Today's Outlook

1、Bless will close the TIME token airdrop registration window.

2、Deribit launches USD Coin (USDC)-settled linear options for Bitcoin (BTC) and Ethereum (ETH).

3、A New York court will hold a hearing today on LIBRA project advisor Hayden Davis. Davis recently admitted for the first time that LIBRA is a meme token. The court will determine whether Davis and his partners manipulated LIBRA for profit.

Macro & Hot Topics

1、Ukraine proposes buying $100 billion in US arms for security guarantees. According to the Financial Times, a document shows Ukraine will commit to spending $100 billion—funded by Europe—on US arms as part of a peace deal with Russia in exchange for American security assurances. Kyiv and Washington would also sign a separate $50 billion deal for joint drone production with Ukrainian firms. Four sources say this proposal is on Ukraine’s talking points list ahead of a meeting with US President Trump.

2、SEC once again delays decisions on Truth Social and multiple crypto ETFs. The SEC postponed the verdict on Truth Social's Bitcoin/Ethereum ETF to October 8. Decisions for CoinShares Litecoin ETF, CoinShares XRP ETF, and 21Shares Core XRP ETF were also deferred this Monday. Proposals related to XRP trusts and the 21Shares Core Ethereum ETF were delayed as well. The SEC says more time is needed to consider rule changes and related issues.

3、Dutch firm Amdax plans to launch a Bitcoin treasury on Euronext. Amsterdam-based crypto services provider Amdax announced plans to launch AMBTS (Amsterdam Bitcoin Treasury Strategy), aiming to hold at least 1% of total Bitcoin supply. CEO Lucas Wensing said over 10% of BTC supply is already held by institutions, governments, and corporates, adding that now is the time to boost strategic reserves. Bitcoin has surged 32% YTD, hitting new highs fueled by regulatory progress and Trump’s support. AMBTS will seek private investment, targeting 1% of total BTC long-term.

4、Volkswagen Singapore partners FOMO Pay to accept digital currency car payments. Volkswagen Singapore (VGS) has joined with regulated payment provider FOMO Pay to allow customers to buy cars and pay for services with BTC, ETH, and stablecoins (USDT, USDC, etc). Daily payment cap: S$4,500 per customer; cumulative cap: S$13,500. This move follows Singapore’s trend toward digital asset adoption, aiming to improve payment speed, security, global connectivity, and reduce transaction costs.

Market Overview

1、BTC & ETH bounced after short-term correction; market diverges. Over the past 24h, $567 million in liquidations were mostly long positions.

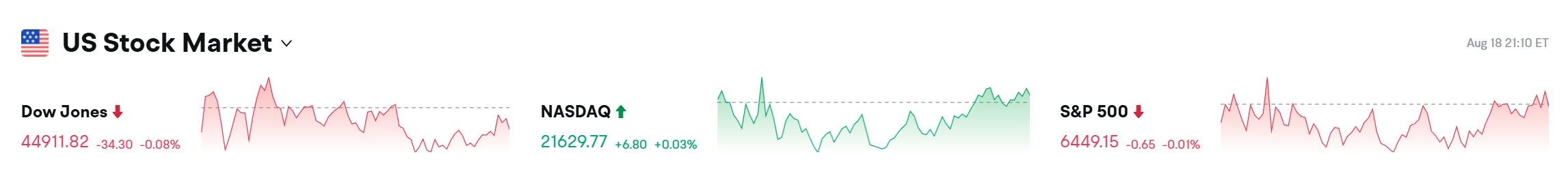

2、S&P 500 closed flat; Novo Nordisk rallied 7% on European stocks; Bitcoin briefly dipped below $115K; oil rebounded.

