Google Finance Integrates Kalshi and Polymarket Data, Enhancing Real-Time Market Predictions

Quick Breakdown:

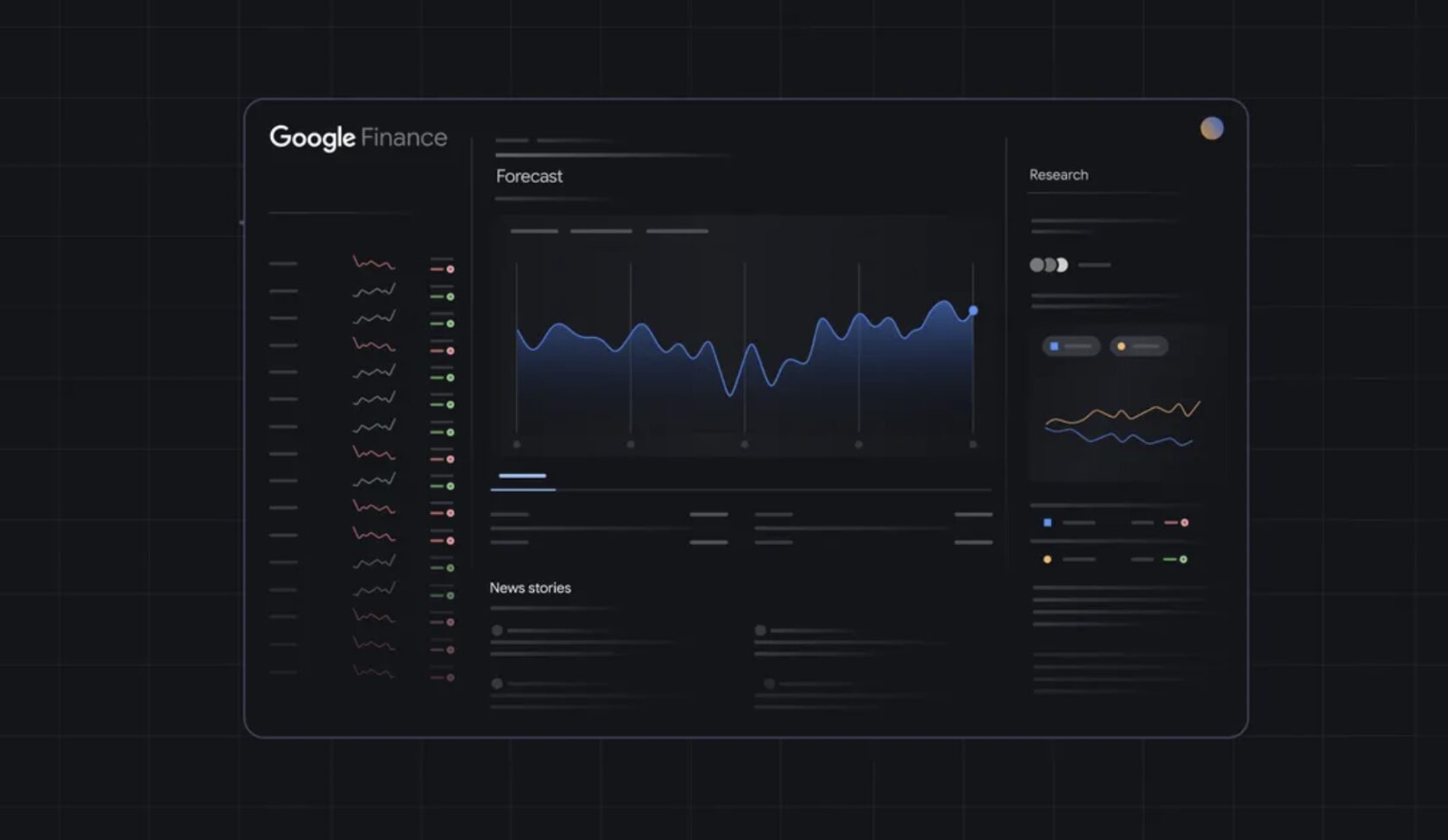

- Google Finance has upgraded its platform by incorporating prediction market data from Kalshi and Polymarket.

- This integration allows users to access real-time probabilities of future events, enhancing financial decision-making with crowd-sourced insights.

- The feature is initially available to Google Labs users and will expand globally soon.

Google Finance Expands with Prediction Market Data

Google Finance’s latest update integrates data from two major prediction market platforms, Kalshi and Polymarket, enabling users to view live odds on future events directly in search results. Users can ask natural language questions about market events like GDP growth, inflation rates, or elections and receive structured probabilities and trend histories from these markets. This innovation aligns with Google’s broader AI-driven financial insight goals, merging traditional financial data with crowd-sourced forecasting tools to provide dynamic market expectations. Initially launched for Google Labs users, the feature will soon be accessible to a global audience, starting with India.

Source:

Google

Source:

Google

Kalshi and Polymarket: Bridging Regulated and Decentralized Markets

Kalshi operates as a fully regulated US Commodity Futures Trading Commission (CFTC) exchange, specializing in event contracts tied to economic, political, and social outcomes. Google Finance users benefit from transparent, institutional-grade data sourced from Kalshi’s regulated markets. Meanwhile, Polymarket uses blockchain technology on the Polygon network as a decentralized platform emphasizing real-world event trading. Polymarket has grown rapidly, hitting record volumes and gaining substantial institutional backing, including a recent $9 billion valuation supported by Intercontinental Exchange (ICE). The inclusion of both providers underscores a merging of traditional finance with decentralized insights, expanding accessibility to real-time event probabilities across sectors such as finance, sports, and macroeconomics.

This partnership also marks prediction markets’ growing legitimacy as valuable financial forecasting tools beyond their traditional niches. Google Finance customers now have advanced tools to track public sentiment and market expectations, highlighting a shift towards interactive and data-driven financial research.

Notably, Google’s significant increase in investment in TeraWulf Inc., making it the largest shareholder with a 14% equity stake supported by a substantial financial commitment of $3.2 billion. This strategic backing is designed to accelerate the expansion of AI data centre infrastructure through a colocation partnership with Fluidstack at the Lake Mariner campus, positioning it as a major hub for high-density AI workloads. The collaboration emphasises zero-carbon, liquid-cooled data centre technology and has secured approximately $6.7 billion in contracted revenues for TeraWulf, highlighting the growing corporate demand for sustainable and scalable AI computing capacity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin new year bear flag sparks $76K BTC price target next

Ether price rallied 260% last time this happened: Can ETH reach $5K?

When "decentralization" is abused, Gavin Wood redefines the meaning of Web3 as Agency!

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.