Date: Wed, Sept 24, 2025 | 05:56 AM GMT

The cryptocurrency market is under notable selling pressure, with Ethereum (ETH) sliding over 6% this week, dropping below the $4,175 level. Following this, major altcoins are also taking a hit — and Hyperliquid (HYPE) is no exception, which is already in a competitive race with the newly launched Aster (ASTER) DEX Perp platform.

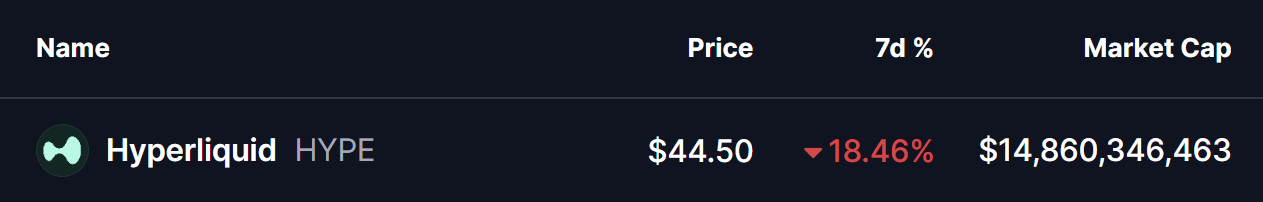

HYPE has seen a sharp decline of around 18% over the last seven days. However, the latest chart formation suggests that a potential rebound may be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Broadening Wedge Setup in Play

HYPE’s daily chart highlights a classic ascending broadening wedge — a structure that reflects both volatility and investor uncertainty. Although often considered bearish, it can also lead to sharp upside moves before a potential breakdown.

The latest decline started after HYPE was rejected from the upper trendline near $59.45 on Sept 18, triggering a steep correction toward the wedge’s lower boundary. At present, HYPE is testing this critical lower trendline support around $43.59, which aligns closely with the 100-day moving average ($44.25).

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

This confluence of support zones makes the current level a decisive point for the token.

What Comes Next?

If buyers manage to defend the wedge’s lower boundary and keep HYPE above the 100-day moving average, the token could attempt a recovery toward the mid-range resistance near $56–58, with the potential of retesting the upper wedge boundary toward the $68+ zone. Such a move would open the door for a possible new all-time high.

On the flip side, if the $43–44 support fails to hold, the wedge’s bearish implications could play out, dragging the token down toward the deeper support zone of $28–26. Such a drop would mark a significant correction and shift sentiment sharply bearish.

Hyperliquid (HYPE) now stands at a make-or-break point. The coming sessions will determine whether this wedge pattern sparks a strong bounce back — or if a breakdown sends the token into a deeper pullback.