Today's Outlook

1、The U.S. Department of Labor will release the seasonally adjusted nonfarm payrolls data for September at

9:30 PM (UTC+8) on November 20, 2025.

2、The U.S. Department of Labor will release the September unemployment rate data at

9:30 PM (UTC+8) on November 20, 2025.

3、LayerZero (ZRO) will unlock approximately

25.71 million tokens at

7:00 PM on November 20, 2025, valued at about

$38.30 million, representing

7.29% of the current circulating supply.

Macro & Hot Topics

1、Ethereum co-founder Vitalik Buterin warned at the Devconnect conference that quantum computing could crack elliptic curve cryptography before the 2028 U.S. presidential election, urging Ethereum to transition to post-quantum cryptography within four years and introducing the "Kohaku" privacy encryption tool.

2、Nasdaq-listed Onfolio Holdings secures

$300 million in financing to establish a digital asset treasury, with initial investments in BTC, ETH, and SOL, planning to boost business growth through cryptocurrency staking.

3、U.S. Senate Banking Committee Chair Tim Scott stated that a committee vote on the cryptocurrency market structure bill is expected "next month," aiming for full Senate review in early 2026 to clarify SEC and CFTC regulatory jurisdictions.

Market Trends

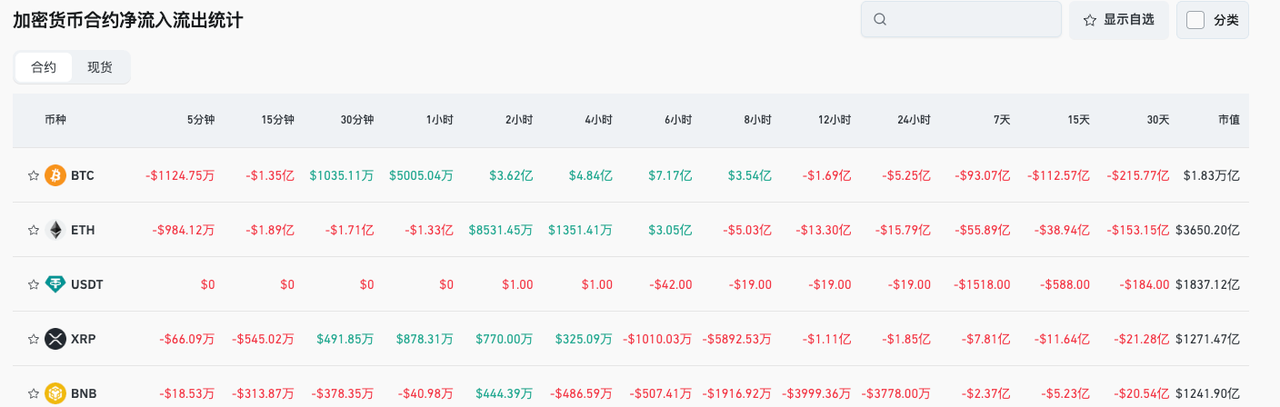

1、BTC and ETH oscillated downward over the past 4 hours amid extreme market panic, with

$656 million in 24-hour liquidations, primarily long positions.

2、U.S. stock indices closed higher across the board, led by tech stocks, with optimistic market sentiment continuing to rise.

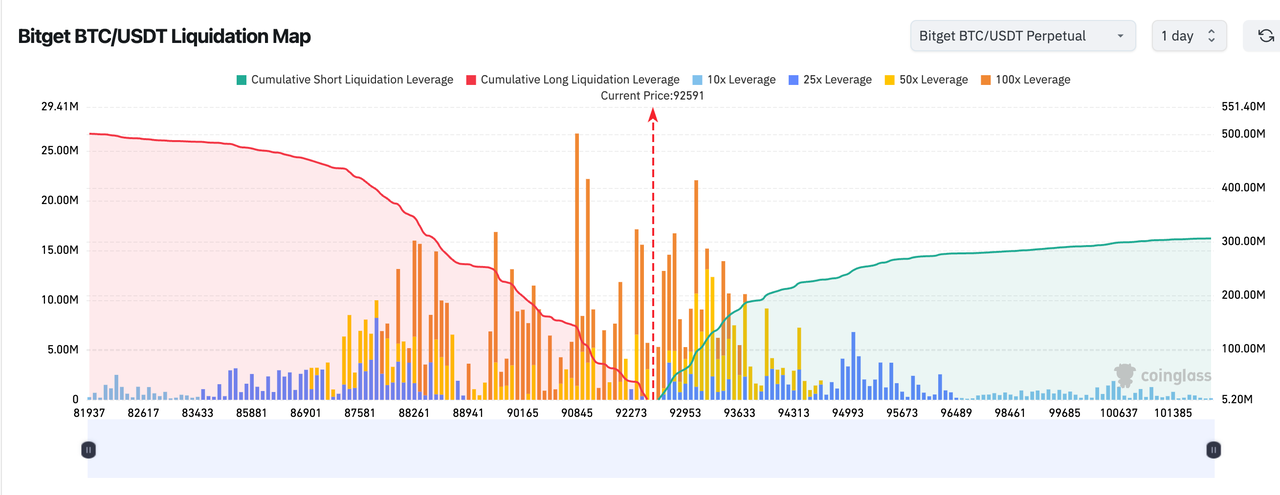

3、Bitget BTC/USDT liquidation map shows: BTC at current price of

92,591; a break below 92K could trigger a long liquidation cascade, pushing prices further to

88K–90K, though short walls remain thin.

