Latin America's Crypto Gold Rush: Seizing Opportunities in Web3 On-Chain Digital Banking

From the perspective of traditional digital banking, Web3 on-chain banks built on blockchain and stablecoin infrastructures will, in the future, meet user needs and serve those populations that traditional financial services cannot reach.

From the perspective of traditional digital banking, let's look at how Web3 on-chain banks built on blockchain and stablecoin architecture will meet user needs in the future and serve those populations that traditional financial services cannot reach.

Compiled by: Will Awang

Almost every narrative design and event sharing I participate in ends with a vision described by Bankless: that we can build a Web3 on-chain digital bank through stablecoin payment + on-chain finance, constructing almost all the services traditional banks can provide, achieving financial inclusion and equality.

The starting point behind this grand vision is not only crypto-native applications like Crypto Consumer Apps, DeFi, and public chains, but also stablecoin payment companies, Fintech, and more. It can be said that the revolution of new digital banks has arrived.

Traditional digital banks and Fintech are booming: Nubank has a market value of $72 billion, serving 122 million users in Latin America; Revolut is valued at $75 billion, with over 60 million customers worldwide; Chime will be valued at $11.6 billion upon its 2025 IPO, with 18 million accounts in the US alone. These "digital-native" banks prove that better, faster, and cheaper banking services can scale to hundreds of millions of users and generate billions of dollars in revenue—without a single physical branch.

Crypto-native Web3 on-chain banks are already emerging. Crypto users have long been self-custodying, trading peer-to-peer, and earning yields with stablecoins; the market is awakening. But for these digital-native ordinary people, crypto is still too complex and risky. What they need is a bridge: a new Web3 bank—a familiar banking interface, but running on blockchain rails, stablecoin accounts, and DeFi infrastructure.

Therefore, we have compiled this article to examine, from the perspective of traditional digital banking, how Web3 on-chain banks built on blockchain and stablecoin architecture will meet user needs in the future and serve those populations that traditional financial services cannot reach.

We will focus on Latin America. Here, crypto has already taken root, new banks have proven they can dominate, and stablecoins are native. Latin America has structural conditions such as currency crises, remittance dependence, and financial exclusion, making Web3 new banks not just "useful" but "necessary." The region processes trillions of dollars in crypto transactions annually, of which 50–90% are stablecoin payments rather than speculation. Argentina's 178% inflation rate makes people desperate for USD-denominated accounts; $160 billion in annual remittances flows through the region, but is heavily gouged by fees; 122 million people remain unbanked, yet everyone has a smartphone.

1. Traditional Digital Banks

1.1 What is a Digital Bank (Neobank)?

A digital bank is a "digital-native" financial institution that operates only through mobile apps and web pages, with no physical branches. Traditional banks move offline business online, while digital banks are born in the cloud, designed from scratch for smartphones. They usually partner with licensed banks for regulatory compliance and deposit insurance, but deliver a better experience, lower fees, and faster service directly to customers.

Five key features that define digital banks:

- Zero branches: All operations are completed on the phone, account opening in 5 minutes, no need to visit a branch, no business hours, 24/7 online customer service.

- Paperless: No piles of forms or notarized documents, automated KYC: take a photo of your ID, do a face scan, done in 10 minutes.

- Ultra-low fees: Free checking accounts, no monthly fees, no minimum balance requirements.

- Mobile-first: The app is not an "additional channel" like in traditional banks, but the entire product itself.

- User-centric: Traditional banks prioritize institutional processes, digital banks prioritize users—spending categorization, savings goals, investment opportunities, cashback rewards are all built-in features, not extra plugins.

Digital Bank ≠ "Bank + App"

The difference lies in the underlying architecture. Traditional banks bolt a digital interface onto decades-old core systems; digital banks are rewritten from day one with API-first modern infrastructure, resulting in better products, faster feature iteration, and lower operating costs.

It is this infrastructure that allows Nubank to serve a customer at an average monthly cost of only $1, while traditional Brazilian banks require $15–20; allows Revolut to launch in a new country in weeks, while traditional banks take years; allows digital banks to acquire 80–90% of new customers through word-of-mouth, while traditional banks spend hundreds of dollars to acquire a single user.

