Date: Tue, Aug 12, 2025 | 04:15 AM GMT

The cryptocurrency market is seeing a slight cooldown as Ethereum (ETH) touched $4,349 before pulling back to around $4,285. This short-term retreat is spilling over into several major memecoins, including Dogwifhat (WIF).

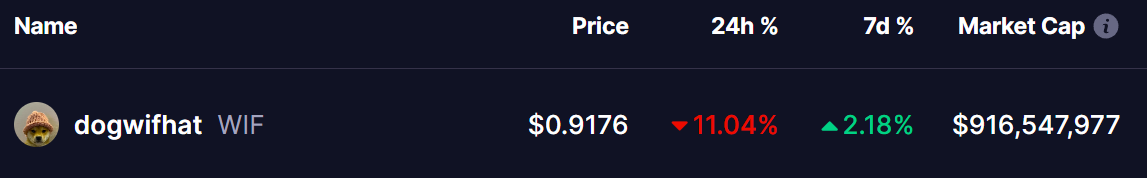

WIF has turned red today, dipping 11% and wiping out almost all of its weekly gains. More importantly, its latest price action is flashing a familiar pattern that could hint at its next move.

Source: Coinmarketcap

Source: Coinmarketcap

Familiar Pattern Points to Potential Downside

On the daily chart, WIF remains locked inside a symmetrical triangle pattern, but short-term signals lean cautious. A notable fractal pattern, reminiscent of mid-June’s price action, is unfolding again within this consolidation.

In June, WIF broke below its 25-day moving average (marked by the first yellow circle). The failed recovery attempt back above that line triggered a sharp 36% sell-off, taking the price to the lower wedge boundary near $0.64.

Dogwifhat (WIF) Daily Chart/Coinsprobe (Source: Tradingview)

Dogwifhat (WIF) Daily Chart/Coinsprobe (Source: Tradingview)

Fast forward to now — the second yellow circle marks another breakdown from the 25-day MA. Price action is showing a similar inability to reclaim that level, raising the possibility of history repeating itself.

What’s Next for WIF?

If WIF fails to climb back above the 25-day MA ($1.01), the pattern suggests a potential slide toward the lower wedge trendline, which aligns closely with the 200-day MA support near $0.76. This would represent a drop of roughly 17% from current levels.

However a decisive reclaim and hold above the 25-day MA could nullify the bearish outlook and spark renewed buying interest, setting the stage for an upside breakout from the symmetrical triangle.