Written by: David, Deep Tide TechFlow

Recently, amid the boom of Perp DEXs, a wave of new projects has sprung up like mushrooms after the rain, constantly challenging the dominance of Hyperliquid.

Everyone’s attention is focused on the innovations of new players, to the extent that the price changes of $HYPE, the leading token, seem to be overlooked. The factor most directly related to token price changes is the supply of $HYPE.

The supply is affected by two things: one is continuous buybacks, which is like constantly buying in the existing market to reduce circulation, lowering the water level in the pool; the other is adjusting the overall supply mechanism, which is like turning off the tap.

Looking closely at the current supply design of $HYPE, there are actually some issues:

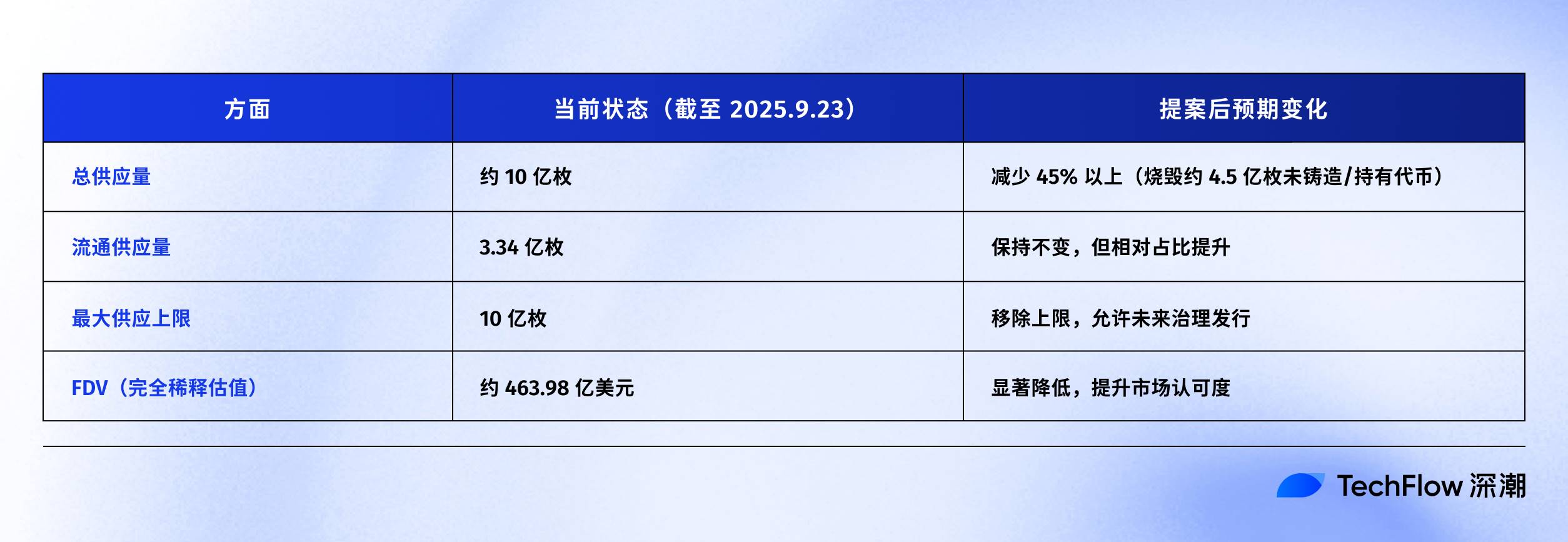

The circulating supply is about 339 million tokens, with a market cap of around $15.4 billion; but the total supply is close to 1 billion tokens, and the FDV is as high as $46 billion.

The nearly threefold gap between MC and FDV mainly comes from two parts. One part is 421 million tokens allocated to "Future Emissions and Community Rewards" (FECR), and another 31.26 million tokens are held in the Aid Fund (AF).

The Aid Fund is an account Hyperliquid uses to buy back HYPE with protocol revenue. It buys every day but does not burn, just holds. The problem is, investors see the $46 billion FDV and still feel the valuation is too high, even though only a third is actually circulating.

