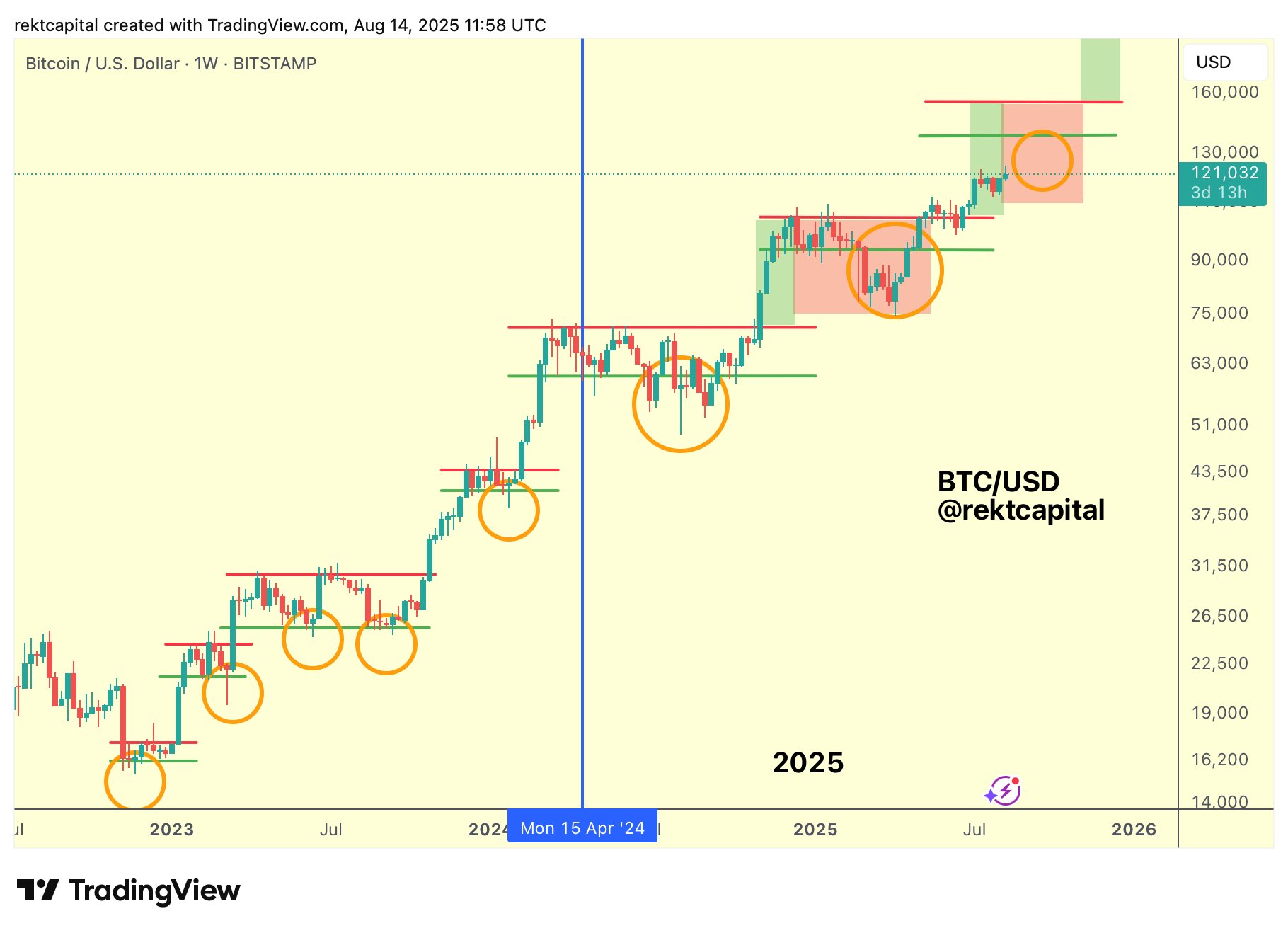

Bitcoin is nearing a “price discovery correction” after six weeks of gains, with historical patterns suggesting a potential dip before new all-time highs in Q4.

-

Bitcoin’s current “price discovery uptrend” is approaching its seventh week, indicating a likely correction.

-

Historical analysis shows BTC typically halts its second uptrend after five to seven weeks.

-

A dip now could still set the stage for new all-time highs later this year.

Bitcoin price analysis indicates a potential correction after six weeks of gains, with expectations for new highs in Q4. Stay informed!

What is Bitcoin’s Price Discovery Correction?

Bitcoin’s price discovery correction refers to a phase where the price stabilizes or declines after a significant uptrend. This typically occurs after several weeks of gains, as seen in previous halving cycles.

How Does Bitcoin’s Price Trend After Halving?

Historically, Bitcoin’s price tends to follow a pattern post-halving, characterized by successive uptrends followed by corrections. Data shows that after each halving, the second uptrend usually concludes within five to seven weeks, as noted by trader Rekt Capital.

Frequently Asked Questions

What causes Bitcoin price corrections?

Bitcoin price corrections are often caused by profit-taking, market sentiment shifts, or external economic factors affecting investor confidence.

When can we expect Bitcoin to reach new all-time highs?

While predictions vary, many analysts believe that Bitcoin could reach new all-time highs in Q4, especially if a correction occurs soon.

Key Takeaways

- Price Discovery Uptrend: Bitcoin is nearing the end of its current uptrend, indicating a potential correction.

- Historical Patterns: Previous cycles show that corrections typically happen after five to seven weeks of gains.

- Future Outlook: A dip now could pave the way for new highs later this year.

Conclusion

In summary, Bitcoin’s price discovery correction is imminent as it approaches the seventh week of its uptrend. Historical data suggests that this phase could lead to new all-time highs in Q4. Investors should stay alert for potential market shifts.