Public Blockchain Moat only 3 points? Alliance DAO Founder's Comments Spark Crypto Community Debate

The debate surrounding "Is the Public Blockchain Moat only 3/10?" has exposed the underlying contradiction in the crypto industry: the systemic tug-of-war between idealism and reality, liquidity and trust, business models and ecosystem foundation.

Original Article Title: "Is the Moat of Public Chains Only 3 Points? Alliance DAO Founder's Comments Sparked a Crypto Community Debate"

Original Article Author: Wenser, Odaily Planet Daily

Recently, Alliance DAO founder qw (@QwQiao) put forward a stunning point of view: "Blockchain moats are limited," and rated the moat of L1 public chains as only 3/10.

This statement quickly ignited the overseas crypto community, sparking heated discussions among crypto VCs, public chain builders, and KOLs. Dragonfly partner Haseeb angrily retorted that rating "the blockchain moat as 3/10" is simply absurd, even Aave founder Santi, who is averse to the industry's gambling atmosphere, never believed that blockchain has "no moat."

The debate over the meaning, value, and business model of blockchain and cryptocurrency constantly resurfaces in cycles. The crypto industry continues to oscillate between idealism and reality: people both cherish the decentralized original intention and aspire to have the status and recognition of the traditional financial industry while also being deeply mired in self-doubt about whether it is merely a repackaged casino. Perhaps the root of all these contradictions lies in scale—the total market value of the crypto industry has always hovered around 3-4 trillion dollars, which still seems small compared to the traditional financial giants with market capitalizations often in the hundreds of billions or trillions of dollars.

As professionals in the field, everyone has a contradictory mentality that is both arrogant and self-deprecating—arrogant because they have adhered to Satoshi Nakamoto's ideal of demonetization and the spirit of decentralization since the birth of blockchain, and the crypto industry has indeed become a burgeoning financial industry that is gradually gaining mainstream attention, acceptance, and participation. The self-deprecating aspect is probably like a poor boy who always feels that what he is doing is not particularly glorious, filled with the blood, sweat, tears, bitterness, and pain of a zero-sum game. In short, the limitation of industry scale has given rise to this cyclical identity anxiety, self-doubt, and self-denial.

Today, we will take advantage of the topic of "Moat Business Ratings" proposed by qw to discuss the existing chronic illnesses and core strengths of the crypto industry.

Origin of the Debate: Is Liquidity the Moat of the Crypto Industry?

This industry-wide discussion about "whether the crypto industry has a moat" actually originally stemmed from a statement by Paradigm team researcher frankie: "The greatest trick the devil ever pulled was convincing crypto people that liquidity is a moat."

It is evident that as a "purebred" VC, Frankie somewhat scoffs at the current trend in the crypto industry that highly esteems "liquidity is everything." After all, for an investor and research expert who holds financial and informational advantages, they often hope that the money they manage can be spent on projects and businesses with real-world use cases, capable of generating actual cash flow and providing them with continuous financial returns.

This viewpoint has also received agreement from many in the comments section:

· Multicoin partner Kyle Samani directly stated "+1";

· Ethereum Foundation member binji believes that "trust is the true moat, even if trust may flow due to opportunities in the short term, liquidity will always be placed where trust is."

· Chris Reis of the Arc blockchain team under Circle pointed out: "TVL always seems like the wrong North Star metric (business guidance goal)."

· Justin Alick of the Aura Foundation jokingly remarked, "Liquidity is like a capricious woman, she may leave you at any time."

· DeFi researcher Defi Peniel bluntly stated, "Relying solely on liquidity is not a moat, hype can disappear overnight."

Of course, there are also many who have refuted this:

· DFDV COO and CIO Parker commented, "What are you talking about? USDT is the worst stablecoin, but it holds absolute dominance. Bitcoin is the worst-performing blockchain, but it absolutely dominates."

· Former Sequoia Capital investor, now Folius Ventures investor KD gave a rhetorical question, "Isn't it?"

· Fabric VC investor Thomas Crow pointed out, "In a trading platform, liquidity is a moat— the deeper the liquidity, the better the user experience; this is the most critical feature in this vertical industry, without exception. That is why the main innovation of crypto asset trading is focused on solving the problem of insufficient liquidity (resulting in a poorer user experience). Examples include Uniswap, which obtains long-tail asset liquidity through LP, and Pump.Fun, which attracts liquidity before token launch through standardized contracts and pooled curves."

