Cryptocurrencies outperform the S&P 500 in Q2, but Eastern European media continues to decline

The second quarter of 2025 saw a strong recovery in the global cryptocurrency market, with a 21,72% appreciation after an 18% decline earlier in the year. Cryptoassets outperformed even traditional indices like the S&P 500, driven by a combination of favorable institutional and regulatory factors—including increased adoption of ETFs, corporate Bitcoin acquisitions, and legislative advances in the United States.

In the field regulatory , the US repealed IRS guidelines that restricted investors and greenlit the Market Structure Bill. This easing of restrictions also benefited the adoption of stablecoins, accelerated by companies of all sizes and by Circle's historic IPO.

Despite market optimism, the media landscape in Eastern Europe followed a different trajectory. According to a report by Outset PR based on data, crypto-native media outlets in the region saw an 18,29% drop in traffic during the quarter, with only 36,9% showing growth. The majority of traffic (80,71%) was concentrated on just 17 sites, such as Comparic.pl, Bithub.pl e Forklog.com.

Concentrated traffic and regulatory resistance

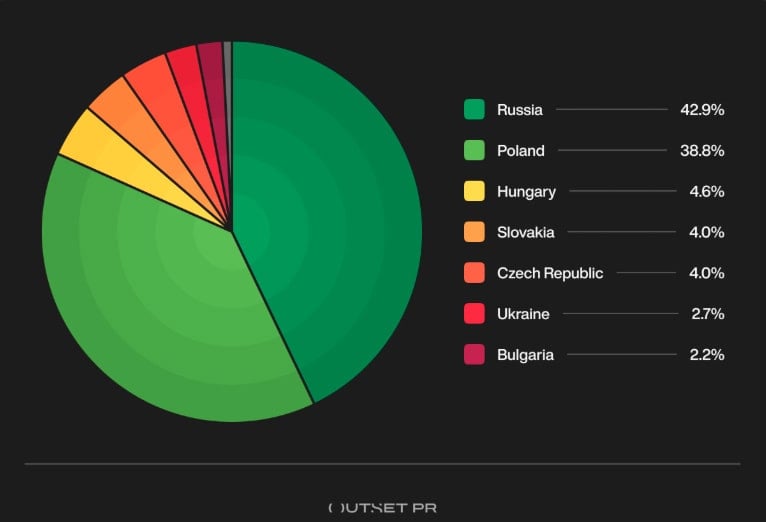

Poland and Russia led the way in terms of traffic, accounting for over 82% of the region's crypto-native media traffic. Among generalist media outlets—which still dominate the total volume, with 894 million visits—75% of traffic was also concentrated in these two countries. Platforms such as Monitorfx.pl, for example, have shown exponential growth, indicating emerging opportunities even outside the crypto core.

The traffic structure reveals a significant reliance on direct access (45,20%) and organic search (42,47%) among crypto-native publishers. Paid traffic remained virtually non-existent, and access from social media platforms and AI tools like ChatGPT and Perplexity began to gain relevance, albeit modestly.

AI and algorithms reshape the landscape

Generative AI tools have emerged as a new avenue for content discovery. About 20,6% of crypto-native publishers and 41,8% of generalist publishers registered traffic originating from these platforms, albeit in low volumes. Publishers reported changes in audience behavior, with fewer clicks coming from searches and more passive views via AI summaries—a fact that raises concerns about the sustainability of editorial visibility in the medium term.

Furthermore, the enforcement of regulations like MiCA in the European Union, and local pressures in countries like Russia, Hungary, and Ukraine, have added layers of complexity. Publishers have cited loss of visibility, self-censorship, and infrastructure relocation as strategies to maintain an active presence amid restrictions.

With a recovering market and a changing media landscape, the second quarter of 2025 made it clear that the growth of cryptocurrencies does not necessarily translate into greater exposure from the specialized press—especially given an uncertain regulatory landscape and a new dynamic of content consumption driven by artificial intelligence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.