Against this backdrop, investment manager Jon Charbonneau (DBA Asset Management, holding a large HYPE position) and independent researcher Hasu published an unofficial proposal about $HYPE on September 22, which is quite radical; the short version is:

Burn 45% of the current total $HYPE supply, bringing FDV closer to actual circulating value.

This proposal quickly ignited community discussion. As of press time, the post had 410,000 views.

Why such a big reaction? If the proposal is adopted, burning 45% of HYPE’s supply means the value represented by each HYPE token nearly doubles. A lower FDV could also attract previously hesitant investors.

We’ve also quickly summarized the original content of this proposal as follows.

Reduce FDV, Make HYPE Look Less Expensive

Jon and Hasu’s proposal seems simple—burn 45% of the supply—but the actual operation is more complex.

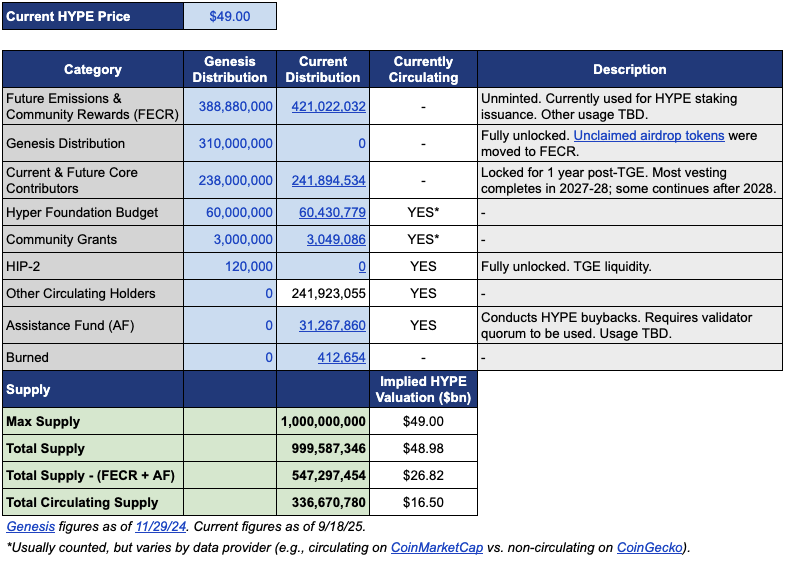

To understand this proposal, you first need to look at HYPE’s current supply structure. According to the data table provided by Jon, at a price of $49 (the price when they proposed), out of the total 1 billion HYPE tokens, only 337 million are actually circulating, corresponding to a $16.5 billion market cap.

But where did the remaining 660 million go?

The two largest portions are: 421 million allocated to "Future Emissions and Community Rewards" (FECR), which is a huge reserve pool but no one knows when or how it will be used; another 31.26 million are held in the Aid Fund (AF), which buys HYPE daily but does not sell, just holds.

So how to burn? The proposal includes three core actions:

