.40% in the past 24 hours despite broad market recoveries.

Also, data shows TST’s Open Interest has dipped by 6.15%, confirming that traders are closing existing positions.

Why the dump matters

Investors often view team and developer holdings as “trust anchors.”

If individuals who launched the asset still hold a substantial stake, it signals confidence in the project’s future.

However, the perceived confidence dwindles once they liquidate their entire holdings.

For the Test coin, the optics are challenging.

The remarkable 2025 surge to $0.52 materialized as the community misinterpreted Binance founder Changpeng Zhao’s tutorial as an endorsement.

CZ clarified that the Test was just an experimental coin for BNB Chain’s tutorial and not an investment vehicle.

He even confirmed that they had deleted the address used to create a token.

That meant no individual could interact with or alter the digital token anymore.

Thus, the sudden developer exit raised eyebrows.

Is it a calculated exit ahead of possible volatility or offloading assets left from tutorial days?

Bearish sentiments prevail

TST’s momentum has shifted to bearish following the developments.

Coinglass data shows its Open Interest plunged sharply by 6.15% after the sudden sell-off.

For context, Open Interest tracks the total outstanding perpetual swap or futures contracts.

A decline in this metric shows traders exiting positions without executing new ones, indicating increased caution or fading optimism.

Also, TST displays weakness on its daily price chart.

It has retraced to $0.02561 with a 30% increase in 24-hour trading volume, indicating increased activity from participants potentially closing their positions.

Test Token: a coin with zero purpose?

TST’s primary challenge is that it lacks real-world utility.

It was an experimental asset to show developers how to deploy tokens on the BNB Chain.

TST doesn’t power any NFT platform, metaverse project, or DeFi app.

However, even useless things can find a considerable following in the crypto world.

TST has over 16K followers on X. Players often treat these assets like meme tokens, waiting for hype to propel prices.

Meanwhile, the latest developer exit has tested the community’s optimism.