· Pantera investor Mason Nystrom retweeted and commented, "Liquidity is definitely a moat." He then provided different examples to illustrate: in public chains, Ethereum's current lead is due to DeFi liquidity (and developers); in CEXs, Binance, Coinbase, etc.; in lending platforms, Aave, MakerDAO; in stablecoins, USDT; in DEXs, Uniswap, Pancakeswap.

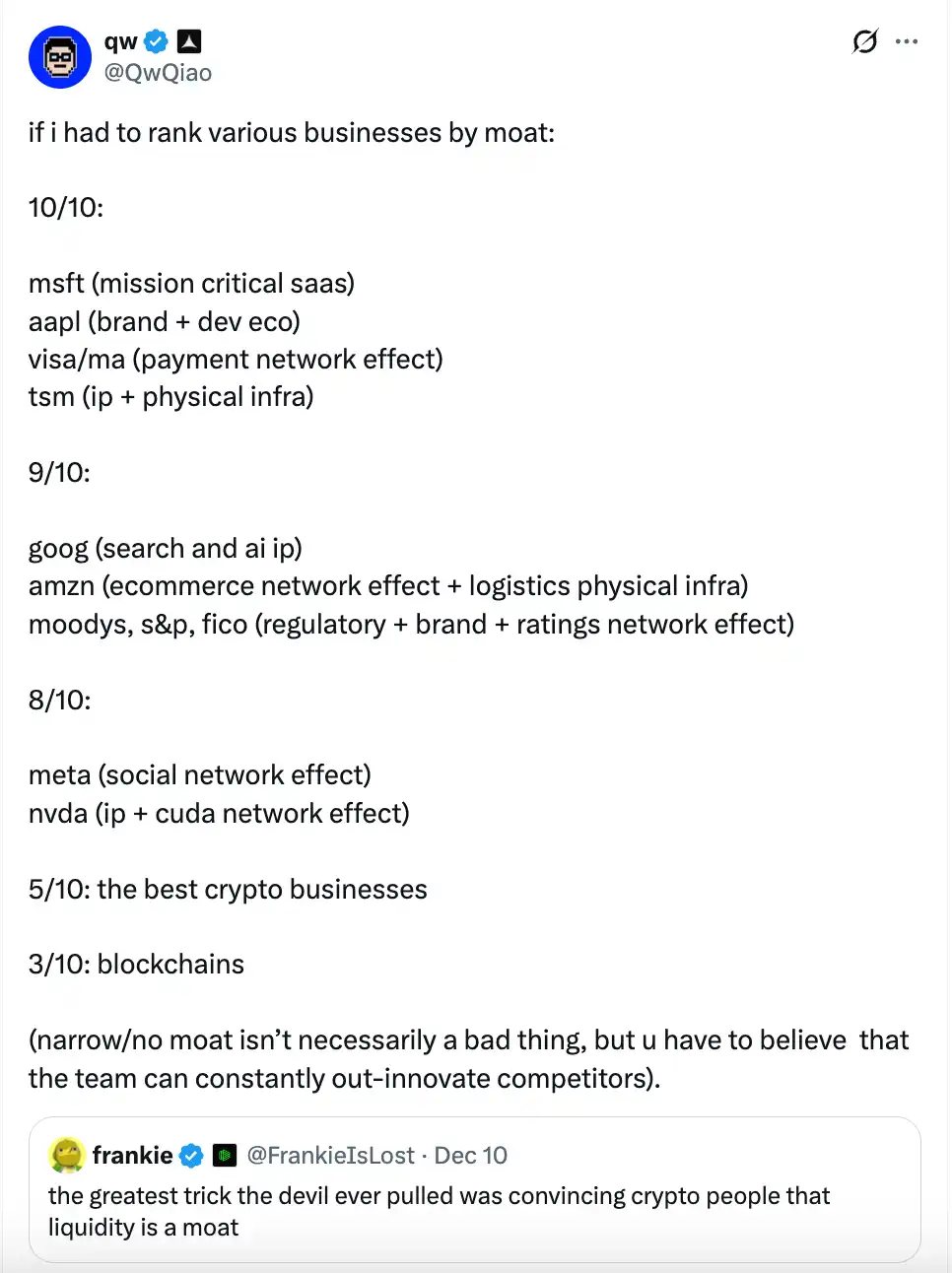

Then, we had the Alliance DAO founder qw's moat rating tweet:

In his view, the moat of a blockchain (public chain) itself is very limited, with a rating of only 3/10.

