Key Notes

- Ethereum’s net take volumes highlight that ETH price could see a drop below $4,000.

- Analysts highlighted key ETH support levels at $3,960 and $3,360, stressing the need to hold these zones to maintain the current market structure.

- Traders expect Bitcoin to outperform in the near term as ETH/BTC weakens amid current capital rotation.

The Ethereum price continues to remain under selling pressure after rejecting its all-time highs. Derivatives data show that any near-term recovery in ETH seems difficult, as sellers exert greater pressure, pushing the price lower. Market analysts believe that the altcoin could see sub $4,000 levels, falling all the way to $3,300.

Ethereum Price In Pressure as Futures Data Shows Sellers’ Dominance

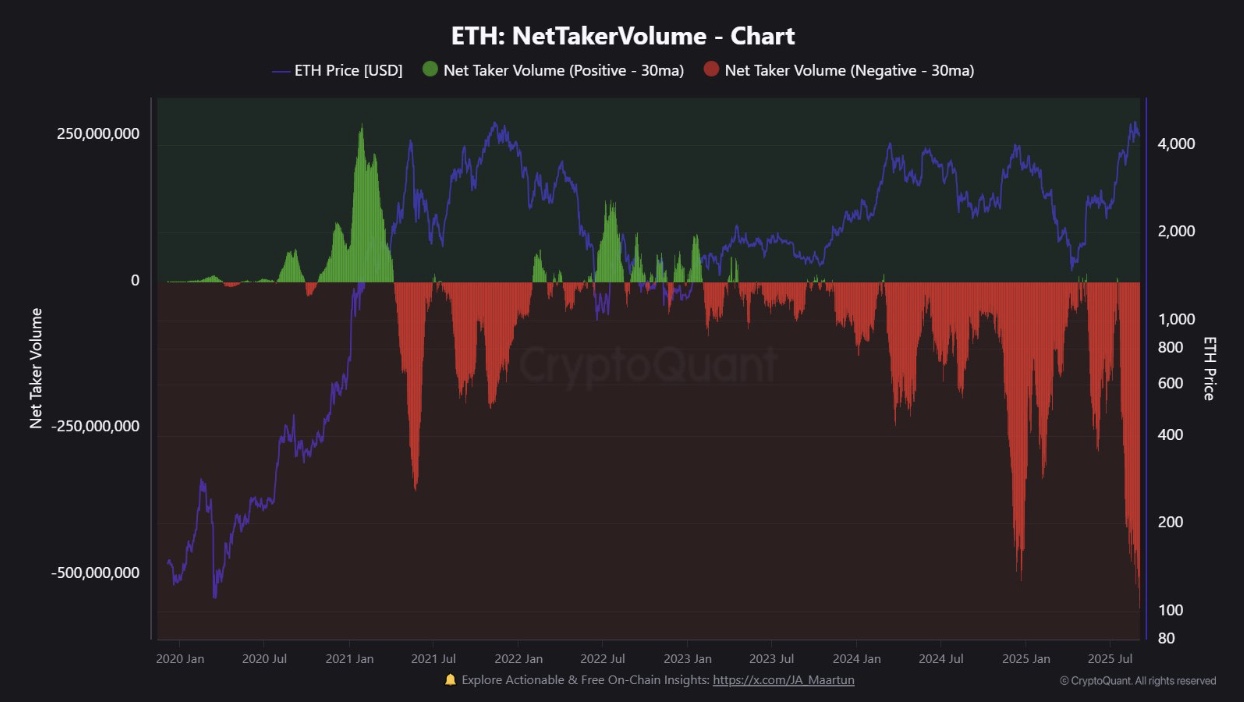

Looking at the derivatives data, Ethereum futures are showing signs of selling pressure as net taker volume skews sharply toward sellers. As per the on-chain data, sell orders have outweighed buy orders by roughly $570 million, reflecting aggressive positioning.

Ethereum sellers outweigh buyers | Source: Maartunn

Historically, such levels of concentrated selling have often coincided with local market tops. As a result, it has raised concerns for an Ethereum price downside risk in the near term.

Crypto analyst Ali Martinez highlighted $3,960 and $3,360 as the key support levels for Ethereum price. He noted that holding above these zones will be critical for sustaining the current market structure.

$3,960 and $3,360 are the most important support levels for Ethereum $ETH ! pic.twitter.com/B7nKoTdXZv

— Ali (@ali_charts) September 5, 2025

ETH to BTC Capital Rotation in Play

After a massive rally and outperforming Bitcoin (BTC), as well as the rest of the crypto market in July and the first half of August, Ethereum has started showing signs of weakness.

Crypto trader Daan Crypto Trades noted that Ethereum (ETH) has remained weak against Bitcoin (BTC), gradually trending lower over the past few weeks. He noted that most of ETH’s larger upward moves during this period were driven by a single entity swapping billions in BTC to ETH. This was evident through institutional inflows in spot Ether ETFs .

$ETH remains relatively weak against BTC and is just slowly grinding down the past few weeks.

Most of the larger green candles during this period were by that single entity, swapping billions of $BTC to $ETH .

I do think BTC will outperform again for some time as the ETH/BTC… pic.twitter.com/ksyTwsKIEq

— Daan Crypto Trades (@DaanCrypto) September 5, 2025

Looking ahead, he expects Bitcoin to outperform in the near term as the ETH/BTC ratio cools off and Bitcoin dominance rises. The analyst noted that such a development would be a healthier path for Ethereum price, eventually breaking out of the current consolidation phase.

Another crypto analyst, Benjamin Cowen, believes that he expects the market rotation toward Bitcoin (BTC) to extend through September and October. While Bitcoin dominance has not shown a significant move yet, Cowen projected that it should climb back above 60% in the coming weeks.

nextThe rotation back to #BTC should continue here through September and October.

I know dominance still has not really moved much, but it should be back above 60% in the coming weeks pic.twitter.com/C54726HZcu

— Benjamin Cowen (@intocryptoverse) September 5, 2025