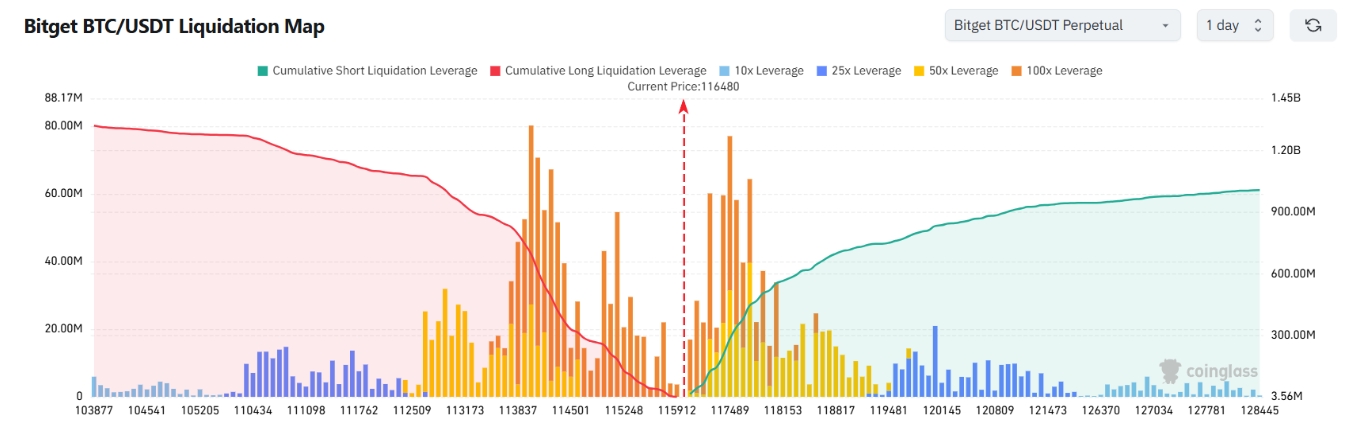

3、Bitget BTC/USDT liquidation map: If prices drop 2,000 to around $114,479 (from $116,479), cumulative long liquidation could exceed $370 million. If prices rise 2,000 to $118,479, cumulative short liquidation could reach $280 million+. With long liquidation potential much higher than shorts, traders should manage leverage prudently to prevent forced liquidations in volatile moves.

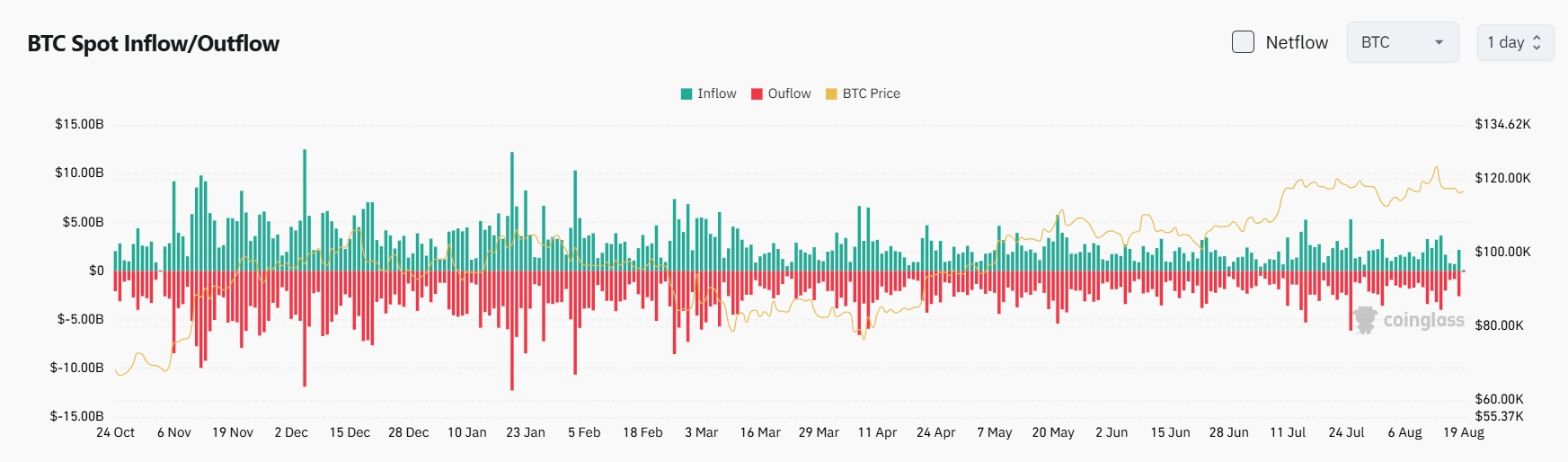

4、Inflow/outflow: BTC spot inflows: $2.1B; outflows: $2.5B; net outflow: $400M (last 24h)