1.2 The Current State of the Digital Banking Market

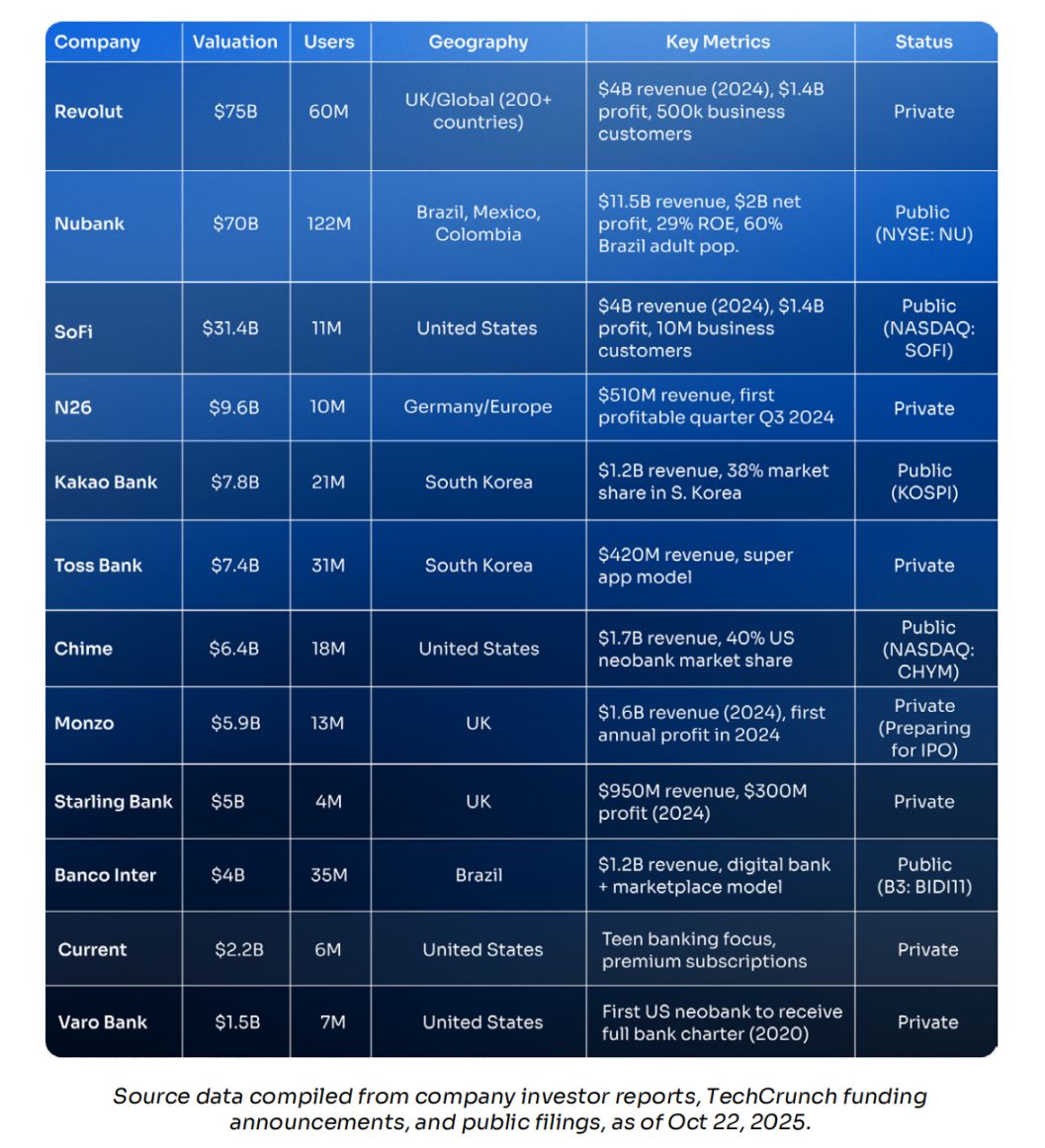

Digital banks have quickly become the most valuable track in fintech. While traditional banks spend decades building branches and stacking legacy systems, digital-native challengers have acquired hundreds of millions of customers and market caps rivaling century-old institutions. Let's look at the numbers:

- Revolut: 60 million customers, $75 billion valuation

- Nubank: 122 million users, $70 billion market cap

- Chime: $11.6 billion IPO valuation

They are no longer "startups," but financial giants: annual transaction volumes in the hundreds of billions, revenues in the tens of billions, and many are consistently profitable. The global landscape is as follows:

A Young Market, Rapid Growth

This territory is not ancient; the entire sector is just over a decade old, yet its combined market cap rivals century-old banks. Fifteen years ago, most players didn't even exist: Revolut was founded in 2015; N26, Chime, and Nubank all emerged in 2013.

From 2023–2024, many companies became profitable, proving the model can scale; public listings came even later: Nubank IPO'd in December 2021, SoFi listed the same year, and Chime will go public in 2025—the story is just beginning.

