3 Altcoins at Risk of Major Liquidation in the Third Week of October

ETH, BNB, and ZEC show diverging trader sentiment as October’s volatility intensifies. With billions in open interest at risk, each coin’s next move could spark major liquidations.

The crypto market has just witnessed a record-breaking liquidation event exceeding $19 billion, with most liquidated positions being longs. After this shock, derivatives traders have turned more cautious. However, a few altcoins appear to be defying that trend.

Some altcoins, such as BNB and ZEC, are still heavily FOMO’d by investors, while many traders remain uncertain about Ethereum’s (ETH) next direction.

1. Ethereum (ETH)

The total open interest in ETH dropped from $63 billion to $48 billion last week, showing that traders have reduced short-term leveraged positions in the market’s leading altcoin.

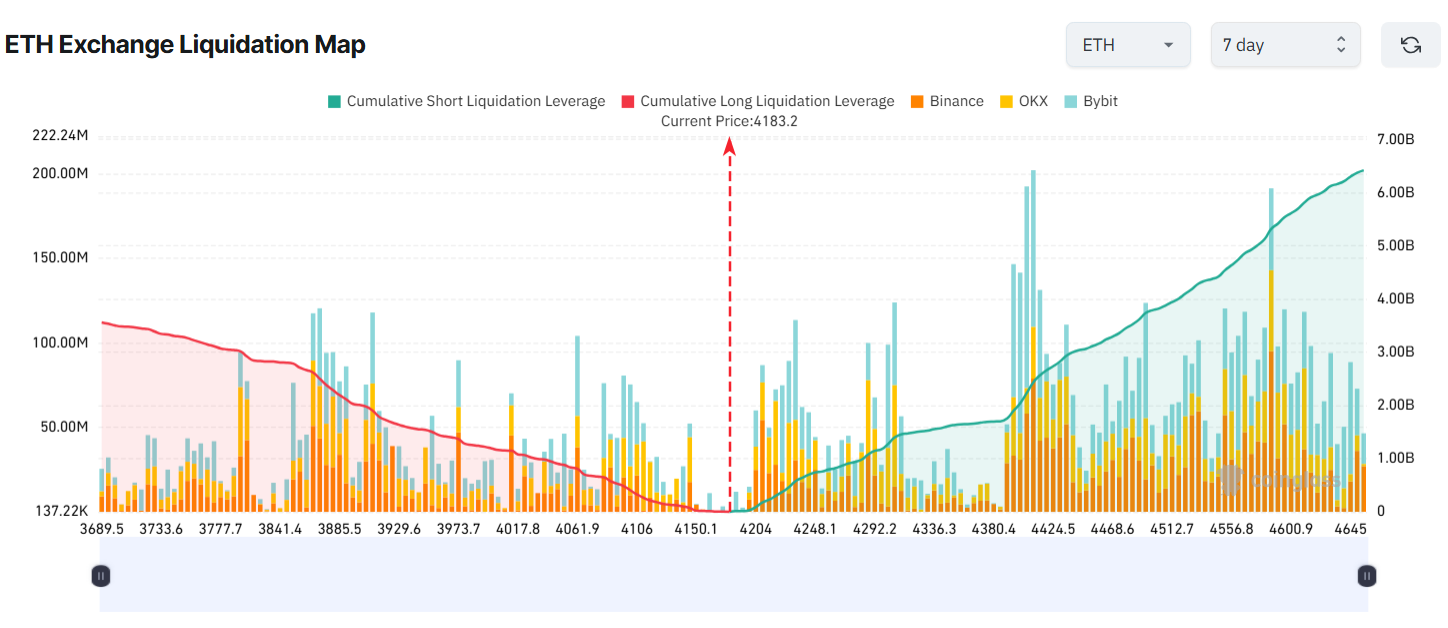

However, short-term bearish sentiment still dominates ETH traders. This imbalance is visible on the liquidation map, where short liquidations (on the right side) slightly exceed long liquidations.

ETH Exchange Liquidation Map. Source:

Coinglass

ETH Exchange Liquidation Map. Source:

Coinglass

Analysts recently outlined several reasons supporting a V-shaped recovery scenario for ETH. Large investors have been accumulating ETH as its price dips near $3,500, and Trump’s latest statements have calmed market sentiment.