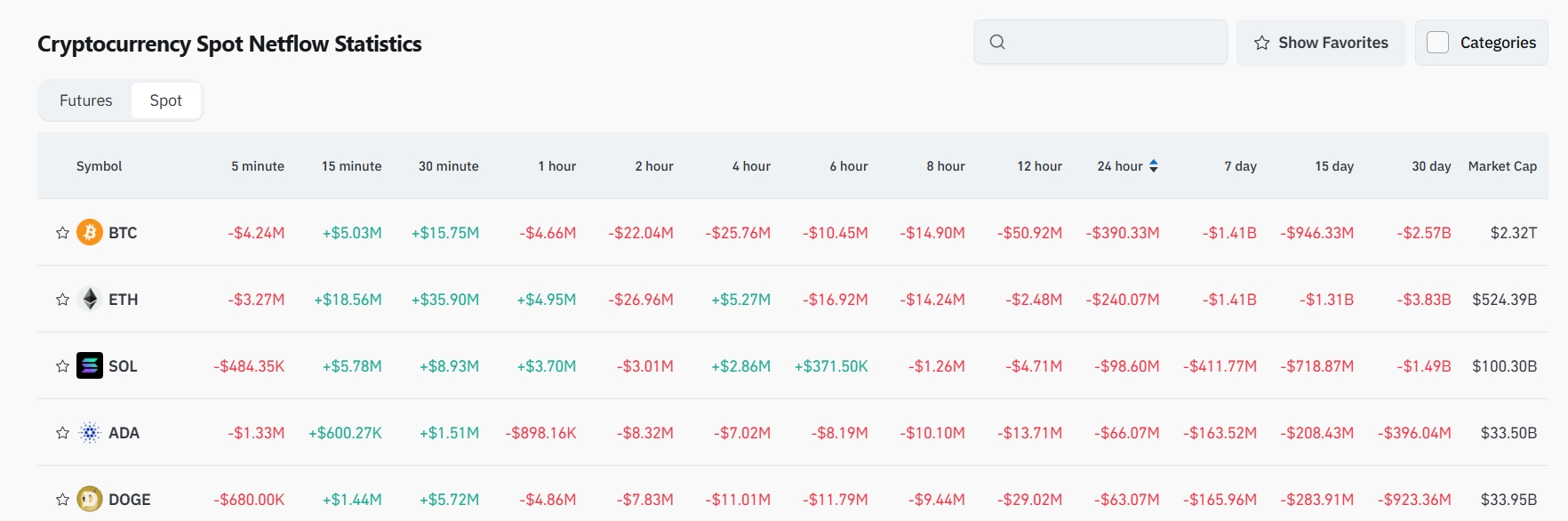

5、Contract trading: Net outflow leads in $BTC, $ETH, $SOL, $ADA, $DOGE contracts, suggesting possible trading opportunities.

Institutional Views

Greeks.Live: About 880,000 ETH are expected to exit staking from now to the end of the month, which could translate to ~$2B weekly sell pressure.

Moonrock Capital: A strong ETH rebound from the $4,000–$4,100 range would be a classic bullish signal.