Latin America's Superstar

Here's the key: the world's largest digital bank by customers is headquartered in Latin America. Nubank has 122 million users in Brazil, Mexico, and Colombia—more than Revolut and Chime combined. In just over a decade, it has grown from zero to cover 60% of Brazil's adult population; annual revenue is $11.5 billion, with a return on equity of 29%, making traditional banks envious.

Even Warren Buffett has bet on it: in 2021, Berkshire Hathaway invested $500 million in Nubank—a rare move for the legendary investor, who seldom touches tech or fintech.

Imagine: if Latin America can nurture a $70 billion digital bank with fiat accounts in a market of high inflation and financial exclusion, how big will the opportunity be when Web3 on-chain digital banks bring stablecoin infrastructure + DeFi yields + blockchain rails to the same population?

This is the gap we need to seize.

1.3 Unit Economics and Revenue Models

To understand how big the opportunity is for Web3 on-chain digital banks, we must first understand how traditional digital banks make money and why their unit economics crush legacy banks.

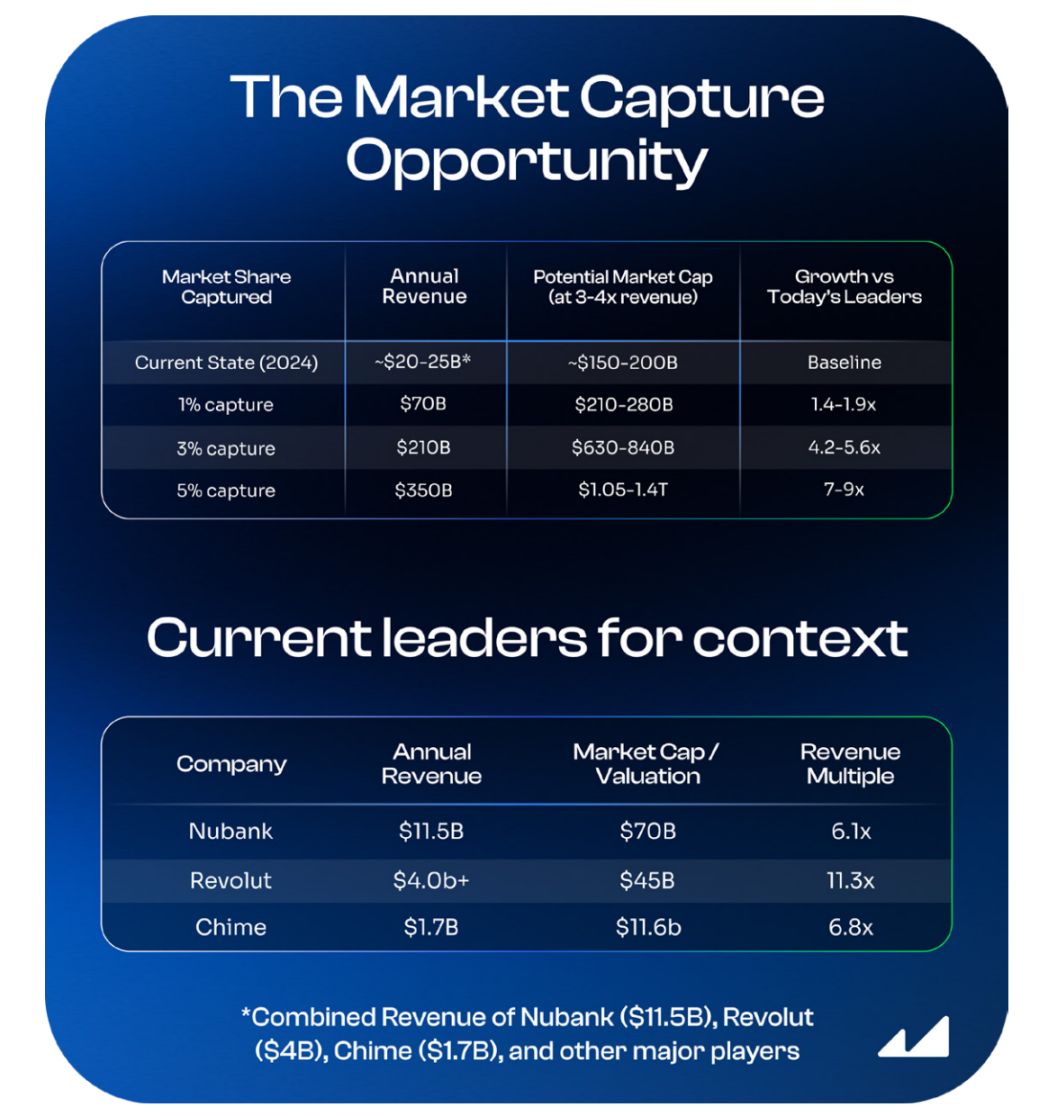

Traditional Banking: $7 Trillion Annual Revenue Baseline

Let's look at the scale. According to McKinsey's "2024 Global Banking Annual Review," global banking generates about $7 trillion in annual revenue. Even the largest digital banks account for less than 1%. The opportunity is not to replace traditional banks overnight, but to carve out just 3–5% of the pie over the next decade.