“I wouldn’t be surprised if we see a V-shape recovery in the next 1–2 weeks,” investor Mnpunk.eth, said.

If ETH continues to recover and rallies toward $4,600 this week, potential short liquidations could reach $5.6 billion. Conversely, if ETH corrects below $3,700, an estimated $3.5 billion worth of longs could be wiped out.

2. Binance Coin (BNB)

BNB has stood out in the recent downturn. While many altcoins struggled to regain their previous highs, BNB surged to a new all-time high (ATH).

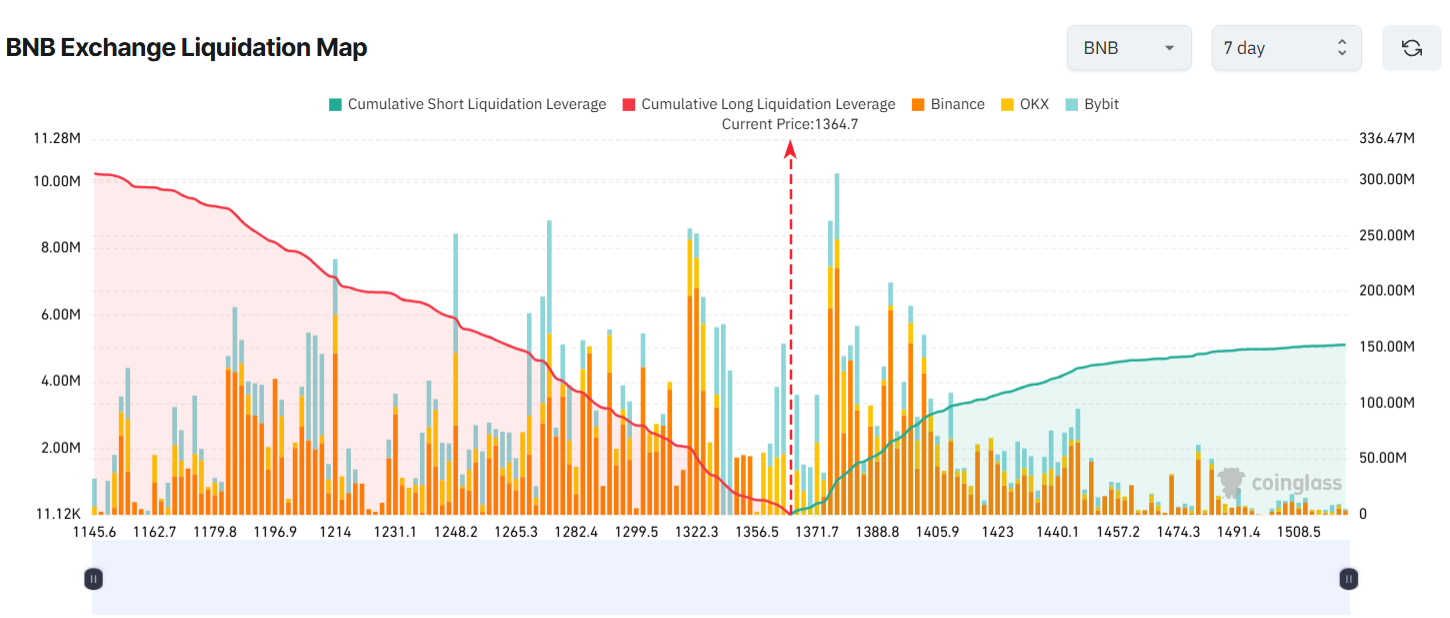

However, this price behavior has created a major imbalance in its liquidation map. The long liquidation volume significantly exceeds shorts, reflecting FOMO-driven leverage among short-term traders.

These long traders continue to bet aggressively with high leverage on BNB’s price increase, exposing them to greater losses if the market moves against them.

BNB Exchange Liquidation Map. Source:

Coinglass

BNB Exchange Liquidation Map. Source:

Coinglass

Recent analysis from BeInCrypto highlighted potential risks. The group of investors holding BNB for 6–12 months has sharply reduced their holdings from 63.89% to 18.15%, suggesting profit-taking and declining short-term confidence.

If BNB corrects to $1,150 this week, long traders could face over $300 million in liquidations. On the other hand, if BNB climbs above $1,500 and sets a new high, around $150 million in short positions would be liquidated.

