Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

Original Title: "Facing Lawsuits from Seven States While Raising $11 Billion: The Song of Ice and Fire for Prediction Market Star Kalshi"

Original Author: Ethan, Odaily

Recently, a class action lawsuit accepted by the Southern District Court of New York has drawn prediction platform Kalshi into yet another regulatory dispute.

Seven users accused the platform of selling sports-related contracts without obtaining any state gambling licenses, and questioned its market-making structure, claiming it "essentially pits users against the house." Just days earlier, a Nevada court had lifted Kalshi's protective injunction, exposing it to potential imminent criminal enforcement in the state.

Regulatory characterization has become increasingly severe. The Nevada Gaming Control Board determined that Kalshi's sports "event contracts" are essentially unlicensed gambling products and should not enjoy the regulatory protection of the CFTC (Commodity Futures Trading Commission). Federal Judge Andrew Gordon stated bluntly at a hearing: "Before Kalshi, no one would have considered sports bets to be financial products."

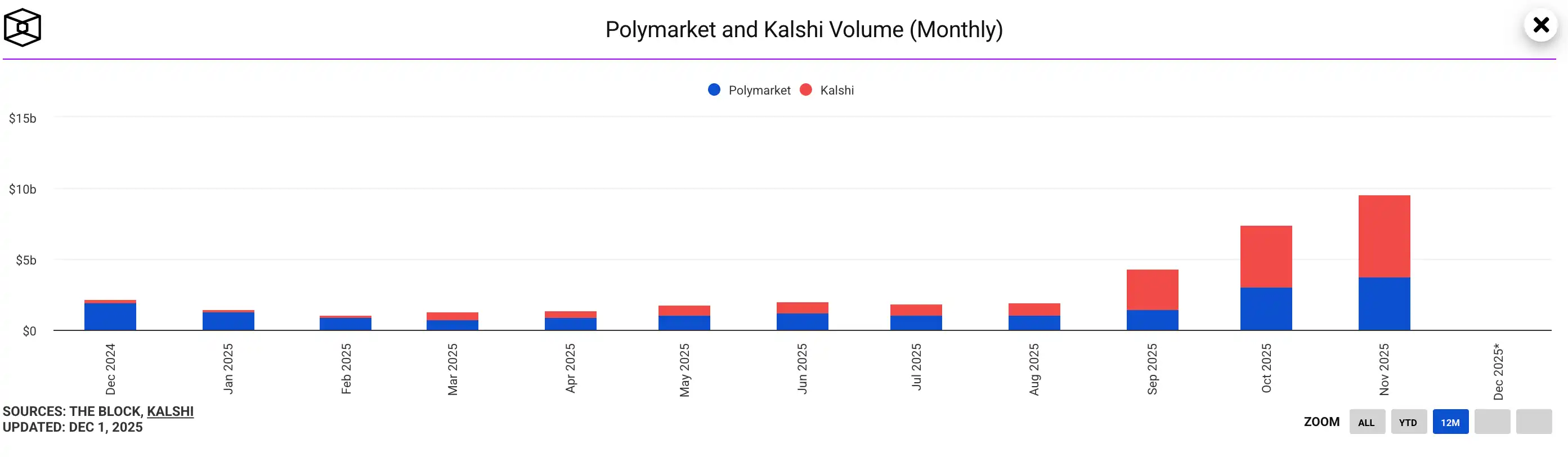

However, what most people did not anticipate is that, in the weeks when regulatory crackdowns and legal pressure were intensifying, Kalshi's business metrics showed an almost defiant countertrend growth—trading volumes repeatedly hit new highs, and its latest funding round valued the company at $11 billion, making it the undisputed superstar in the prediction market sector.

The fervor of capital and the chill of regulation form a striking contrast: Why does a company labeled as "illegal" by multiple parties show unprecedented vitality in the market? This article attempts to look beyond court rulings and trading data to dissect the regulatory logic conflicts, trust crisis, and contrarian capital bets facing Kalshi, restoring the real logic at the heart of this billion-dollar market storm.

The Fracture of Legal Identity: How Did Kalshi Go from "Compliant" to "Illegal"?

Returning to the origin of the incident, one often overlooked question is: Kalshi was not "illegal" in the past; it simply was suddenly no longer allowed to operate legally. This shift from "compliant" to "illegal" did not stem from a change in business operations, but from a shift in regulatory interpretation—especially regarding the core question of whether prediction markets are "financial derivatives" or "unlicensed gambling."