Let's do some simple math:

- If digital banks capture 5% of global banking revenue → $350 billion/year;

- At current valuation multiples (most are 3–4x revenue, high-growth like Revolut command higher premiums);

- The industry's total market cap will reach $1–1.4 trillion;

- This would be 5–6 times the combined value of today's top digital banks, and Web3 on-chain digital banks could claim a significant share.

1.4 Four Core Revenue Streams of Digital Banks

A. Credit Card Interchange Fee Sharing

Every time a customer swipes a card, the merchant pays a 1–3% transaction fee. The card network (Visa/Mastercard) takes a cut, and the rest goes to the digital bank. This is the largest revenue source (about 70–90% of Chime's revenue comes from this).

B. Credit Products

Credit cards, personal loans, BNPL, etc., generate interest income. Traditional banks get 50–60% of their revenue from lending; digital banks first attract deposits and issue cards, then move into lending once trust and data are established.

Nubank's Q3 2024 loan balance is about $21 billion, with ROE as high as 30%, far exceeding the traditional bank average of 15–18%, because it targets underserved populations and strictly controls risk.

C. Premium Subscriptions

Monthly fees of $10–45 unlock airport lounges, better exchange rates, crypto trading, and other benefits. Revolut Premium, Nubank Ultravioleta, etc., rely on this for high-margin, predictable recurring revenue.

D. FX and Crypto Trading Spreads

They charge spreads on foreign exchange and crypto trading. Revolut already supports 80+ cryptocurrencies, and its wealth/crypto segment saw strong revenue growth in 2024; in Latin America, customers continuously convert volatile local currencies into USD or stablecoins, making spread income especially lucrative.

Traditional digital banks have already proven with superior unit economics that a purely digital banking model can scale to hundreds of millions of users and generate billions in revenue.

So, what happens if "crypto-native" is written into the DNA from day one?

2. The Era of Web3 On-Chain Digital Banks Arrives

Digital banks are the ultimate destination for cryptocurrency. This view can push the on-chain world into the mainstream. Every real-world asset tokenization (RWA), every token, every DeFi product, every investment vault, every Layer1 or Layer2 public chain—everything on-chain needs distribution channels. The new wave of digital banks is connecting all the dots.

Digital banks disrupted traditional banks with "digitalization"; Web3 on-chain digital banks will disrupt digital banks again with blockchain and stablecoins.

This is not as simple as adding a "crypto trading" tab to an existing banking app. Web3 on-chain digital banks are blockchain-native architectures from the ground up, completely restructured.

2.1 How Are Web3 On-Chain Digital Banks Different?—UR: A Real Example

UR, supported by Mantle's multi-billion dollar treasury, will launch in June 2025 (UTC+8) as a Web3 on-chain digital bank. Users can open Swiss IBAN accounts supporting USD, CHF, EUR, CNY, JPY, SGD, and HKD, with 1:1 reserve backing, and spend globally via Mastercard debit cards. All accounts are provided by licensed Swiss financial institutions, but the core system is connected to tokenized deposits and NFT identities.

