Ethereum Surpasses $3,900 Mark, Gains 0.59% in Daily Trade

- Ethereum crosses $3,900 with 0.59% gain.

- Institutional interest indicated by whale activity.

- Korea Premium Index surge suggests heightened retail enthusiasm.

Ethereum (ETH) surpassed $3,900, marking a daily gain of 0.59%. Binance reported a 24-hour spot volume near $964.4 million, and a significant whale transaction highlighted institutional confidence, while retail enthusiasm reflected higher regional market interest.

Points Cover In This Article:

ToggleLede

Ethereum (ETH) has breached the $3,900 threshold, marking a 0.59% increase in its value as reported on October 19, 2025, according to verified exchange figures.

Nut Graph

Ethereum’s breach of the $3,900 mark signals increased market interest and potential volatility, echoing historical trends seen with similar resistance level breaks.

Market Dynamics

In the latest market movement, the price of Ethereum rose above the $3,900 level, reflecting a 0.59% daily gain. Vitalik Buterin and the Ethereum Foundation have yet to release statements on this surge.

Market activity remains concentrated among institutional and retail traders. New whale wallets acquired over 4,300 ETH worth approximately $17 million amid price fluctuations.

DeFi Market Impact

The impact on decentralized finance (DeFi) markets and related crypto tokens is notable. Market leaders observe increased liquidity, particularly in pairs like ETH/BTC and ETH/USDT.

Analysis indicates that this round-number breach may trigger FOMO, as seen in historical patterns. Retail interest, driven by the Korea Premium Index, has spiked sharply.

Investment Opportunities and Risks

The breakout above $3,900 presents opportunities and risks for investors. Analysts continue to monitor market trends for further developments influenced by technical analysis.

CryptoQuant reports that the current retail enthusiasm places Ethereum in a “high-risk zone,” reflecting concerns over potential corrections. Historical data suggests that these conditions often precede volatility.

“ ETH hit 3,900 dollars , flagging a real-time price level for intraday tracking by traders,” commented Crypto Rover, a key opinion leader on X/Twitter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

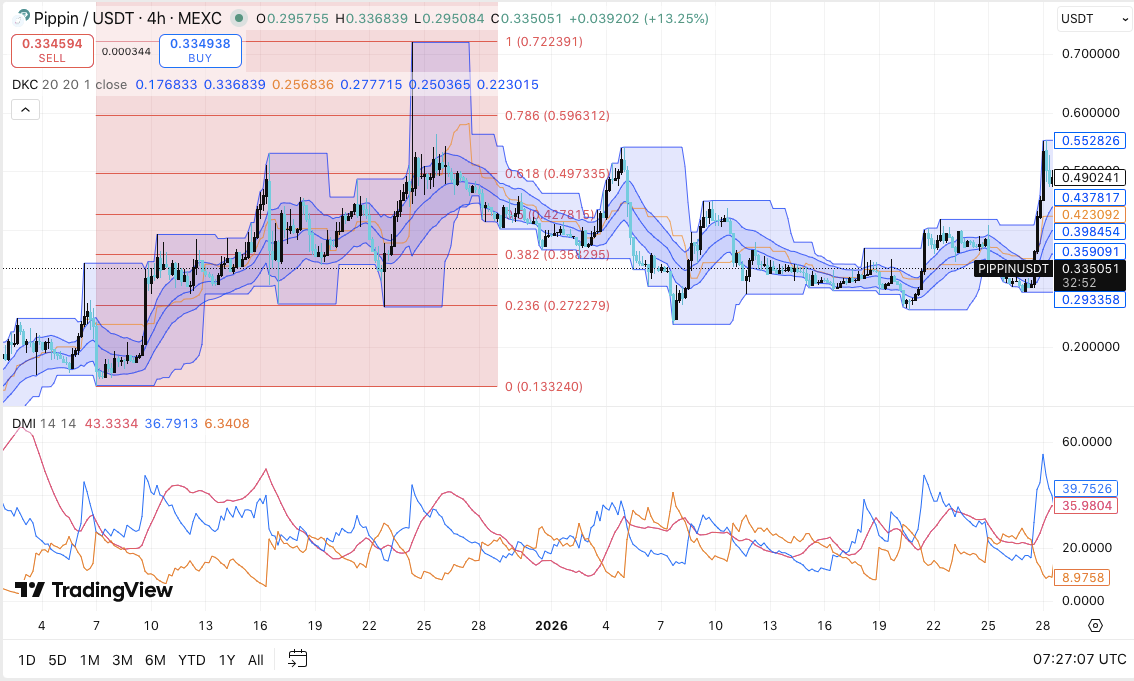

pippin Price Prediction: Whale Inflows Lift PIPPIN as Short-Term Trend Turns Higher

Cisco unveils new AI networking chip, taking on Broadcom and Nvidia