Pop Culture stakes $33m in Bitcoin to fuel Web3 entertainment vision

Pop Culture’s $33 million treasury move into Bitcoin is the seed capital for a radical plan to transform fan engagement into ownable, tradable digital assets on a global scale. The company aims to weave crypto into content, live events, and artist management.

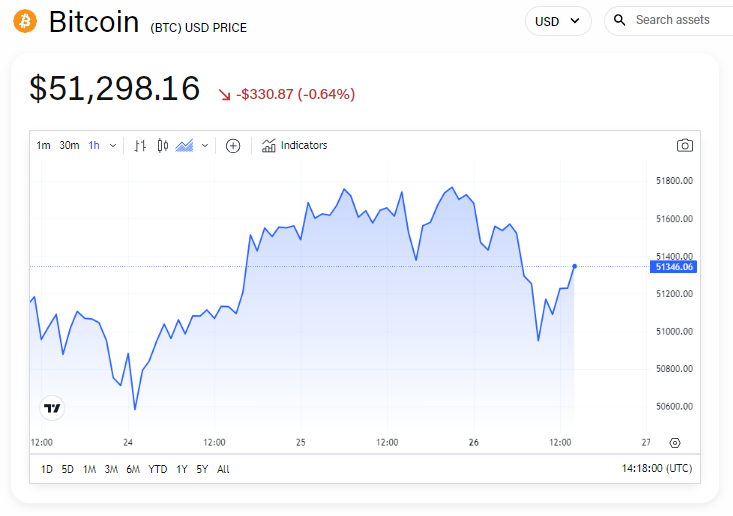

- Pop Culture Group invested $33 million in Bitcoin, acquiring 300 BTC to anchor a new crypto fund.

- The company plans to expand into Ethereum, BOT, and Web3 entertainment projects tied to music, live events, and artist incubation.

- The move comes as corporate Bitcoin holdings hit record highs, with firms and institutions now controlling over 7% of total supply.

According to a press release dated September 10, the Nasdaq-listed cultural industry operation enterprise Pop Culture Group Co., Ltd. (CPOP) has completed a $33 million acquisition of Bitcoin ( BTC ).

The purchase, which includes 300 BTC, serves as the cornerstone asset for a newly established cryptocurrency fund pool. Pop Culture said the strategy extends beyond Bitcoin accumulation, with plans to deploy capital into Ethereum ( ETH ) and its own native token, BOT, alongside targeted investments in Web3 entertainment.

Building a new entertainment economy on a crypto foundation

While the Bitcoin purchase provides a stable base, Pop Culture’s blueprint involves a more aggressive deployment into specific Web3 initiatives directly tied to its core business. The company’s proposed fund pool targets promising cryptocurrencies within the Web3 pan-entertainment track, a broad category that likely includes fractional ownership platforms for music rights, metaverse concert experiences, and fan engagement tokens.

More concretely, the strategy signals direct investment into high-quality equity projects and artist incubation programs that leverage blockchain for rights management and novel revenue streams, effectively turning the company into a venture studio for crypto-native entertainment.

“Our strategic cryptocurrency investment marks the beginning of a vision to build not only a pan-entertainment platform, but a global Web3 pan-entertainment super ecosystem. Spanning live entertainment, digital entertainment, short films, and artist management, we aim to create a symbiotic network deeply connecting creators, users, and the platform itself,” Pop Culture CEO Huang Zhuoqin said.

Pop Culture’s ambitious pivot reflects a much broader institutional march toward Bitcoin adoption. According to data compiled by Bitwise Asset Management, corporate Bitcoin holdings surged dramatically in Q2 2025, with public companies adding a record 159,107 BTC to their balance sheets.

Notably, the race is no longer just for publicly listed companies . States and private institutions are also major participants, with aggregator CoinGecko tracking 115 institutions worldwide that collectively hold a staggering 1.5 million BTC, worth over $171 billion and accounting for 7.14% of the total supply.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks

Egrag Crypto: Selling XRP Now Makes No Sense. Here’s Why

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says