US tech stocks under pressure as AI growth shows signs of cooling

U.S. tech stocks came under pressure on Friday, driven by concerns about the rapid pace of investment in AI and a series of disappointing earnings reports in the semiconductor sector. The Nasdaq Composite fell 1.2%, closing out a week in which the tech-heavy index struggled to maintain recent highs.

Semiconductor sector hit hard

Among the notable tumblers, Marvell Technology plunged nearly 19%, resembling Bitcoin’s early days, after revealing that its data center revenue had failed to meet market expectations.

The stock was downgraded from “buy” to “neutral” by Bank of America in response to these earnings. Meanwhile, Nvidia, whose market capitalization makes it the largest listed semiconductor company globally, dropped 3.3% on Friday.

The company flagged ongoing uncertainty in its sales to China, largely due to U.S. export restrictions impacting its AI chips.

For the week, Nvidia shares fell 2.1%, marking their steepest weekly decline since May. Broader weakness in chipmakers dragged the Philadelphia Semiconductor Index to its lowest point since mid-April.

The S&P 500 also retreated, down 0.6% for its largest single-day drop of the month, though it still managed to finish August up 1.9%. The tech stocks selling is likely attributed to investors taking profits near month-end, especially after a hot August when technology shares led markets to record levels.

Tech stocks overheated and China uncertainties loom

Despite the hundreds of billions of dollars of investment already poured into data centers fueling generative AI projects like ChatGPT, actual revenues in this space remain relatively modest.

According to Morgan Stanley, generative AI products from major cloud providers such as Amazon, Microsoft, and Google brought in about $45 billion last year.

Marvell, a key supplier of custom semiconductors to these companies, has faced additional headwinds, including trade tensions and questions around its growth prospects. Its shares, which had previously surged on the AI hardware boom, have slumped more than 40% since the beginning of 2025.

Nvidia, meanwhile, awaits clarification from the U.S. government regarding a deal to resume H20 chip exports to China, with the administration set to collect a revenue share from those sales.

Chinese authorities have discouraged local firms from buying Nvidia’s technology, ramping up efforts to support domestic alternatives. Cambricon, a leading Chinese AI chipmaker, recently posted record profits and claimed advancements that bring its products closer to Nvidia’s standards, sending its stock price soaring.

Shares in U.S.-based Super Micro Computer, a vital part of Nvidia’s supply chain, fell 5.5% after reporting internal accounting challenges.

Bitcoin price slumps further into the weekend

While tech stocks and AI-linked companies face their own market turbulence, Bitcoin has not been immune to broader risk-off sentiment.

Bitcoin’s price fell below $108,000 on Saturday, heading into the weekend, down nearly 7% for the week and at its lowest point since July.

Selling has accelerated as investors react to persistent uncertainty around U.S. monetary policy, sticky inflation, and weakening labor market data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

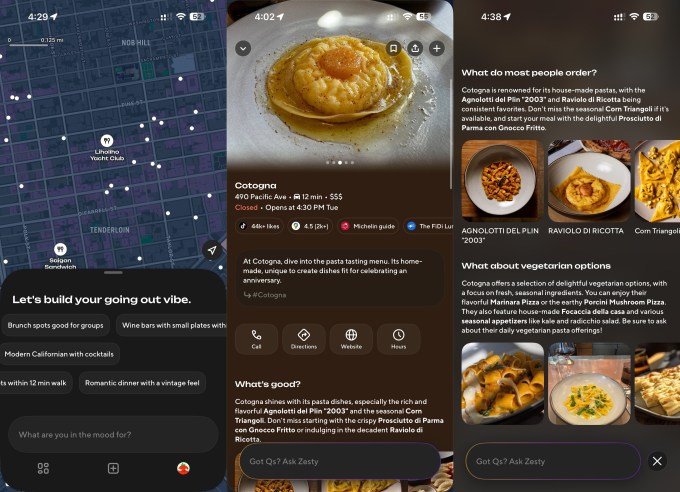

DoorDash rolls out Zesty, an AI social app for discovering new restaurants

Ethereum price plunges below $3,000, liquidations surge, volatility intensifies