Kalshi's self-narrative has always been clear: it is a "Designated Contract Market" (DCM) registered with the CFTC, and the event contracts it offers are a form of binary options derivatives with "real economic purpose," and thus should be exclusively federally regulated. In recent years, this argument has indeed found space within the U.S. regulatory system, allowing Kalshi to launch binary prediction contracts in hundreds of fields such as election cycles, macroeconomics, and technology events, gradually becoming an industry leader.

However, Nevada regulators clearly do not accept this logic, especially when Kalshi began to touch the sports sector, causing conflict to escalate instantly. Sports betting is one of the most strictly and locally regulated sectors in the U.S., with each state having completely different systems for licensing, taxation, and risk control. In other words, sports betting is a typical "state rights red line." When Kalshi began offering contracts involving touchdown times, game progress, and other sports events, Nevada regulators deemed these products essentially prop bets—a typical sports betting category, not financial derivatives.

This is also why Judge Gordon's attitude shifted significantly during the hearing. He pointed out that, by Kalshi's definition, anything involving future events and money could be packaged as a derivative, which would render the regulatory system ineffective. The court subsequently ruled that sports events do not fall under the "excluded commodity" framework of the Commodity Exchange Act and are therefore not subject to exclusive CFTC oversight.

As a result, the Nevada court not only officially lifted Kalshi's protective injunction at the end of November but also made it clear that these sports event contracts are essentially gambling contracts, not derivatives.

This ruling not only exposes Kalshi's operations in Nevada to both criminal and civil enforcement risks, but also provides an important legal reference for other states nationwide. Currently, at least six states across the U.S. have initiated lawsuits in various courts over the "regulatory boundaries of prediction markets," with increasingly obvious jurisdictional divergences in the rulings:

· Federal Faction: Some states still insist on federal preemption, advocating for unified CFTC regulation;

· Gambling Faction: More states are following Nevada's lead, mandating inclusion in local gambling licensing systems;

· Legislative Faction: Some states are attempting to redefine the legal boundaries of "prediction markets" through legislation.

In this fragmented regulatory environment, Kalshi's legitimacy suddenly lacks a unified interpretation and has become a casualty in the "battle for regulatory interpretation." More realistically, without the injunction, if Kalshi continues to operate in Nevada, it faces the risk of imminent criminal enforcement, which is why the company urgently applied for a court stay of execution.

From derivatives to gambling, from federal to state regulation, and with fierce contention among courts, users, and industry stakeholders, several unavoidable questions arise: What exactly are prediction markets? Is their legal identity stable? Can they find their place in the current U.S. regulatory system?

And before this identity crisis is resolved, Kalshi faces a more thorny second blow—doubts from its own users.

Why Are Even Users Suing? Market-Making Controversy, Gambling Accusations, and the "House" Shadow

If regulatory conflict only exposes institutional gaps, then the class action from users directly strikes at the trust foundation of the trading platform.

On November 28, a class action lawsuit was filed by seven Kalshi users through the nationally renowned plaintiff law firm Lieff Cabraser Heimann & Bernstein. Although the core accusations are only two, they are deadly, aiming to fundamentally reshape public perception of Kalshi:

First, illegal operation accusation: The plaintiffs allege that Kalshi falsely advertised and provided de facto "sports betting" services without holding any state-level gambling licenses.

Second, being both referee and player: The plaintiffs accuse Kalshi's affiliated market makers of not being mere liquidity providers, but actually acting as the "house" on the platform, causing users to unknowingly bet against professional trading platforms with information or capital advantages.

In other words, users are not questioning the prediction contracts themselves, but the transparency and fairness of the trading mechanism. The lawsuit contains a highly provocative statement that quickly spread within the industry: "When consumers place bets on Kalshi, they are not facing the market, but the house."

This statement is so damaging because it precisely pierces the "identity defense" of prediction markets. Platforms like Kalshi have always argued that they are neutral matchmakers, discovering prices in the market, not gambling operators betting against users. However, if the accusation that "the platform participates in pricing and profits from it" holds, this boundary will instantly collapse both legally and ethically.

In response, Kalshi co-founder Luana Lopes Lara quickly countered, calling the lawsuit "based on a fundamental misunderstanding of derivatives market mechanisms." Her defense aligns with standard financial market logic:

· Like other financial trading platforms, Kalshi allows multiple market makers to competitively provide liquidity;

· Affiliated market makers do not receive any internal privileges;

· In the early stages, having affiliated institutions provide liquidity is "industry practice."