News Flash

1、Ukraine offers to buy $100 billion in U.S. arms for security guarantees

2、South Korea’s FSC plans to introduce a stablecoin regulatory bill by October

3、Indian tax authorities launch crypto taxation policy dialogue

Project Updates

1、JPYC’s yen stablecoin to deploy on Ethereum, Avalanche, Polygon

2、SEC once again delays Truth Social and several crypto ETF approvals

3、Starknet’s v0.14.0 proposal passed; mainnet launch set for Sept 1

4、Injective launches the first on-chain NVIDIA H100 GPU derivatives market

5、institutions bought $4.7B worth of ETH last week; stablecoin supply up $6.72B

6、$1.39M used to buy back 17.32M SKY tokens on Sky Protocol last week; cumulative buybacks now 1.14B SKY

7、SOL Strategies’ validator staking wallets hit a record 6,031

8、Volkswagen Singapore partners with FOMO Pay to accept BTC, ETH, stablecoin payments for vehicles/services

9、Bonk.Fun adds “Points” label to its launchpad

10、BTCS announces ETH dividend and loyalty rewards—$0.05 in ETH per share

Trending on X/Twitter

1、AB Kuai.Dong: BMNR’s Accelerated ETH Buying—370,000 ETH in 7 Days; Institutional Hand-Off in Progress BitMine (BMNR) revealed a surge in holdings from 1.15M to 1.52M ETH in just a week—an estimated $1.58B worth bought during the ETH pullback. Meanwhile, established Eastern ETH whales, miners, and profit-takers are gradually exiting, while Western Wall Street forces are buying via public companies and strategies. Institutional and public company ETH holdings only account for 5–6% (vs BTC’s 12%). It feels like ETH is at a handover stage akin to BTC last year: as institutional FOMO heats up, a reshuffle is brewing.

Link:

https://x.com/_FORAB/status/1957420467905810521

2、Phyrex: U.S. Stocks Steady; BTC Pullback Doesn’t Break Core Bullish Structure—$115,000 Support Holds Strong BTC pulled back today despite a rally in China’s A-shares, but US stocks remain resilient; Buffett’s Apple trim failed to spark selloff, signaling no clear bearish driver. Russia-Ukraine talks are progressing peacefully, with no direct impact on macro/US stock fundamentals. The current churn is led by short-term bottom fishers; early holders remain steady, with ETFs/spot volumes still low and little panic selling. All in all, $115,000 remains solid support; $117,000 may become new consensus resistance/support. No structural change in the market so far.

Link:

https://x.com/Phyrex_Ni/status/1957525732982419895

3、Lsp: New Chains Must Find Unique Positions—Outgrowing the 'ETH Killer' Narrative The game for new layer 1 blockchains has changed since the DeFi era; simply launching a DEX or lending protocol on a new chain rarely yields big returns now. The past saw only SOL and BSC break through, both with top-tier exchange ecosystems ensuring liquidity and listings. Ordinary chains lacking liquidity and fiat on-ramps rarely produce durable opportunities. Chain performance is no longer a big differentiator; ecosystem narratives are also losing steam. The few L1 breakthroughs—e.g., Sui (by subsidized TVL and listing power), TRON (stablecoin transfers making up 40% of on-chain gas)—do so via differentiated positioning. Success for new chains now depends on vertical focus, e.g., Plasma/Stable/Stripe-Tempo on payments, or X Layer/Mantle focusing on RWA, AI, ZK, etc. The future depends on real on-chain activity and wealth creation, not marketing hype. OKX’s X Layer draws attention, but its true value likely lies in payment/apps, not just ecosystem bribes.

Link:

https://x.com/lsp8940/status/1957274104798789971

4、Crypto Old Fish: Tom Lee & Cathie Wood Pushing ETH Isn’t a Retail Play, It’s About 'Making the Pie Bigger' Some claim Tom Lee and Cathie Wood “shill” ETH to dump on retail, but this is misguided; retail flows are tiny compared to their scale, and they aren’t looking to farm retail like low-cap project insiders. Their exit depends on growing the entire crypto pie—inviting more institutional & even sovereign wealth. While retail can cash out for a 30% pump, major funds must wait until the industry is much larger and liquid. Their public bullishness reflects aligned interests—with us—as they work to grow crypto's total market cap for mutual gain.

Link:

https://x.com/Billions_2022_/status/1957428132245606459