Bitcoin proxy Strategy makes smallest BTC purchase since March

Key Takeaways

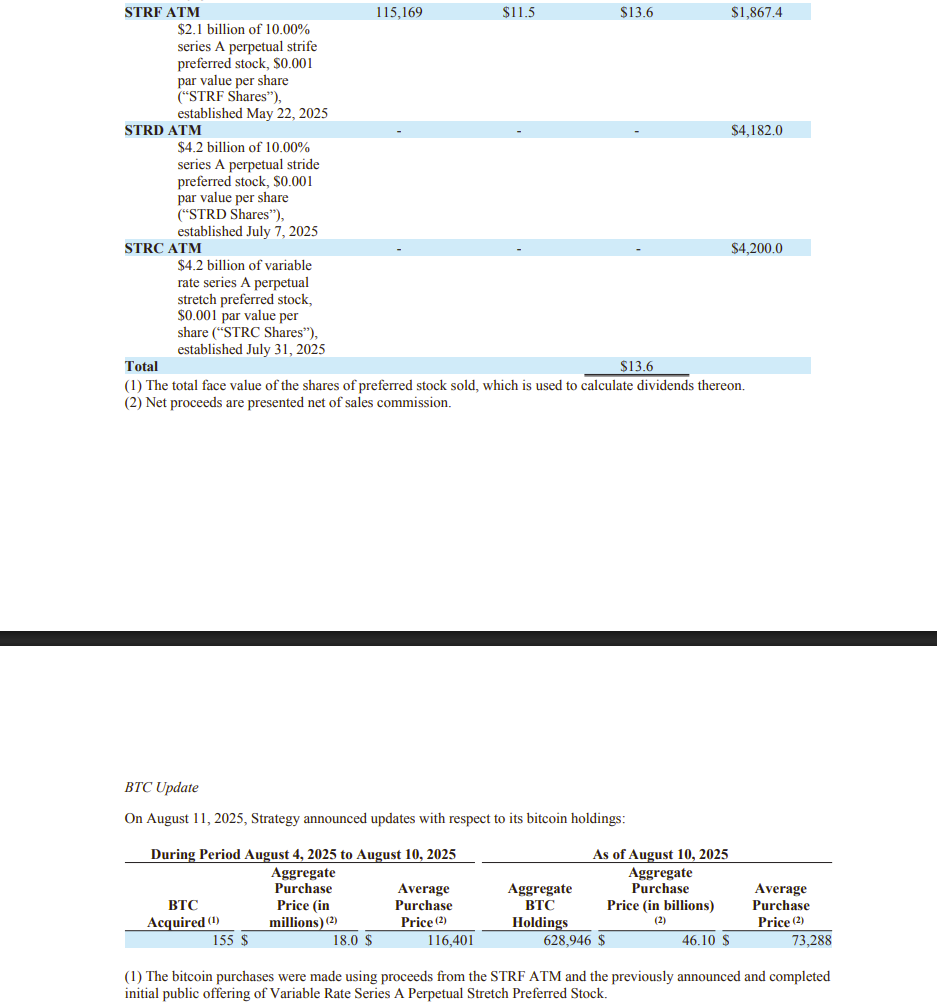

- Strategy purchased 155 additional Bitcoin for $18 million, increasing its digital asset holdings.

- The acquisition price equates to over $116,000 per Bitcoin.

Strategy, the world’s largest Bitcoin corporate holder, has resumed its BTC acquisition. The company announced Monday it had added 155 BTC to its treasury last week, its smallest purchase since mid-March.

Michael Saylor, the company’s Executive Chairman, dropped a hint about the acquisition yesterday. When Saylor puts out the Bitcoin tracker, it is often followed by an announcement within a few days.

The latest purchase, disclosed in an SEC filing , was made at an average price of $116,401 per BTC. Bitcoin briefly reclaimed $122,000 earlier today, according to TradingView.

Following the purchase, Strategy’s BTC holdings have grown to 628,791 BTC. With BTC now trading at around $119,500, the stash is valued at more than $75 billion, giving the company unrealized gains of about $29 billion.

Strategy financed its latest acquisition with proceeds from selling Series A Perpetual Strife Preferred Stock (STRF) and from the completed IPO of Variable Rate Series A Perpetual Stretch Preferred Stock. Between August 4 and 10, it sold more than 115,000 STRF shares, bringing in over 13 million dollars in net proceeds.

Strategy could potentially accumulate up to 7% of the global Bitcoin supply , as stated by Saylor. However, he insists on not aiming for total dominance, emphasizing a model that promotes decentralized participation in Bitcoin.

Saylor ardently supports the growth of Bitcoin corporate adoption and the decentralization ethos of the crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Opinion: The GENIUS Act Has Become Law, Banks Should Not Attempt to Rewrite It Now

When there is competition, consumers are the real winners.

How much further can the institutional bull market go after the rate cut?

The project philosophies of Bitcoin, Ethereum, and Solana correspond to three human instincts when facing the future: survival, order, and liquidity, respectively.

Overtake partners with World to bring Proof-of-Human to the OVERTAKE trading marketplace

When identity verification is combined with custodial payments, the reliability of transactions is significantly enhanced, which has the potential to drive large-scale user adoption and long-term market expansion.

Big Volatility During the Rate-Cut Cycle: Will Bitcoin Rise First and Then Fall?

The Federal Reserve has begun a rate-cutting cycle, which could trigger a parabolic surge; however, this bull market may end with a historic crash.