In traditional finance or mature crypto asset markets (such as Binance or Coinbase), the coexistence of "market makers" and "proprietary trading" may be an industry norm. But in the gray, emerging field of prediction markets, user structure and perception are entirely different. When ordinary retail investors encounter high-win-rate opponents, bottomless order walls, or instantly shifting odds, they are unlikely to interpret this as "efficient market pricing," but rather as "house manipulation."

The most dangerous aspect of this lawsuit is that it forms a deadly narrative resonance with Nevada's regulatory actions. Regulators say you are unlicensed gambling; users say you are a house-run casino. Combined, Kalshi now faces not just compliance risk, but a much harder-to-reverse narrative risk.

In the financial world, "market making" is a neutral infrastructure; but in the context of prediction markets, it is rapidly being stigmatized as "manipulation" and "harvesting." Once "Kalshi is not the open market it claims to be" becomes consensus, its legitimacy and business ethics will simultaneously collapse.

Ironically, however, the dual crisis of law and trust has not interrupted Kalshi's growth curve. After the lawsuit was exposed, trading volumes in its sports and political sections did not fall but rose. This abnormal phenomenon reveals the deepest contradiction in prediction markets today: in the face of extreme speculative demand, users seem not to care whether this is a "trading platform" or a "casino"—as long as the odds are moving, capital will flow in.

Why Is Kalshi More Favored by the Market the Deeper It Sinks into the "Compliance Quagmire"?

Despite facing regulatory crackdowns from multiple states, negative judicial rulings, and class action lawsuits from users, Kalshi has delivered a jaw-dropping report card amid crisis: platform trading volume has soared exponentially, driven by sports and political contracts, and it has completed a $1 billion funding round led by Sequoia Capital, pushing its latest valuation to $11 billion. This coexistence of a "regulatory winter" and a "market summer" seems counterintuitive, but in fact deeply reveals the structural characteristics of this emerging prediction market sector. Kalshi's countertrend explosion is no accident, but the result of four resonant market logics.

1. Psychological Game: The "Regulatory Countdown" Triggering a Rush Effect

Regulatory uncertainty has not deterred users; instead, it has sparked a kind of "doomsday carnival" participation frenzy. With Nevada lifting the injunction, the public realizes that the boundary between prediction markets and traditional gambling is blurring. This expectation of "imminent regulatory tightening" translates into a scarcity anxiety among users: traders rush in before the window closes. For speculative capital, the less clear the rules, the greater the potential arbitrage opportunities. Kalshi is actually enjoying a traffic dividend brought by a "regulatory risk premium."

2. Capital Voting: Betting on the "Institutional Dividend" Endgame

From the perspective of top institutions like Sequoia, the current legal disputes are merely growing pains in the industry's early stages, not the endgame. The logic of capital is very clear: prediction markets are not just substitutes for gambling, but part of future financial infrastructure. According to a Certuity report, the market size will exceed $95.5 billion by 2035, with a compound annual growth rate of nearly 47%. In the eyes of institutional investors, the resistance Kalshi currently faces is precisely proof that it is a leading player. Capital is making a contrarian bet: prediction markets will eventually be incorporated into the regulatory framework, and the surviving leading platforms will enjoy huge institutional dividends. The current high valuation is a pricing of the time window where "regulation is not yet finalized, but demand is already irreversible."

3. Competitive Landscape: Liquidity Siphoning from Supply-Side Shakeout

The surge in Kalshi's trading volume is largely due to the forced exit of competitors. As Crypto.com and Robinhood successively suspended related businesses during appeals, a huge vacuum appeared on the supply side of compliant prediction markets in the U.S. With demand (especially during election and sports seasons) continuing to expand, market liquidity was forced to seek new outlets. As the only remaining open platform in this field, Kalshi absorbed the massive traffic overflow from competing platforms. This "survival of the fittest" effect has made it, in the short term, the deepest and broadest liquidity pool in the U.S. market, further strengthening its Matthew effect.