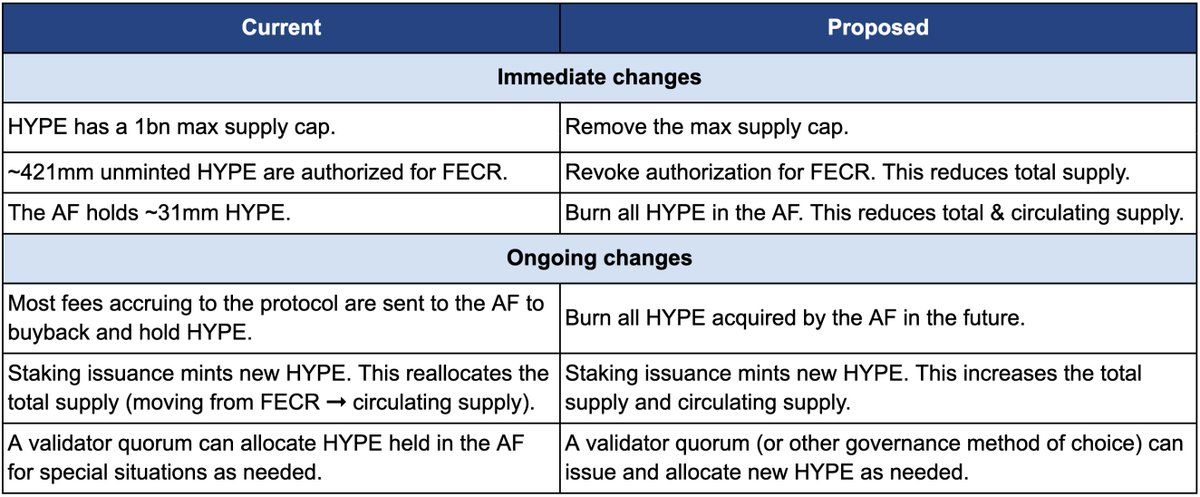

First, revoke the authorization of the 421 million FECR (Future Emissions and Community Rewards) tokens. These tokens were originally planned for future staking rewards and community incentives, but there has never been a clear issuance schedule. Jon believes that instead of letting these tokens hang over the market like the Sword of Damocles, it’s better to revoke the authorization directly. When needed, they can be re-approved for issuance via governance voting.

Second, burn the 31.26 million HYPE held by the Aid Fund (AF), and burn all HYPE bought by AF in the future as well. Currently, AF uses protocol revenue (mainly 99% of trading fees) to buy back HYPE daily, with an average daily purchase of about $1 million. According to Jon’s plan, these purchased tokens will no longer be held but burned immediately.

Third, remove the 1 billion supply cap. This sounds counterintuitive—if you want to reduce supply, why remove the cap?

Jon explains that a fixed cap is a legacy of bitcoin’s 21 million model and has no practical meaning for most projects. After removing the cap, if new tokens need to be issued in the future (such as for staking rewards), the specific amount can be decided through governance, rather than being allocated from a reserved pool.

The comparison table below clearly shows the changes before and after the proposal: the left is the current situation, the right is after the proposal.

Why be so radical? Jon and Hasu give a core reason: HYPE’s token supply design is an accounting issue, not an economic one.

The problem lies in how major data platforms like CoinmarketCap calculate things.

Burned tokens, FECR reserves, AF holdings—all are handled differently by each platform when calculating FDV, total supply, and circulating supply. For example, CoinMarketCap always uses the 1 billion max supply to calculate FDV, even if tokens are burned, it doesn’t adjust.

The result is, no matter how much HYPE is bought back or burned, the displayed FDV never goes down.

As you can see, the biggest change in the proposal is that the 421 million FECR and 31 million AF tokens will disappear, and the 1 billion hard cap will be removed, replaced by governance-based issuance as needed.

Jon wrote in the proposal: “Many investors, including some of the largest and most mature funds, only look at the surface FDV number.” The $46 billion FDV makes HYPE look more expensive than Ethereum—who would dare to buy?

However, most proposals are influenced by self-interest. Jon clearly states that his DBA fund holds a "material position" in HYPE, and he personally holds it too. If there is a vote, they will both vote in favor.

The proposal emphasizes that these changes will not affect the relative share of existing holders, will not affect Hyperliquid’s ability to fund projects, and will not change the decision-making mechanism. In Jon’s words,

“This just makes the ledger more honest.”

When “Allocated to the Community” Becomes an Unspoken Rule

But will the community buy this proposal? The original post’s comment section has already exploded.

Among them, Dragonfly Capital partner Haseeb Qureshi’s comment puts this proposal into a broader industry phenomenon:

“Some ‘sacred cows’ in the crypto industry just won’t die, it’s time to slaughter them.”

He refers to an unspoken rule in the crypto industry: after a project generates tokens, it always reserves so-called 40-50% of the tokens for the “community.” This sounds very decentralized and Web3, but in reality, it’s a kind of performance art.