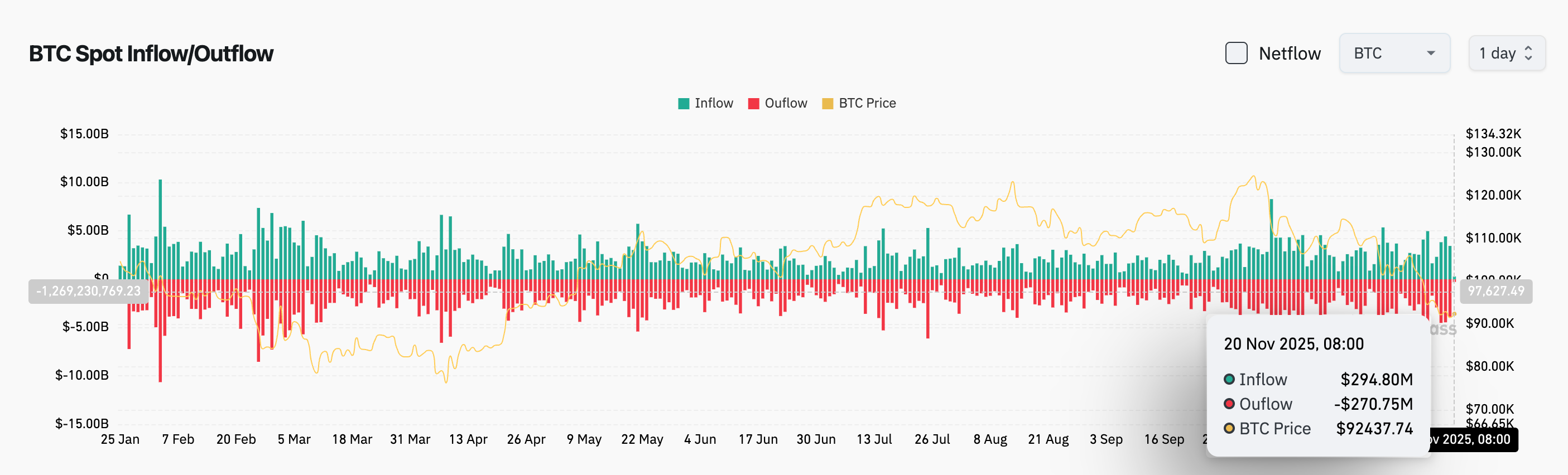

4、Over the past 24 hours, BTC spot inflows totaled

$294 million, outflows

$270 million, netting an inflow of

$24 million.

5、In the past 24 hours, contract net outflows led for BTC, ETH, USDT, XRP, BNB, and other tokens, potentially signaling trading opportunities.

News Highlights

1、The U.S. Securities and Exchange Commission (SEC) has removed dedicated focus on crypto assets from its FY 2026 examination priorities.

2、The U.S. Office of the Comptroller of the Currency (OCC) has approved banks to hold cryptocurrencies for paying blockchain gas fees.

3、UBS Group and Ant International have reached a strategic partnership to explore blockchain-based tokenized money innovations and global payment solutions.

4、HSBC Holdings announced it will launch tokenized deposit services for U.S. and UAE corporate clients in the first half of 2026.

Project Updates

1、Ethereum: Launches unified interoperability layer for seamless L2 usage.

2、21Shares Solana ETF: Officially approved and begins trading.

3、KAITO: Will unlock

8.35 million tokens at

8:00 PM on November 20, 2025, valued at about

$6.40 million, representing

2.97% of the current circulating supply.

4、LayerZero: Nearing completion of major token unlock, boosting liquidity and market attention.

5、Onfolio Holdings: Initiates crypto asset staking and treasury construction to deepen business layout.

6、Base Co-Founder: Personal token $jesse to launch on Base platform.

7、BlackRock: Registers iShares Ethereum Staking ETF in Delaware.

8、Polygon: Continues advancing L2 cross-chain and interoperability solutions, optimizing and expanding developer tools.

9、Polkadot: Upgrades on-chain governance and slot auction processes to strengthen ecosystem collaboration.

10、Bitget: Enhances liquidation map data and risk management strategies to support high-frequency trading users.

Disclaimer

This report is generated by AI, with human verification for informational purposes only. It does not constitute any investment advice.