DeFi Development Corp's Strategic Solana Accumulation: A Conviction Play in Institutional DeFi Exposure

- DeFi Development Corp. (DFDV) acquired 407,247 SOL ($77M) via equity proceeds, boosting holdings to 1.83M SOL ($371M) for long-term staking and validator operations. - Solana's institutional adoption grows with $1.72B corporate staking (6.86% yield), driven by BlackRock, Stripe, and the first U.S. crypto staking ETF (REX-Osprey). - DFDV maintains 0.0864 SOL/share ($17.52) buffer against dilution, leveraging Solana's $11.7B DeFi TVL and Alpenglow upgrades (100-150ms settlement, 4,000+ TPS). - A potential

DeFi Development Corp. (DFDV) has emerged as a pivotal player in the institutional adoption of Solana (SOL), leveraging its corporate treasury to amplify exposure to the high-performance blockchain. In August 2025, the company announced the acquisition of 407,247 SOL tokens for $77 million, raising its total holdings to 1,831,011 SOL, valued at $371 million [1]. This move, funded by a recent equity raise with $40 million in remaining proceeds, underscores DFDV’s commitment to compounding value through long-term staking and validator operations [2]. By staking these tokens across its own infrastructure and third-party validators, the company generates native yield while reinforcing Solana’s network security and decentralization [3].

The strategic significance of DFDV’s accumulation lies in its alignment with broader institutional trends. Solana’s ecosystem has attracted $1.72 billion in corporate staking across 8.277 million tokens—1.44% of the total supply—with an average yield of 6.86% [4]. This momentum is driven by partnerships with global firms like BlackRock , Stripe, and Apollo , as well as the launch of the REX-Osprey Solana + Staking ETF, the first U.S.-listed crypto staking ETF [5]. Pantera Capital’s $1.25 billion Solana-focused fund further validates the chain’s institutional appeal [6]. For DFDV , these trends create a flywheel effect: as Solana’s utility and adoption grow, so does the intrinsic value of its corporate treasuries.

DFDV’s per-share Solana allocation (SPS) is a critical metric for investors. At 0.0864 SOL per share (valued at $17.52), the company maintains a buffer against dilution, with a guaranteed floor of 0.0675 SOL per share even after full warrant impact [7]. This resilience is bolstered by Solana’s DeFi ecosystem, which now holds $11.7 billion in total value locked (TVL), driven by protocols like Kamino Finance and Jito [8]. Solana’s Alpenglow upgrades—reducing settlement times to 100–150 milliseconds and enabling 4,000+ transactions per second—have further cemented its position as a scalable infrastructure for decentralized finance [9].

Looking ahead, the October 16, 2025, SEC decision on a spot Solana ETF could unlock $3–6 billion in institutional capital if approved [10]. DFDV’s dual focus on real estate technology and Solana treasury management positions it to benefit from both stable SaaS revenue and capital appreciation from its growing token holdings [11]. While dilution risks exist, the company’s transparent capital allocation and strategic alignment with Solana’s institutional adoption make it a compelling vehicle for indirect exposure to the chain’s long-term value creation.

Source:

[1] Solana News Today: DeFi Dev Corp. Bets Big on ...

[2] DeFi Development Corp. boosts its Solana holdings by 29 ...

[3] DeFi Dev Corp. Purchases $77M SOL Following Recent ...

[4] Institutions Bet Big on Solana, Staking 8.277M SOL for 6.86 Yields

[5] Institutional Validation and Growth Catalysts in Solana's Ecosystem

[6] The Case for Strategic Entry into Solana (SOL) Amid ...

[7] DeFi Development Corp. Announces $125 Million Equity Raise to Accelerate Solana Treasury Growth

[8] Top Solana DeFi Projects 2025: Driving SOL's Value

[9] Institutions Bet Big on Solana, Staking 8.277M SOL for 6.86 Yields

[10] The Case for Strategic Entry into Solana (SOL) Amid ...

