Ether can flip Bitcoin, Tom Lee says: What are the chances he’s right?

The Ethereum/Bitcoin rivalry is real, according to Tom Lee, chairman of BitMine and co-founder of Fundstrat.

Lee, a key Ethereum stakeholder whose market influence stems from his institutional investments and public advocacy, claims that ETH can reach $60,000 in five years and has a 50% chance of flipping Bitcoin.

However, while Ether has been performing undoubtedly well this past summer, topping Bitcoin is a hot take.

- After the immensely bullish summer for Ether, the “ETH will flip BTC” narrative is back.

- Ethereum flipped Bitcoin in spot ETF inflows and demonstrates consistent growth.

- Despite Ether’s success, it must reckon with Bitcoin’s status and so-called “Ethereum killers.”

Crypto influencers tend to argue, on X, that Ethereum earns extra praise when Bitcoin is down. A closer comparison between the two cryptocurrencies show that, in the long run, Ethereum is gradually going down against Bitcoin.

Ether was at its peak price against BTC in February 2018 at 0.13 BTC per Ether. In the spring and the fall of 2021, when Bitcoin was trending higher, the peak Ether prices were in the 0.08–0.09 BTC range.

Fast-forward to 2025: at 0.04 BTC per ETH, one Ether is worth 4 million sats — fewer than before. In other words, after the spring of 2021, Ether’s price saw no serious spikes against Bitcoin.

While Ether has gained price against Bitcoin since April — its price rising from 0.019 to 0.04 — in BTC terms, each unit of ETH is cheaper than it was in 2021 or 2017.

Therefore, despite Ether’s current price of $4,280 (a 92.5% rally from last year), Bitcoin maintains its position as the dominant cryptocurrency. As Jeff Embry of Globe 3 Capital put it:

“ETH has too high a hill to climb to surpass BTC, and the drivers of what creates value for both should keep BTC in the lead.”

Ether competition

Spot ETFs for Ether rivals are on the horizon, and treasury holdings in other digital assets could challenge Ether’s dominance. For example, Tron’s low-cost transactions may gain traction as stablecoins expand.

While Ether could outpace Bitcoin, it remains far below its 2017 highs, and its uncapped supply limits its potential to surpass Bitcoin.

Lee’s bold predictions come as BitMine Immersion Technology (BMNR) strategically shifts its focus to building a large Ethereum treasury.

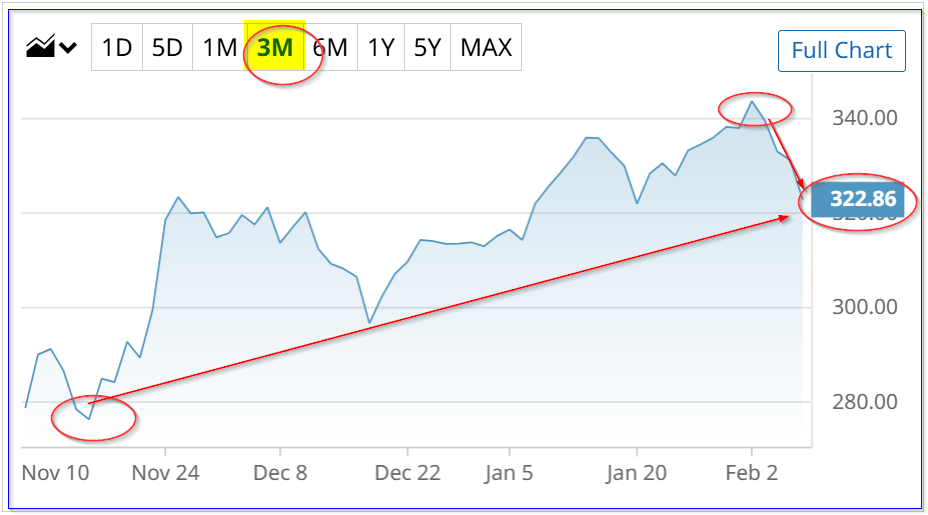

Meanwhile, Michael Saylor’s Bitcoin-focused Strategy is facing challenges, having been recently sued by investors and snubbed from the S&P 500.

Thinking about the S&P right now… pic.twitter.com/Y5nPc9XT4l

— Michael Saylor (@saylor) September 6, 2025

Ethereum: the bullish case

As of Sept. 6, Bitcoin’s market cap is over $2.2 trillion. Ether’s market cap is $515 billion. But, in April, the market cap of Ether was below $180 billion, so it grew considerably in the summer months.

Ethereum co-founder Joseph Lubin says it’s only a matter of time before his brand of crypto closes the gap.

“ETH will likely 100x from here,” he posted to X on Aug. 30. “Probably much more.”

Ethereum co-founder Joseph Lubin hinted on CNBC that he believes $ETH could flip $BTC within "the next year or so, especially with these treasury companies driving things."

— Satoshi Stacker (@StackerSatoshi) August 10, 2025

At bitcoin's current market cap, ETH would need to be around $20,000 to flip it. pic.twitter.com/o3730nEmCY

Before June, Ether struggled amid criticism of large sales by the Ethereum Foundation, which contributed to price declines.

Solana eventually surpassed Ethereum as a leading platform for memecoins. And this past spring, ETH was trading below $2,000.

By July, Ether gained over 60% while Bitcoin gained only around 10%. Ethereum dominance doubled between May and August, going from 7% to 14%.

The summer of 2025 saw a lot of factors contributing to Ether’s bull run:

- BitMine’s Ether pivot.

- Massive Ether ETF inflows and intensifying stablecoin race.

- The European Union plans to use Ethereum for a digital euro.

