Negative Sentiment Toward XRP Hits 6-Month Peak — History Says That’s Bullish

Negative sentiment towards XRP has hit a six-month high, a contrarian signal that could mean a rally is ahead. Santiment says historical trends show price rebounds often follow periods of extreme fear.

Negative sentiment toward XRP has reached its highest level in six months, a trend that on-chain data platform Santiment believes could signal a price rally.

The firm’s analysis shows that retail investors are experiencing the highest level of fear, uncertainty, and doubt (FUD) since the US “tariff war” in April. Historically, XRP price rebounds have often occurred when market sentiment was at its most negative.

Retail FUD Spikes as XRP Slips in Rankings — A Contrarian Setup?

Santiment’s metric for negative mentions uses a machine-learning-based sentiment analysis model to evaluate text data from sources like social media. The model assigns a positive or negative score to each piece of text (e.g., messages, comments).

A negative mention is counted when a text has a negative sentiment score of 0.7 or higher. The firm aggregates these scores to determine the total volume of negative mentions.

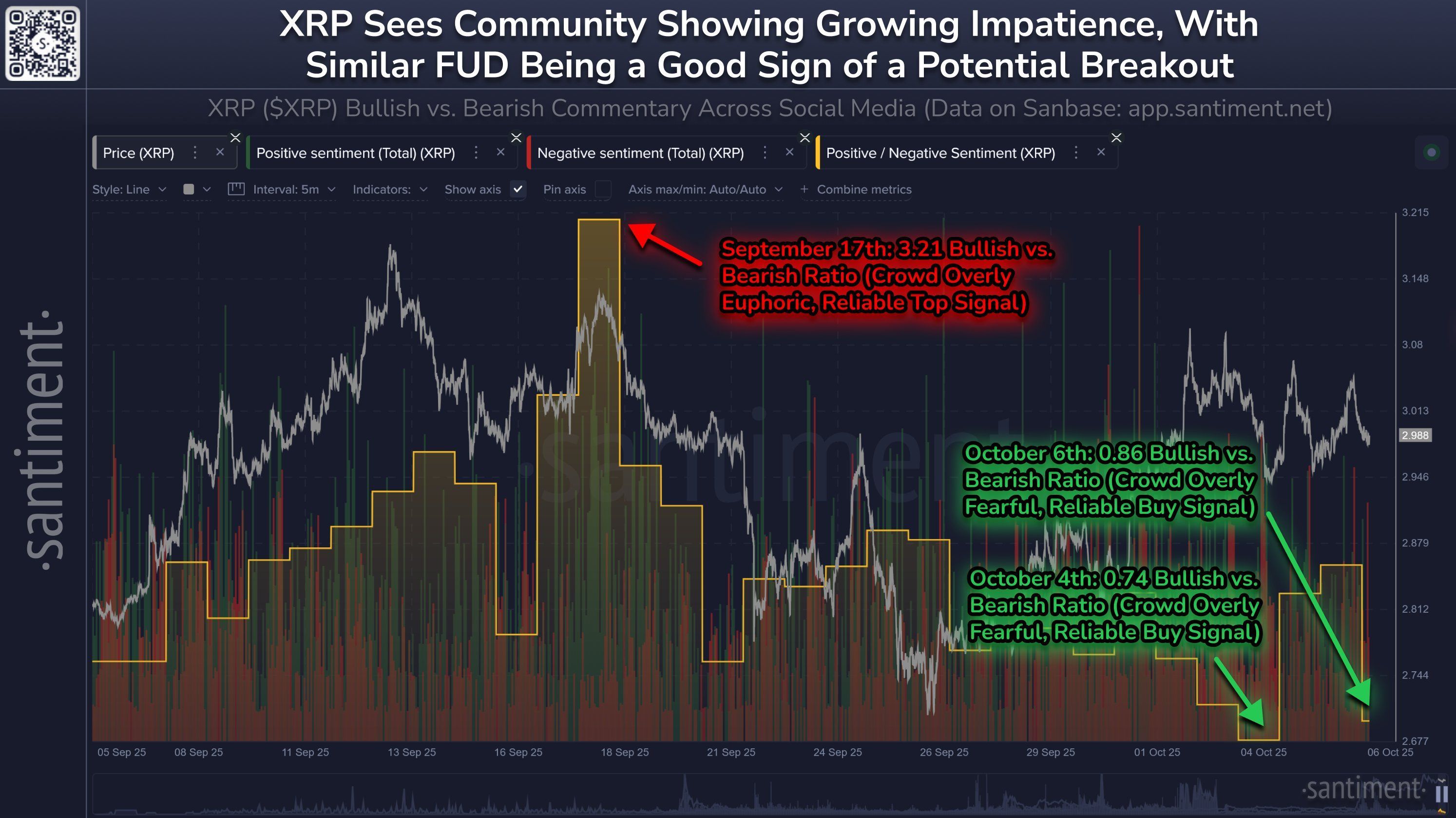

XRP Bullish vs. Bearish Commentary Across Social Media. Source:

Santiment

XRP Bullish vs. Bearish Commentary Across Social Media. Source:

Santiment

According to Santiment’s data, negative mentions of XRP outnumbered positive ones on two of the last three days. Santiment considers this a sign of “crowd fear,” representing the weakest sentiment the asset has seen in the last half-year.

Previous periods of extreme negative sentiment have historically led to buying opportunities for institutional investors, which then drive price rebounds. A similar surge in negative sentiment during the US tariff war six months ago was followed by a strong recovery for XRP after a brief correction.

The ratio of positive to negative mentions for XRP hit a psychological low of 0.74 on October 4. After a slight rebound, it fell again to 0.86 on Monday. Santiment views these periods of higher negative mentions as ideal buying opportunities for XRP, stating that “markets move opposite to small trader expectations.”

Conversely, periods of high positive sentiment are considered an ideal time to sell. For example, on September 17, positive mentions were 3.21 times higher than negative ones. In the eight days that followed, XRP’s price fell by about 14.1%.

The weakening sentiment for XRP is not just reflected in online posts but also in its market capitalization ranking.

“XRP has fallen to #4 in market cap as BNB has surged. I don’t mind as this as the move has come from BNB’s recent strength in the market rather than XRP weakness,” a crypto investor pointed out on X.

BNB climbed over 5% on Tuesday to a market cap of $180.91 billion, while XRP fell about 0.3% to a market cap of $178.89 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Ethereum Privacy Infrastructure: In-depth Analysis of How Aztec Achieves "Programmable Privacy"

From the Noir language to Ignition Chain: a comprehensive breakdown of Ethereum's full-stack privacy architecture.

CARV In-depth Analysis: Cashie 2.0 Integrates x402, Transforming Social Capital into On-chain Value

Today, Cashie has evolved into a programmable execution layer, enabling AI agents, creators, and communities not only to participate in the market, but also to actively initiate and drive the building and growth of markets.

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

A once-in-a-century major transformation is taking place in the U.S. financial system.

Gensyn launches two initiatives: A quick look at the AI token public sale and the model prediction market Delphi

Gensyn previously raised over 50 million dollars in total through its seed and Series A rounds, led by Eden Block and a16z, respectively.