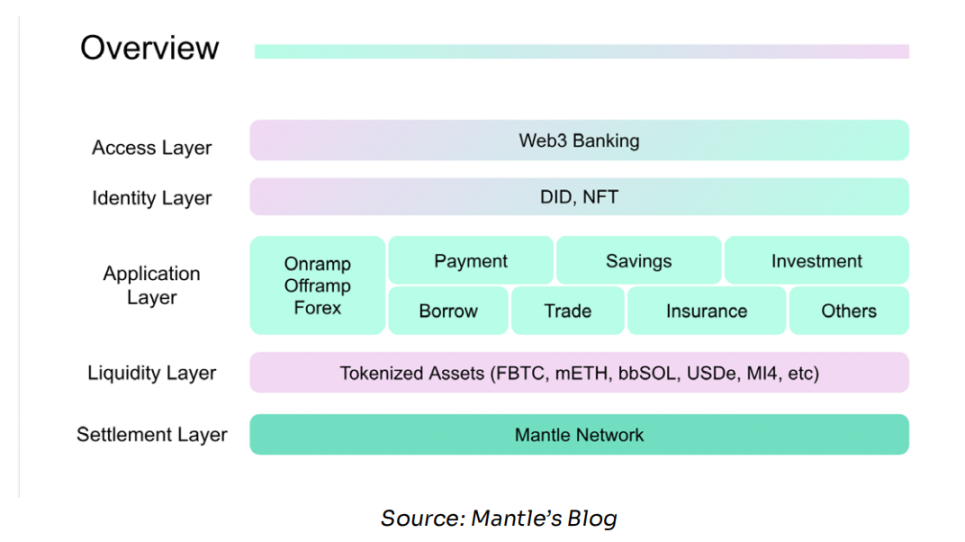

The key is the underlying layer: UR is deeply integrated with Mantle Network (Ethereum L2) and its native products—mETH (liquid staking token) and MI4 (tokenized money market fund). Thus, UR can provide traditional banking services (IBAN, debit cards, fiat), while also allowing users to access on-chain yields and DeFi opportunities.