4. The Nature of Demand: A Paradigm Shift from "Speculation" to "Risk Expression"

Finally, and most fundamentally: the core driver for users to participate in prediction markets is no longer just speculation. In an era of heightened macro volatility, the need to price risks for events such as interest rate decisions, election trends, and geopolitical developments has surged. Traditional financial derivatives cannot cover these non-standardized events, while prediction markets fill this gap. For professional traders, this is a risk hedging tool; for ordinary users, it is a high-frequency channel to participate in public events. This event-based trading demand is extremely rigid and will not disappear due to a single state's regulatory ban. On the contrary, the high exposure brought by regulatory disputes has pushed prediction markets from a niche financial circle to the center of public opinion.

In summary, Kalshi's countertrend growth is not because "the more illegal, the more attractive," but the result of a rigid demand explosion on the demand side, long-term capital bets, and a supply vacuum on the competition side.

Kalshi is currently at a highly charged historical moment: it faces unprecedented darkness on the legal front, yet enjoys its brightest growth on the business front. This may be the "coming-of-age ceremony" that all disruptive financial innovations must undergo—before the regulatory system achieves logical self-consistency, the market has already cast its vote with real money.

Conclusion: The Future of Prediction Markets Is Being Ripped Open Early by Kalshi

The storm Kalshi is currently experiencing is by no means a simple compliance crisis for a startup, but a prematurely triggered institutional conflict. In an extremely concentrated and intense way, it is forcing the U.S. financial system to confront a long-shelved core question: How should this new type of financial infrastructure—prediction markets—be defined, regulated, or even allowed to exist?

It straddles the edge of securities and gambling—possessing the price discovery function of financial markets while also having the entertainment attributes of mass consumption; bearing the serious need to hedge real-world risks while also filled with the fervent speculation of gamblers. It is precisely this "hybrid identity" that has led to a four-way tug-of-war among CFTC regulators, state law enforcers, the judiciary, and market users, each with divergent goals and mutually exclusive approaches.

In this sense, Kalshi's experience is not an accidental "surprise," but the inevitable "origin" for the entire industry.

From Nevada to Massachusetts, the regulatory boundaries of prediction markets are being rewritten state by state; from the CFTC's policy swings to repeated local court rulings, the federal system is revealing its hesitation in the face of new species; and from user-initiated class actions to heated public debates, the public is beginning to scrutinize the industry's essence—Is it an information-transparent "oracle," or a "digital casino" in financial disguise?

This intense uncertainty may seem dangerous, but it is actually proof of the industry's explosive potential. Looking back over the past two decades, from electronic payments to crypto assets, from internet securities to DeFi, every institutional conflict at the financial frontier has ultimately driven a reconstruction of underlying logic and spawned new regulatory paradigms. Prediction markets are now entering the same cycle, only evolving much faster than expected.

Standing at the crossroads of the future, we can at least identify three irreversible trends:

First, the legitimacy battle will become a "war of attrition." Since at least six states have issued completely different legal interpretations, the battle for jurisdiction is likely to escalate to the Supreme Court. No single ruling will settle everything; regulatory fragmentation will be the norm.

Second, prediction markets are moving from "niche toys" to "infrastructure." Whether it's using money as votes to hedge political risk or quantifying society's expectations for macro events, prediction markets are becoming an indispensable "risk pricing anchor" for the real world.

Third, the industry's endgame will be dynamically reshaped by multiple forces. The ultimate form of prediction markets will not be determined by the unilateral will of any single regulator, but by a dynamic balance constructed by market demand, capital will, political games, and judicial precedents.

Therefore, Kalshi's success or failure may no longer be the only focus; it is more like the first curtain to be torn open. In the short term, two key legal documents on December 8 and 12 will determine whether Kalshi can survive this regulatory storm; but in the longer historical perspective, these two days are destined to become the first watershed in this billion-dollar prediction market track.

The future of prediction markets will not be written by any single court ruling, but its direction will inevitably change at some critical point. And that point is arriving early, thanks to Kalshi.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing short to repay long: The Bank of England and the Bank of Japan lead the shift from long-term bonds to high-frequency "interest rate gambling"

If expectations are not met, the government will face risks of uncontrollable costs and fiscal sustainability due to frequent rollovers.

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.

Babylon partners with Aave Labs to launch native Bitcoin-backed lending services on Aave V4

Babylon Labs, the team behind the leading Bitcoin infrastructure protocol Babylon, today announced the establishment of a strategic partnership with Aave Labs. Both parties will collaborate to build a native Bitcoin-backed Spoke on Aave V4 (the next-generation lending architecture developed by Aave Labs). This architecture adopts a Hub and Spoke model, aiming to support markets built for specific scenarios.