WLFI Slides Toward $0.16 All-Time Low as Market Pressure Mounts

WLFI faces mounting bearish pressure as its price approaches the $0.16 all-time low, with weak demand and declining futures activity weighing heavily.

World Liberty Financial’s WLFI, a token linked to US President Donald Trump, has dropped 7% over the past week, signaling mounting bearish pressure in the market.

Data from both spot and derivatives markets suggest waning trader interest, heightening concerns that the token could revisit its all-time low of $0.16.

WLFI Bears Tighten Grip

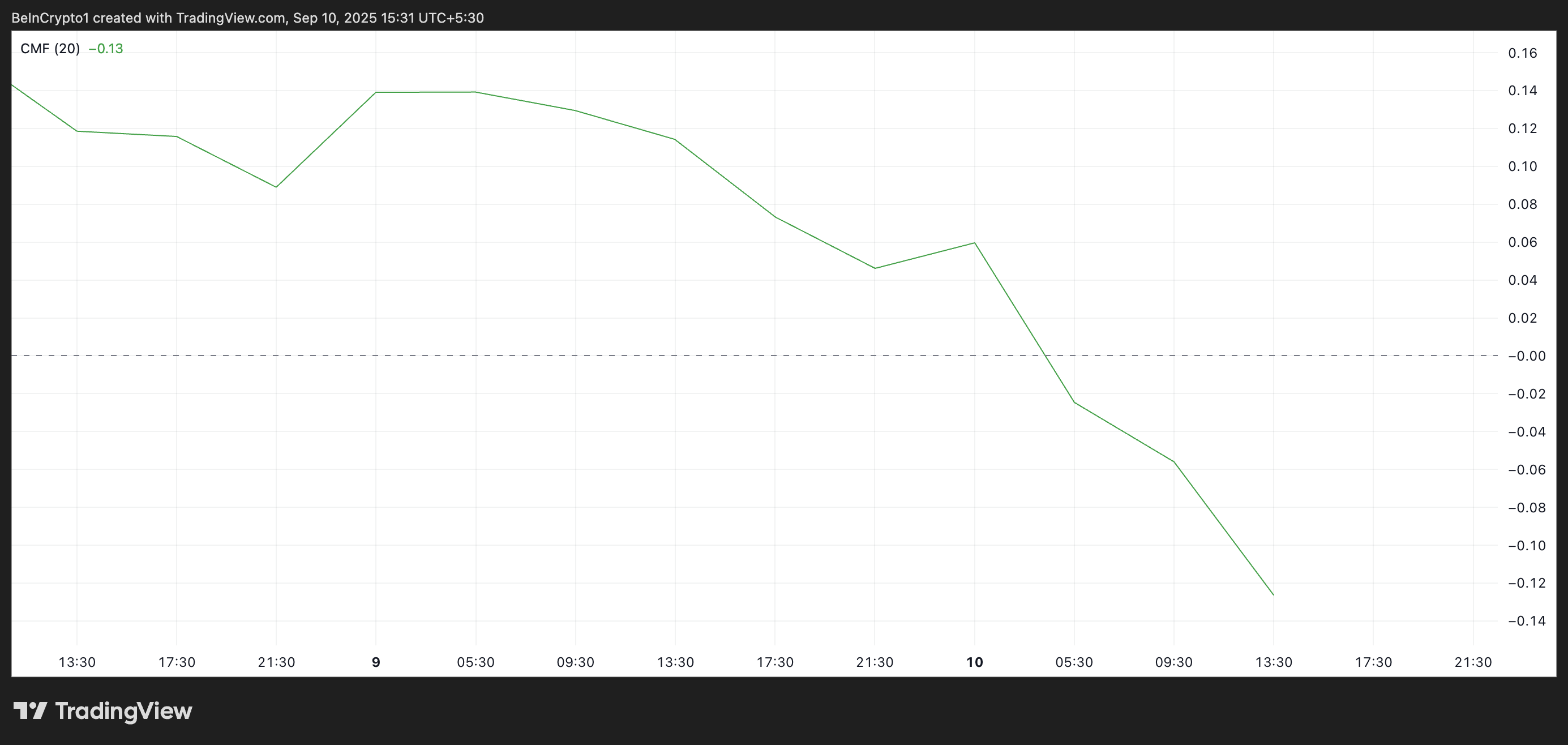

An assessment of the WLFI/USD four-hour chart has revealed a steady decline in the token’s Chaikin Money Flow (CMF). This key momentum indicator sits below the zero line at -0.13, and is in a downward trend as of this writing.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

WLFI CMF. Source:

TradingView

WLFI CMF. Source:

TradingView

The CMF indicator measures buying and selling pressure by combining price and volume data. A positive CMF reading signals strong buying activity and accumulation, while a negative value indicates selling pressure and distribution.