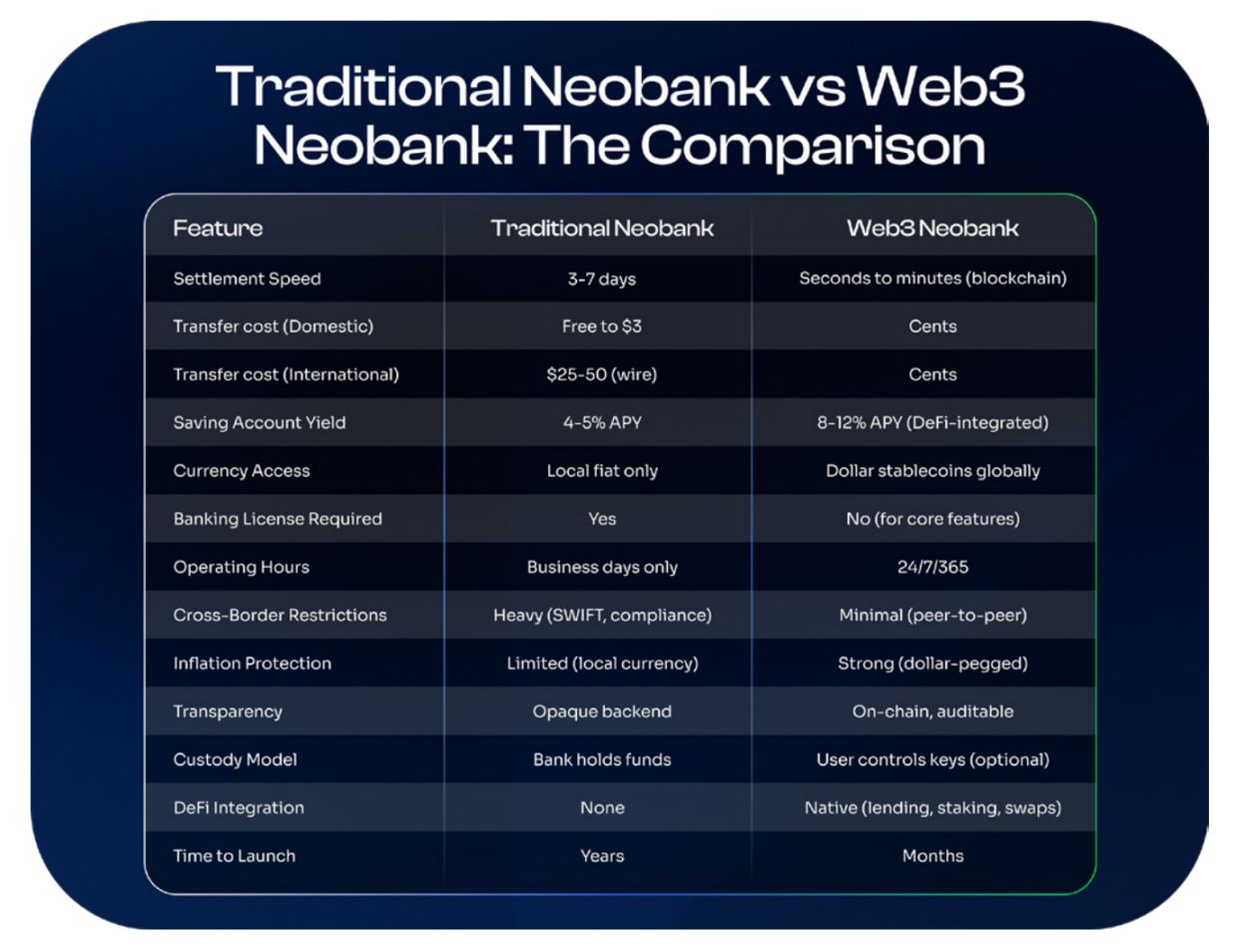

This is the core difference: traditional digital banks have a single-layer banking architecture; Web3 on-chain digital banks separate the layers, connecting the settlement layer to global blockchains, the liquidity layer to tokenized pools and DeFi protocols, while the experience layer retains the familiar banking interface.

Users don't need to understand Mantle or mETH; all they see is: "USD deposit annualized XYZ%," "EUR→USD instant exchange" (UTC+8). Blockchain infrastructure is invisible but supports superior economics.

Bank cards are distribution channels; accounts are infrastructure. We believe successful digital banks should be "account-first": building regulated, named, multi-currency accounts that connect to the traditional financial system, enabling on-chain dollars to be used for payroll, bill payments, and accumulating credit history over time. We firmly believe this is the path to building a successful digital bank that blurs the line between fiat and crypto.

——Neo Liat Beng, UR Chief Operating Officer

Now, let's break down the four core differentiators that make this architecture so powerful:

A. Blockchain Financial Infrastructure

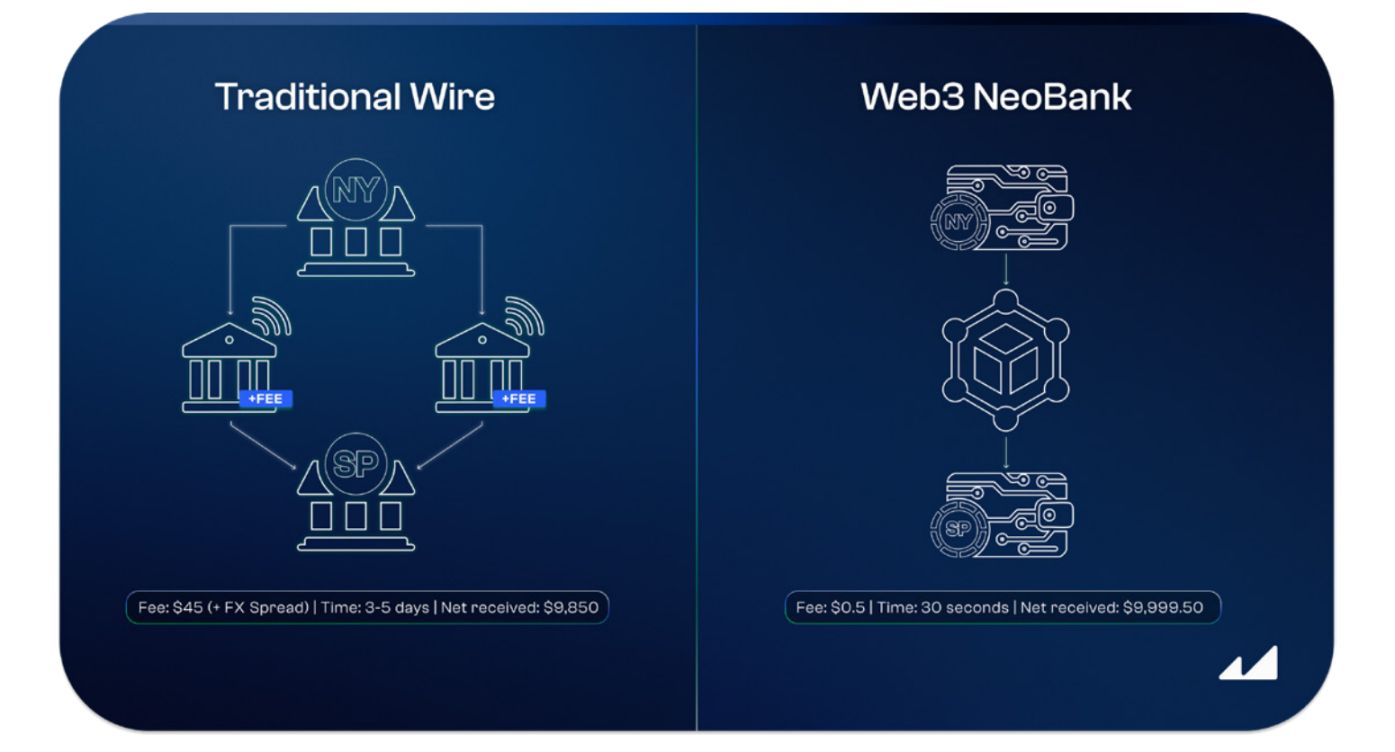

Traditional digital banks still run on old financial rails. When you transfer money with Revolut or Nubank, the funds go through ACH (US), SEPA (Europe), etc., taking 3–7 business days to settle; wire transfers are even slower and cost $25–50 per transaction; SWIFT cross-border is even more exaggerated, starting at 5 days, with multiple intermediary fees.

