Can Bitcoin reclaim $120k? Analysts warn of macro pressures

Analysts at Bitfinex see Bitcoin targeting $117K–$120K, but recovery hinges on fresh capital entering the spot market.

- Analysts at Bitfinex report a 2.5x imbalance between sellers and buyers in crypto markets

- U.S.–China trade tensions erased $1 trillion from the crypto market

- For Bitcoin to recover, fresh capital needs to enter, despite murky fundamentals

After weathering one of the most violent liquidation events in crypto history, Bitcoin could be making a comeback. On Monday, Oct. 13, Bitfinex released a report detailing the crash and outlining a potential recovery. However, the outlook largely depends on spot demand and macro clarity.

BTC rebounded from the largest liquidation event in history by notional value. Sparked by U.S.-China trade tensions, the crash wiped out almost $1 trillion from the crypto market cap in hours, from $4.26 trillion to $3.30 trillion.

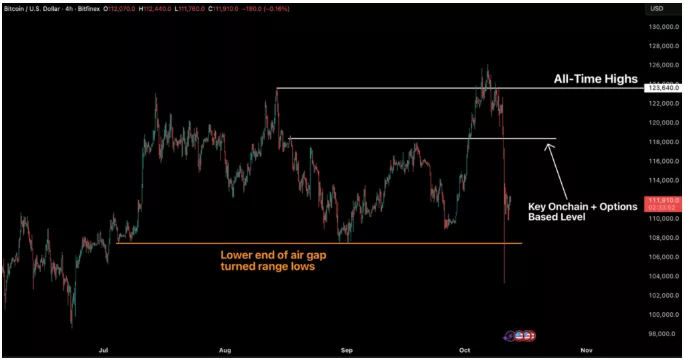

Bitcoin price chart, showing the major price drop that led to the liquidation event | Source: Bitfinex Alpha

Bitcoin price chart, showing the major price drop that led to the liquidation event | Source: Bitfinex Alpha

While Bitcoin (BTC) fell 18.1%, altcoins declined as much as 80%, with some temporarily becoming illiquid. The report notes that a 2.5x imbalance toward sellers created the conditions for the flash crash, contributing to $19 billion in futures liquidations in a single day. Although BTC bounced, further recovery remains uncertain.

Chart depicting Bitcoin liquidations, which reached more than $19 billion in a single day | Source: Bitfinex Alpha

Chart depicting Bitcoin liquidations, which reached more than $19 billion in a single day | Source: Bitfinex Alpha

Will Bitcoin recover to $120,000?

According to Bitfinex analysts, the recovery will largely depend on BTC holding key support at $110,000. That would put it in position to retest the $117,000 to $120,000 range. However, additional gains will depend on spot demand and the macro backdrop.

For a full recovery, Bitcoin needs fresh capital inflows to drive spot demand. This will largely depend on macro conditions, which are currently clouded by the lack of economic data due to the U.S. government shutdown.

“For now, the absence of data may be masking underlying fragility. If the shutdown persists, delayed reports on inflation and employment could amplify volatility once they are released. But the market message is clear: liquidity, credit confidence, and the expectation of further easing from the Fed are keeping the economy afloat, even as the lights in Washington remain dim,” wrote analysts at Bitfinex.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.