Date: Sat, Oct 11, 2025 | 12:30 PM GMT

The cryptocurrency market has witnessed one of the most unforgettable and painful events in the last 24 hours — a complete bloodbath following the shocking announcement by President Donald Trump of a 100% tariff on goods imported from China. The news sent global markets tumbling, and Bitcoin (BTC) was no exception.

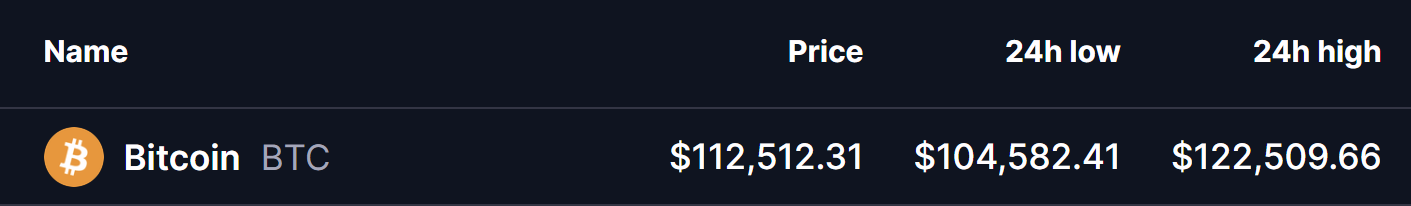

The price of Bitcoin saw a violent sell-off, crashing from its 24-hour high of $122,509 down to $104,582 before managing a modest recovery to above $112,000.

Source: Coinmarketcap

Source: Coinmarketcap

After a staggering $19 billion in liquidations across the crypto market within just 24 hours, Bitcoin’s chart is now hinting at a possible bullish reversal setup that could bring much-needed relief to traders.

Bullish Megaphone in Play?

On the daily chart, BTC appears to be forming a classic bullish megaphone pattern, a structure often associated with a potential trend reversal from bearish to bullish momentum.

As seen in the chart, the latest drop came after BTC was rejected from the upper boundary near $126,185 on October 6, leading to a steep correction toward the lower edge of the pattern at $102,500 — where strong buying support emerged.

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

This support trendline acted as a safety net, halting the fall and triggering a rebound. Currently, BTC is trading around $112,408, sitting just below the 100-day moving average (MA) positioned at $115,222, which now serves as a key resistance level.

What’s Next for BTC?

If Bitcoin manages to hold above the $108,696 support wall and successfully reclaim levels above the 100-day MA, it could pave the way for a potential recovery toward the upper trendline, around $127,000.

A decisive breakout above this megaphone structure would strengthen the bullish case — potentially setting the stage for a rally toward the $150,000 zone in the coming weeks.

However, if BTC fails to hold the current support, the market could face another wave of selling pressure before any meaningful bounce occurs.

For now, all eyes are on whether Bitcoin can reclaim momentum and lead the broader crypto market into recovery mode after one of its most volatile days in recent history.