Web3 on-chain digital banks settle directly on blockchain. Sending USDC to the other side of the world takes seconds to minutes (UTC+8), with fees under $1 (Solana, Plasma, and other efficient chains are even below $0.1). No weekends, no holidays, no intermediaries, no delays.

Real-life example: Sending $10,000 from New York to São Paulo

- Traditional wire transfer: $45 fee, 3–5 days to arrive (UTC+8), intermediary fees + FX spread, net received $9,850

- Web3 on-chain digital bank (USDC): $0.5 fee, 30 seconds to arrive (UTC+8), net received $9,999.50

This is not theoretical; millions of users already use stablecoins for cross-border remittances because it's cheaper and faster.

B. Stablecoin Accounts

Traditional digital banks only offer local currency accounts (Brazilian Real, Mexican Peso, Argentine Peso). To hold USD assets, you either open a US bank account or get "ripped off" by local banks with high FX spreads.

Web3 on-chain digital banks provide stablecoin accounts (USDC, USDT) directly—anyone, anywhere, can own USD-denominated assets with one click. No US bank, no local residency, no credit history required—just download the app and deposit dollars on-chain.

In Latin America, this is about survival: when local currencies depreciate by over 50% annually (Argentina, Venezuela), holding dollars is not speculation—it's "life-saving."

C. DeFi Integration

Traditional digital banks offer savings account rates tied to central bank policy. In the US, high-yield savings accounts offer 4–5% APY, matching the Fed rate; in Brazil, Nubank's rate is about equal to the CDI (Brazilian interbank benchmark), currently a nominal 10–11% APY.

But Brazilian users face a trap: inflation is 4–6%, the Real is constantly hit by political and FX volatility (over 15% depreciation against the USD in 2024), so the apparent 10% Real yield may actually be negative in USD terms—interest is earned, but purchasing power is lost.