[11] DeFi Development Corp. Acquires Additional 407247 SOL, ...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

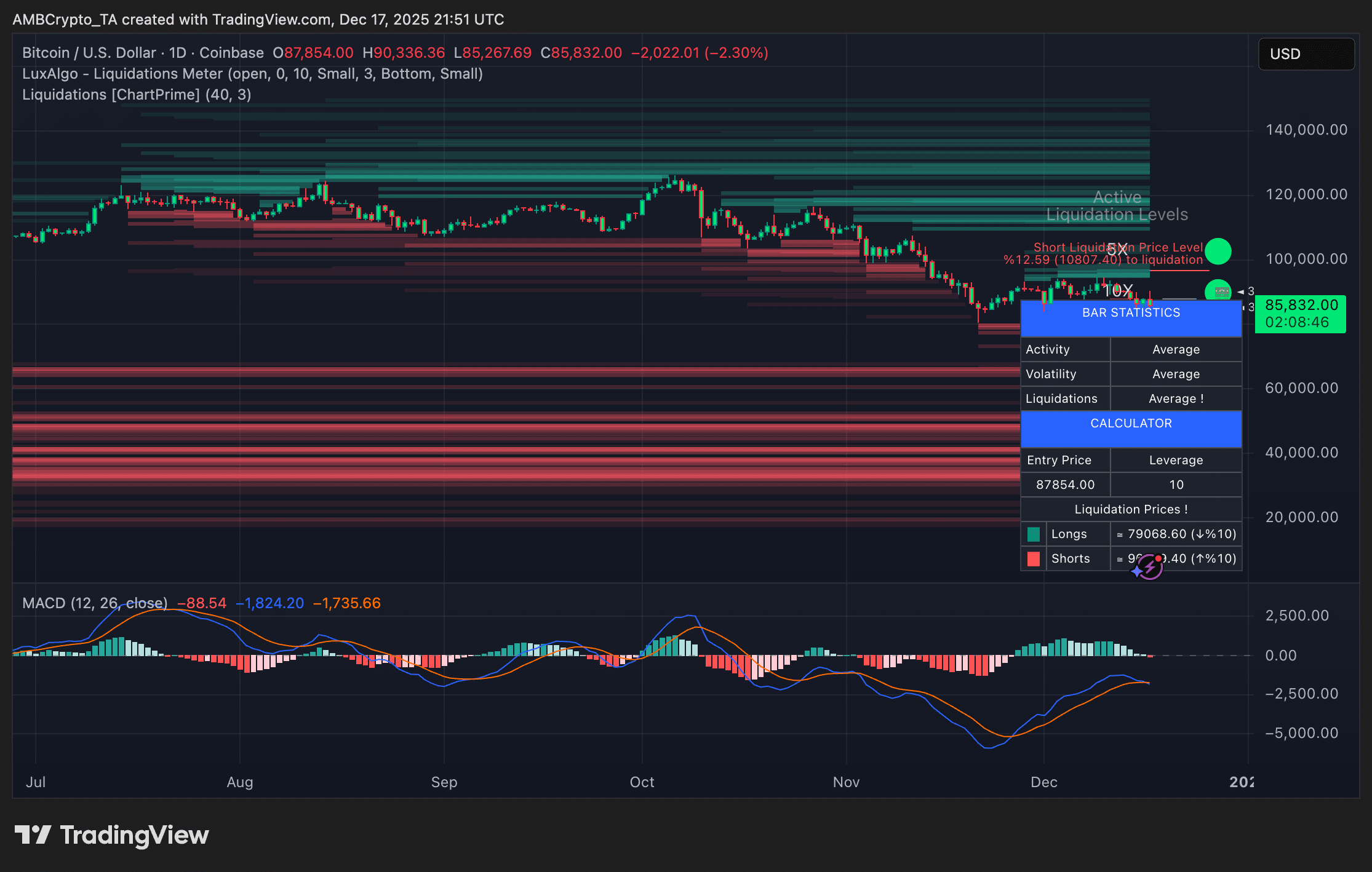

Santa Rally Hopes Fade as Bitcoin Jumps to $90K, Then Falls Even Harder

Nexo Initiates Multi-Year Global Collaboration with Tennis Australia