WLFI’s negative and downward-trending CMF suggests that sellers currently dominate the market. This reflects weak demand and reinforces the risk of a further dip toward its all-time low.

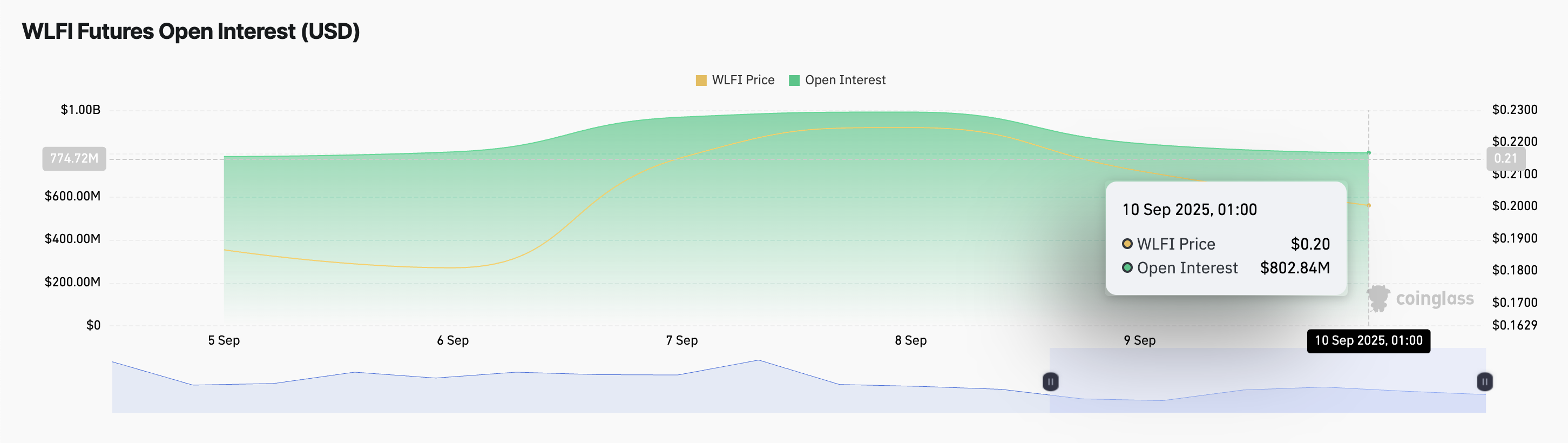

Furthermore, its futures open interest has declined steadily, confirming the broader negative sentiment in the market. At press time, it was $802.84 million, plummeting 5% in the past day.

WLFI Futures Open Interest. Source:

Coinglass

WLFI Futures Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding futures contracts that have not been settled, serving as a gauge of liquidity and trader participation in the derivatives market.

Rising futures open interest reflects growing interest and conviction in a token’s price direction, while a decline indicates traders are closing positions and withdrawing capital.

In WLFI’s case, the drop in open interest signals fading confidence, as market participants are exiting trades rather than opening new ones.

WLFI Under Pressure — $0.16 or a Rally Above $0.22?

With demand showing little improvement, WLFI faces an increasing risk of further losses. If selling continues, the token could revisit its all-time low of $0.16, and charge lower if selloffs strengthen.

WLFI Price Analysis. Source:

TradingView

WLFI Price Analysis. Source:

TradingView

However, if new demand enters the market, the altcoin’s value could surge above $0.22.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Cysic Network (CYS)

Decoding 30 Years of Wall Street Experience: Asymmetric Opportunities in Horse Racing, Poker, and Bitcoin

A horse race, a poker book, and the wisdom of three legendary investors led me to discover the most underestimated betting opportunity of my career.

Fed cuts rates again: Internal divisions emerge as three dissenting votes mark a six-year high

This decision highlights the unusual divisions within the Federal Reserve, marking the first time since 2019 that there have been three dissenting votes.

Antalpha highlights strong alignment with industry leaders on the vision of a "Bitcoin-backed digital bank" at Bitcoin MENA 2025

Antalpha confirms its strategic direction, emphasizing the future of bitcoin as an underlying reserve asset.