US SEC Poised for Wave of Crypto ETF Decisions in October

Contents

Toggle- Quick Breakdown

- Key deadlines and market impact

- Industry expectations and missing giants

Quick Breakdown

- The U.S. SEC will rule on 16 crypto ETF applications in October, covering Solana, XRP, Litecoin, Dogecoin, Cardano, and Hedera.

- Key deadlines include Canary’s Litecoin ETF on October 2, Grayscale’s Solana and Litecoin trusts on October 10, and WisdomTree’s XRP fund on October 24.

- Analysts predict approvals could trigger a new altcoin season, though major players like Fidelity and BlackRock are not part of the October filings.

The U.S. Securities and Exchange Commission (SEC) is set to rule on 16 cryptocurrency exchange-traded fund (ETF) applications in October, a pivotal moment that could open the door to a wave of altcoin-focused investment products, Bloomberg ETF analyst James Seyffart reported . The pending decisions cover major tokens such as Solana (SOL), XRP, Litecoin (LTC), Cardano (ADA), Hedera (HBAR), and Dogecoin (DOGE), with final deadlines staggered across the month.

NEW: Here is a list of all the filings and/or applications I’m tracking for Crypto ETPs here in the US. There are 92 line items in this spreadsheet. You will almost certainly have to squint and zoom to see but best I can do on here pic.twitter.com/lDhRGEQBoW

— James Seyffart (@JSeyff) August 28, 2025

Key deadlines and market impact

The first decision is expected on October 2 for decentralized exchange Canary’s proposed Litecoin ETF, followed by October 10 rulings on Grayscale’s applications to convert its Solana and Litecoin trusts. The review cycle concludes on October 24 with WisdomTree’s XRP fund. Bloomberg ETF analyst James Seyffart outlined the timetable, noting that the SEC could issue approvals or rejections ahead of the official deadlines.

Analysts are closely watching the developments for signs of a broader market rally. Bitfinex researchers previously predicted that successful ETF approvals could spark a new altcoin season, allowing investors to gain exposure to top cryptocurrencies with reduced risk. NovaDius Wealth Management president and ETF analyst Nate Geraci described October as an “enormous” period for the industry, highlighting the unprecedented number of filings nearing decision points.

Industry expectations and missing giants

Crypto trader Daan Crypto Trades labeled October “ETF month,” pointing to the growing excitement around spot crypto ETF approvals. However, he noted the absence of filings from industry heavyweights Fidelity and BlackRock, two of the largest players in the ETF market. Despite their absence, Seyffart earlier placed the probability of SEC approvals for the pending altcoin ETFs at 90% or higher in 2025, signaling strong momentum for crypto-based investment vehicles.

If approved, these ETFs could reshape market participation by opening the door for institutional and retail investors seeking regulated exposure to a wider range of digital assets .

Meanwhile, Fidelity projects that nearly half of Bitcoin’s circulating supply could become illiquid within the next decade, a shift that could tighten supply and influence long-term price dynamics even as new altcoin products come to market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

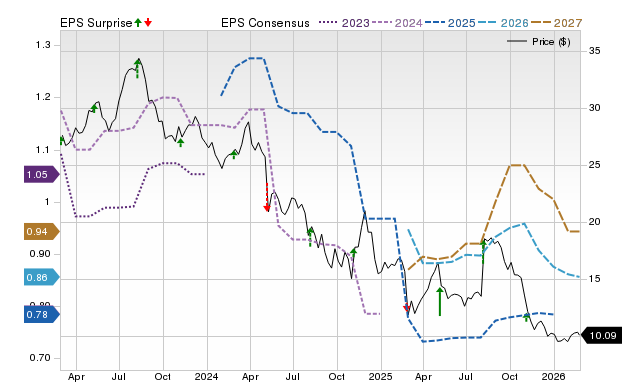

Grocery Outlet Holding Corp. (GO) Anticipates Increased Profits: Is It a Good Time to Invest?

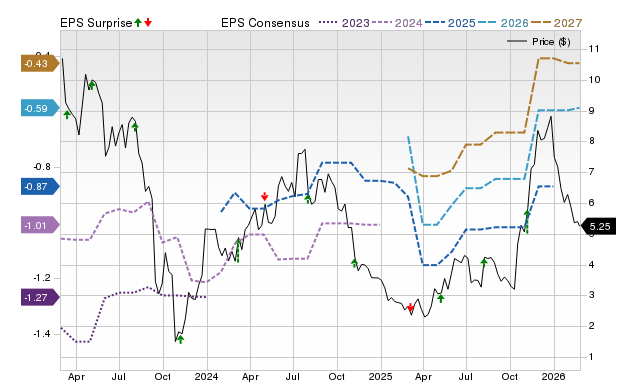

Earnings Outlook: Tourmaline Oil Corp. (TRMLF) Anticipated to Report Lower Q4 Profits

Sight Sciences, Inc. (SGHT) Projected to Surpass Earnings Predictions: Will the Share Price Rise?

Zacks Investment Ideas section spotlights: Bloom Energy, Excelerate Energy, and GE Vernova