3. Zcash (ZEC)

In October, several KOLs supported the idea that the privacy culture in blockchain is reawakening.

This argument gained more credibility after ZEC showed remarkable resilience during last Friday’s sell-off. The privacy coin avoided major losses and moved against the panic trend, setting a new all-time high.

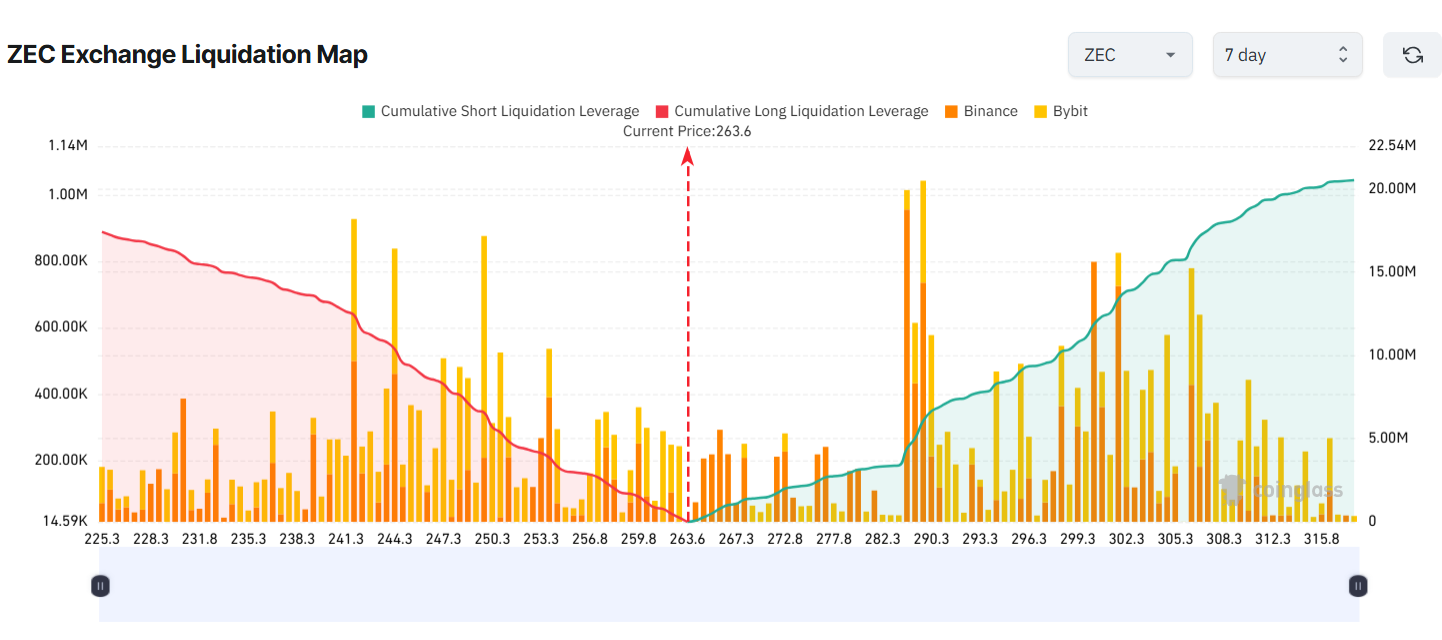

Entering the third week of October, long and short traders on ZEC appear evenly matched, as reflected in the balanced liquidation map.

ZEC Exchange Liquidation Map. Source:

Coinglass

ZEC Exchange Liquidation Map. Source:

Coinglass

If ZEC continues its upward momentum and breaks above $315, over $20 million in short positions could be liquidated. Conversely, if it drops toward $227, around $17 million in long positions could face liquidation.

Regardless of direction, liquidation risks remain elevated. CoinGlass data shows ZEC’s total open interest has surpassed $300 million, marking its highest level since 2020.

These three altcoins represent different shades of sentiment regarding short-term derivatives.

- ETH traders are leaning bearish and betting on short positions.

- BNB traders remain optimistic and expect further gains.

- ZEC traders are balanced but increasing exposure on both sides.

This divergence highlights the growing complexity of market volatility as October unfolds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.