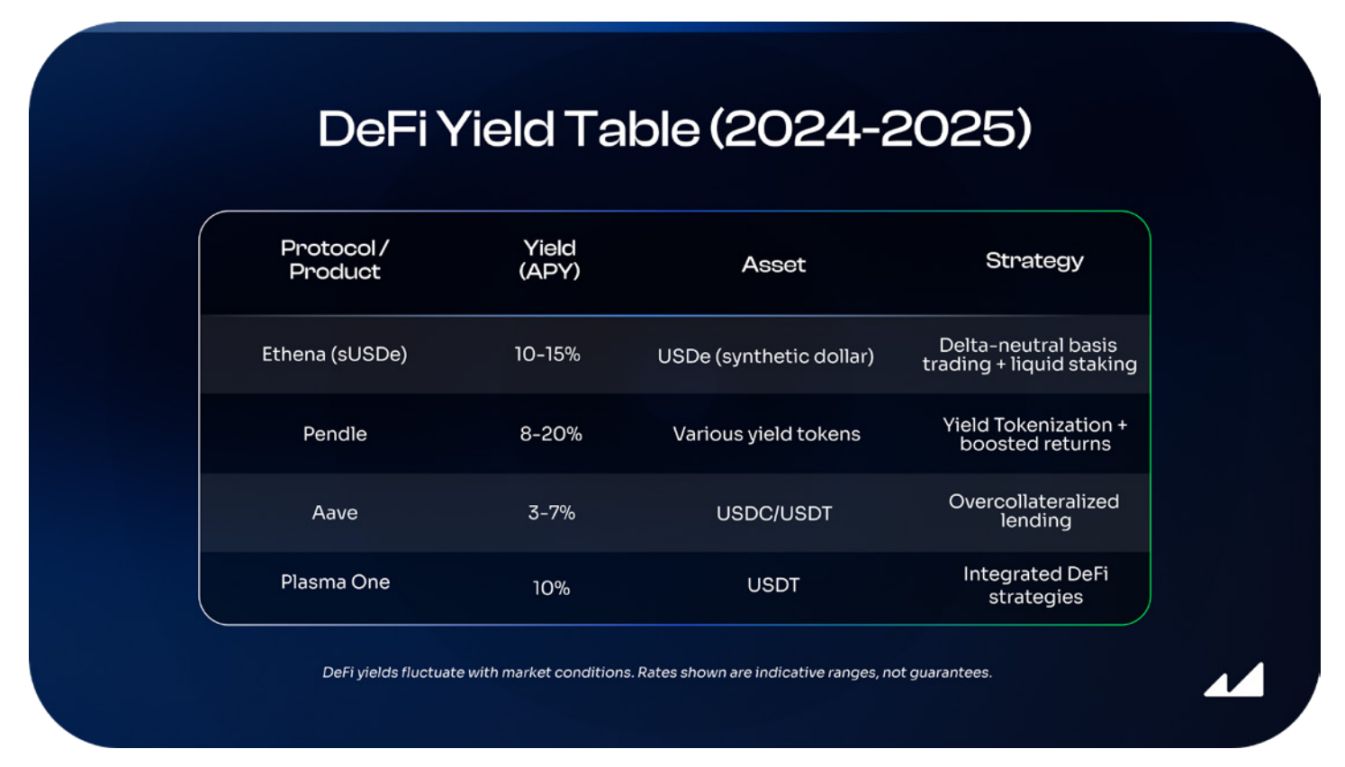

Web3 on-chain digital banks integrate DeFi protocols directly, allowing users to earn yield on USD stablecoins, hedging both inflation and devaluation. Yield sources include:

- Overcollateralized lending: lend USDC/USDT to borrowers with ≥150% collateralization

- Liquidity provision: provide liquidity to DEX stablecoin pairs

- On-chain vaults: professional asset managers run delta-neutral and other strategies on-chain

- Staking rewards: hold liquid staking tokens to earn validator rewards

- Yield tokenization: platforms like Pendle split and trade future yields, add leverage

Comparison: Chase regular savings 0.01% APY, Nubank 10% APY but currency depreciates 15%. For Brazilian users, earning 12% APY on USD stablecoins via Ethena beats earning 10% on the Real that devalues every year.

Although these yields come with smart contract risk and are not FDIC insured; DeFi protocols can be hacked, Ethena's delta-neutral strategy depends on derivatives markets functioning normally, and Pendle's high yields require deep understanding of the fixed income market. But context determines choice. In the following countries:

- Triple-digit inflation (Argentina 178%)

- Strict FX controls (Venezuela)

- Banking system turmoil (Lebanon, Turkey, Nigeria)

- Political instability causing capital flight

DeFi risk is often "safer" than local banks. Those who have experienced government account freezes (Argentina 2001, Brazil 1990) or overnight 90% currency devaluation find "smart contract risk" relatively manageable.

For hundreds of millions globally, this is a no-brainer.

D. Permissionless

Traditional digital banks must first obtain a banking license, pass regulatory approval, partner with licensed banks to provide FDIC insurance, sign card issuance agreements with Visa/Mastercard, and comply with dozens of local financial regulations—spending years and millions on legal and compliance before doing a single transaction.

The core products of Web3 on-chain digital banks (stablecoin accounts, DeFi yields, peer-to-peer transfers) can be launched permissionlessly:

- Let users hold USDC

- Connect to Aave for yield

- On-chain transfers

None of this requires a banking license. From development to deployment, it can be done in weeks to months. Although Web3 on-chain digital banks still need licenses and partners for the following: debit/credit cards (Visa/Mastercard issuance); fiat on/off ramps; KYC/AML compliance (licensed vendors required). However, the core product of stablecoins + DeFi can be launched immediately, with cards and fiat channels added later. The entry barrier drops sharply, and go-to-market cycles are greatly shortened.

For this reason, 2025 will see an explosive launch of Web3 on-chain digital banks:

- Infrastructure is mature → demand is validated → regulatory frameworks are in place (GENIUS Act)

- Builders can now go full speed ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Sharpe ratio is nearly at zero, a rare risk-reward signal

XRP price ‘looking very bullish’ after 25% weekly gain: How high can it go?

HIP-3 projects are transforming the Hyperliquid ecosystem

US stocks, Pokémon cards, CS skins, pre-IPO companies—a diversified, all-weather liquid capital market.

Aethir establishes DePIN computing leadership with enterprise-level growth: a new generation of computing infrastructure model driven by real revenue

Aethir is a global leader in decentralized GPU cloud infrastructure, dedicated to providing enterprise-level computing power services for AI, gaming, and next-generation Web3 applications.