Under Lee, BitMine Immersion Technology turned into the second-biggest digital asset treasury in the world and the top corporate ETH holder. As of Aug. 25, it owns 1.71 million Ether units. The company aims to buy 5% of the Ether supply. At the current stage, it owns nearly a third of the needed amount.

Lee isn’t the only one who cares about BitMine’s success. Big-name investors like Peter Thiel, Cathie Wood, and Bill Miller III now hold large stakes in the company. The company announced its plans to issue $20 billion worth of BMNR stock to raise capital for further increase of ETH holdings.

ETFs

Spot Ethereum ETFs have outpaced Bitcoin ETFs, signaling strong institutional demand. In July, Ethereum ETFs saw $1.8 billion in inflows versus $70 million for Bitcoin ETFs. This surge in 2025 followed Circle’s successful IPO, the GENIUS Act enabling stablecoin issuance, and growing stablecoin competition, with Ethereum supporting roughly half of the stablecoin market.

On Aug. 22, the European Central Bank reportedly considered using Ethereum and Solana to issue a digital euro, potentially placing Ethereum at the core of a major economy. That same day, Fed Chair Jerome Powell’s Jackson Hole remarks hinted at a possible September rate cut, boosting liquidity. Combined, these developments propelled Ether near $5,000 for the first time on Aug. 29.

Jerome Powell: “It might be time to cu—”

— Alan Carroll (@alancarroII) August 22, 2025

The market: pic.twitter.com/TPoVyUTB9H

Institutional investors are draining the Ether supply while drastically increasing demand for it. The amount of ETH held on exchanges has reached the lowest point in around ten years. These factors may contribute to the ETH price ascension.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

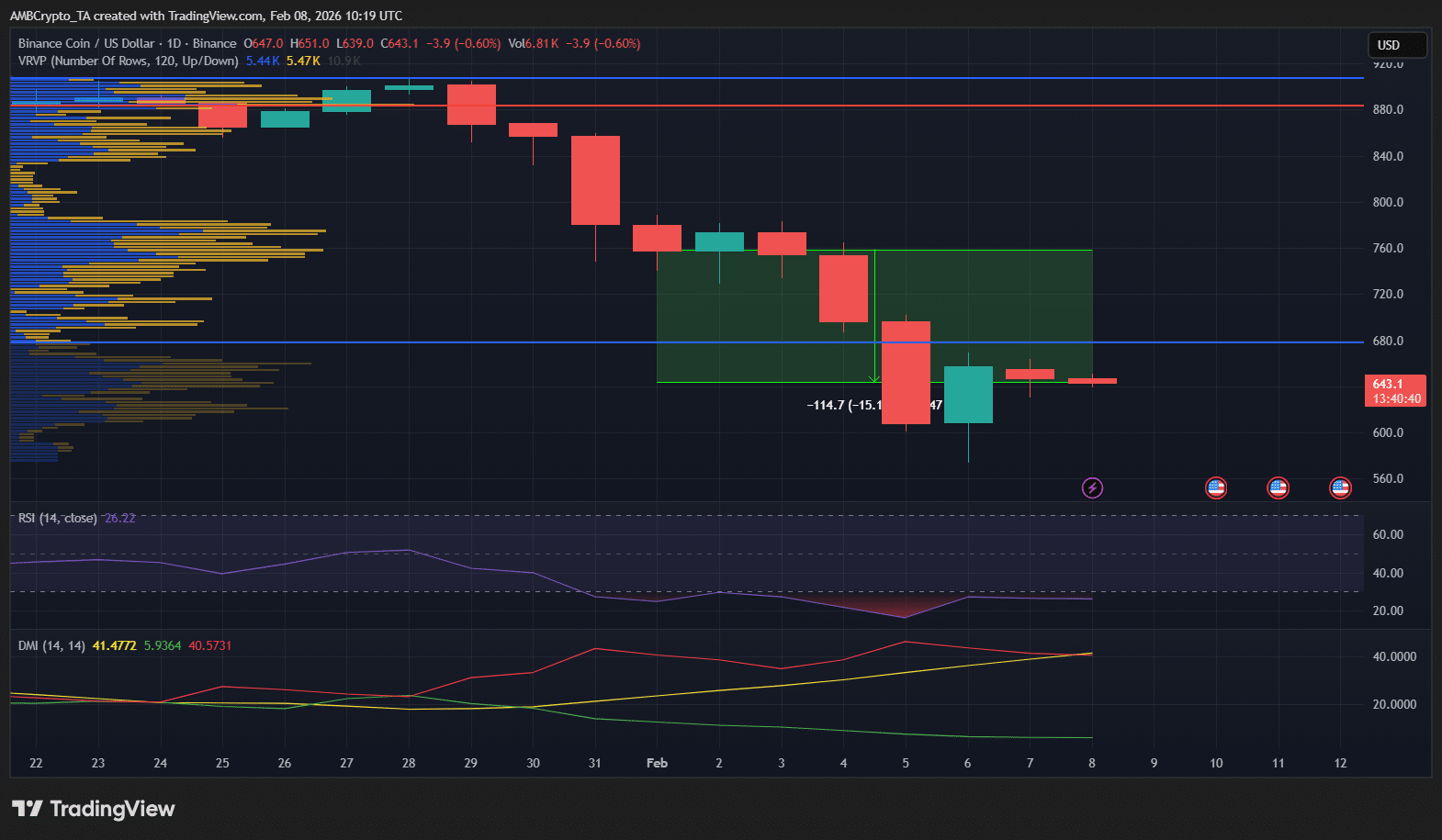

Crypto Crash: DeepSnitch AI Eyes 1000% ROI While Bitcoin Dumps to $60K and $434 Million Flees ETFs

Bitcoin starts a fragile rebound after its brutal collapse

Crypto market’s weekly winners and losers – M, MYX, BNB, XMR, and more!