BTC Market Pulse: Week 47

Bitcoin extended its drawdown, trading down to $93K in a continuation of the orderly trend lower that has characterised recent weeks. The move has now carried the asset into a region where historically demand has tended to re-engage.

Overview

While the prevailing trajectory remains to the downside, the market is entering levels where incremental buyers would typically begin to assess value, setting the stage for potential stabilisation should selling pressure continue to ease.

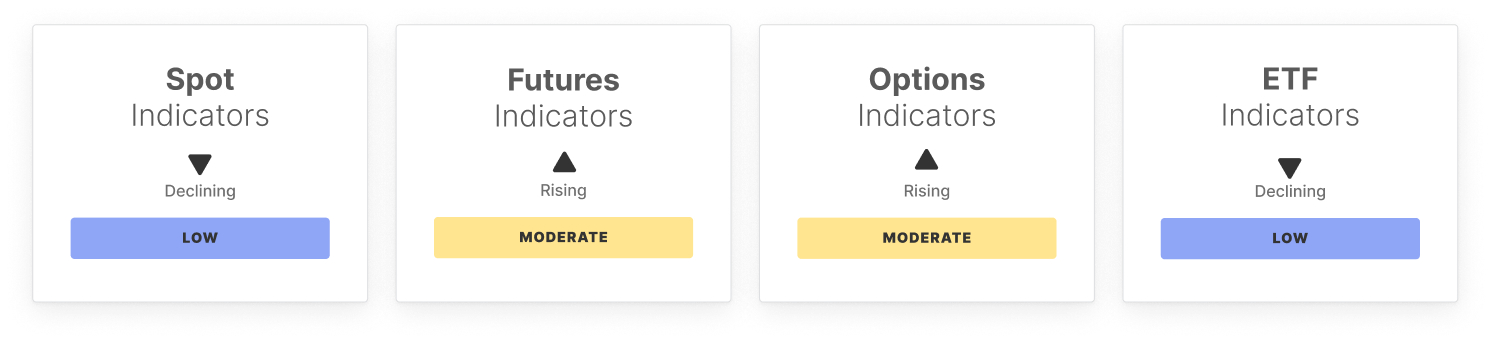

The 14-day RSI has dropped further into oversold territory, signaling sustained pressure on momentum. This aligns with heightened stress in the derivatives markets: both the Futures CVD slope and Perpetual CVD have plunged to extreme negatives, showcasing strong sell-side dominance. Yet, Futures Open Interest remained stable, indicating that the market has not seen a surge in leverage, but rather a more orderly sell-off.

In the spot market, trading volumes edged lower, and ETF outflows moderated significantly, suggesting a shift from aggressive selling to a more measured repositioning phase. Options markets remain defensive with 25-delta skew elevated, and a rising volatility spread indicating traders are bracing for larger price swings.

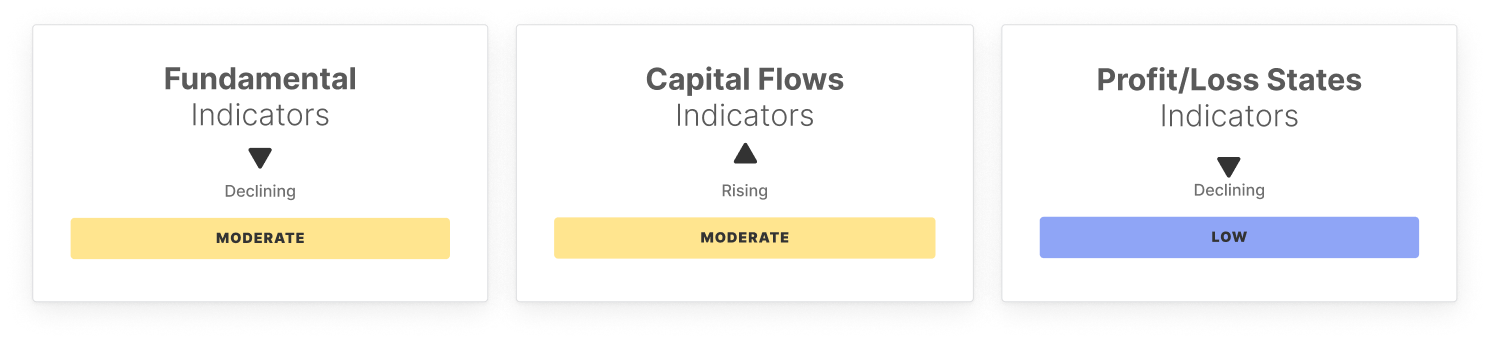

On-chain activity softened as well. Transfer volumes, fee revenue, and Realized Cap Change all declined, reflecting a quieter network and more cautious participant behavior. Profitability metrics weakened further, with NUPL and Realized P/L showing deeper losses and an increased share of short-term holder supply, a pattern often observed in late-stage corrections.

In sum, Bitcoin is navigating a period of consolidation following a sharp drop, with oversold momentum and moderating outflows hinting at early signs of stabilization. While profitability remains under pressure, the emergence of exhaustion signals suggests the market may be forming a local bottom around the $94K– $100K range.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What key signals did the U.S. "sleepless night" reveal to the market?

According to the latest data from Polymarket, the probability that the Federal Reserve will not cut interest rates in December this year has risen to 67%.

The "To VB" project secures new investment, as Ethereum veterans jointly launch a "compliant privacy pool"

0xbow is essentially a compliant version of Tornado Cash.

As Bitcoin falls below $90,000, who is quietly buying and who is continuously selling?

MicroStrategy and Harvard University, two major institutions, have increased their holdings against the trend. Is this a case of bottom accumulation or a buying-at-the-top trap?

Gavin's first treasury proposal: Restarting Polkadot's human-centric growth with "individuality"!