In 2021, at the peak of the bull market, every project was competing to be more “decentralized.” So tokenomics would write 50%, 60%, or even 70% for community allocation—the bigger the number, the more politically correct.

But how are these tokens actually used? No one can say clearly.

From a more cynical perspective, for some project teams, the reality is that the tokens allocated to the community can be used whenever and however they want, under the guise of “for the community.”

The problem is, the market isn’t stupid.

Haseeb also revealed an open secret: professional investors automatically discount these “community reserves” by half when evaluating projects.

A project with a $50 billion FDV but 50% “community allocation” is actually valued at only $25 billion in their eyes. Unless there’s a clear ROI, these tokens are just pie in the sky.

This is exactly the problem HYPE faces. Of HYPE’s $49 billion FDV, over 40% is “Future Emissions and Community Rewards” reserves. Investors see this number and shy away.

It’s not that HYPE is bad, but the numbers on paper are too inflated. Haseeb believes Jon’s proposal is a push in the right direction, turning previously taboo radical ideas into mainstream views; we need to question the crypto industry’s convention of allocating tokens to “community reserves.”

In summary, supporters’ views are simple:

If you want to use tokens, go through governance—explain why, how much, and what the expected return is. Be transparent and accountable, not a black box.

At the same time, because this post is so radical, there are also some opposing voices in the comments. We’ve summarized them into three main points:

First, some HYPE must be kept as risk reserves.

From a risk management perspective, some believe the 31 million HYPE in the Aid Fund AF is not just inventory, but emergency funds. What if there’s a regulatory fine or a hack that needs compensation? Burning all reserves means losing a buffer in times of crisis.

Second, HYPE already has a complete burn mechanism technically.

Hyperliquid already has three natural burn mechanisms: spot trading fee burn, HyperEVM gas fee burn, and token auction fee burn.

These mechanisms automatically adjust supply based on platform usage, so why intervene manually? Usage-based burning is healthier than one-off burning.

Third, large-scale burning is bad for incentives.

Future emissions are Hyperliquid’s most important growth tool, used to incentivize users and reward contributors. Burning them is like cutting off your own arm. Also, large stakers will be locked in. Without new token rewards, who will want to stake?

Who Do Tokens Serve?

On the surface, this is a technical discussion about whether to burn tokens. But if you analyze the positions of each side, you’ll find the disagreement is actually about interests.

The view represented by Jon and Haseeb is clear: institutional investors are the main source of incremental capital.

These funds manage billions of dollars, and their buying can really drive prices. But the problem is, when they see a $49 billion FDV, they don’t dare to enter. So the number needs to be corrected to make HYPE more attractive to institutions.

The community sees it completely differently. In their eyes, the retail traders opening and closing positions on the platform every day are the foundation. Hyperliquid’s success today is not due to VC money, but the support of 94,000 airdrop users. Changing the economic model to cater to institutions is putting the cart before the horse.

This disagreement is not new.

Looking back at DeFi history, almost every successful project has faced a similar crossroads. When Uniswap issued its token, the community and investors fought fiercely over treasury control.

The core issue is always the same: is an on-chain project ultimately serving big capital, or is it serving grassroots crypto natives?

This proposal seems to serve the former: “Many of the largest and most mature funds only look at FDV.” The implication is clear—if you want big money to come in, you have to play by their rules.

Proposer Jon himself is an institutional investor; his DBA fund holds a large amount of HYPE. If the proposal passes, the biggest beneficiaries are exactly big holders like him. With reduced supply, the token price may rise, and the value of their holdings will soar.

Combined with the fact that a few days ago Arthur Hayes just sold $800,000 worth of HYPE, joking that he was going to buy a Ferrari, you can sense a subtle timing. The earliest supporters are cashing out, and now someone is proposing to burn tokens to push up the price—who is really being set up here?

As of press time, Hyperliquid officials have not yet commented. But regardless of the final decision, this debate has already torn open a truth everyone is reluctant to face:

When it comes to profit, maybe we never really cared about decentralization—we were just pretending.