- He believes that Microsoft (key SaaS), Apple (brand + development ecosystem), Visa/Mastercard (payment network effect), TSMC (IP + physical infrastructure) can achieve a rating of 10/10 (strongest moat);

- Google (search and AI IP), Amazon (e-commerce network effect + logistics infrastructure), rating agencies like Moody's, S&P, FICO (regulation-driven + brand + rating network effect), large cloud providers (AWS/Azure/GCP, etc.) can achieve a rating of 9/10;

- Meta (social network effect), Nvidia (IP + CUDA network effect) have a rating of 8/10;

- The best crypto businesses in the crypto industry have a rating of 5/10;

- Public chains (blockchains) have a rating of only 3/10 (narrow moat).

qw further stated that a low moat rating is not necessarily a bad thing, but it means the team must be able to consistently lead innovation; otherwise, they will be quickly replaced. Subsequently, perhaps feeling that the previous ratings were too hasty, qw provided some additional ratings in the comments:

- The big three cloud service providers have a rating of 9/10;

- Bitcoin's moat rating is 9/10 (Odaily Planet Daily Note: qw pointed out that no one can replicate BTC's public chain founding story and the " Lindy Effect," but deducted 1 point because it is unclear if it can handle security budgets and quantum threats);

- Tesla 7/10 (Odaily Planet Daily Note: qw believes that the IP for autonomous driving is very impressive, but the automotive industry is commoditized, and humanoid robots may be similar);

- ASML, the lithography machine manufacturer, has a perfect 10/10 rating.

- AAVE's moat rating may be higher than 5 points (out of 10), with qw's reason being, "As a user, you must trust that their smart contract security testing is thorough enough not to lose your funds."

Of course, when seeing qw arrogantly acting as a "sharp critic," in addition to the debate on the "moat system" in the comments section, some people also made irrelevant sarcasm about qw's remarks. Someone even mentioned, "What about those completely failed launch platforms you invested in?" (Odaily Planet Daily Note: After launching pump.fun, Alliance DAO's subsequent investments in one-click launch platforms (such as Believe) have underperformed, to the point that he himself does not want to rate them)

With such a highly inflammatory focal point, Dragonfly partner Haseeb then made an angry retort.

Dragonfly Partner's Inner OS: Nonsense. I Have Never Seen Such Shamelessness

Regarding qw's "moat rating system," Dragonfly partner Haseeb wrote in a post: "What? Blockchain Moat: 3/10? This is a bit absurd. Even Santi doesn't believe that a public blockchain has no moat."

Ethereum has dominated for 10 consecutive years, with hundreds of challengers raising over $10 billion, trying to gain market share. After ten years of competitors trying to beat it, Ethereum has successfully defended its throne every time. If this still cannot demonstrate that Ethereum has a moat, I really don't know what a moat is.

In the tweet's comments section, qw also expressed his views: "What you are saying is all about looking back (the past ten years) and is factually incorrect (Ethereum no longer holds the throne on several metrics)."

Subsequently, the two engaged in several rounds of discussion on "What is a moat?" and "Does Ethereum really have a moat?" qw even brought up a post he made in November, pointing out that in his view, "moat" is actually revenue/profit. However, Haseeb then provided a counterexample—prominent crypto projects like OpenSea, Axie, and BitMEX, which, although once had high revenue, did not actually have a moat. A true moat should focus on whether "it can be replaced by a competitor."

Abra Global's Head of Asset Management, Marissa, also joined the discussion: "I agree (with Haseeb's point). qw's statement is a bit odd—switching costs and network effects can be strong moats—Solana and Ethereum both have these. I think over time, they will become stronger than other blockchains. They both have a strong brand and developer ecosystem, which is clearly part of the moat. Perhaps he is referring to those other blockchains that do not have these advantages."

Haseeb continued to mock Laman: "qw is just sophistry, bringing trouble upon oneself."

Building upon the above discussion, perhaps we should dissect what elements constitute the "true moat" of the public blockchain industry.

The 7 Major Components of a Public Blockchain Moat: From Characters to Business, from Origin to Network

In the author's view, the reason why qw's "moat scoring system" is somewhat unconvincing mainly lies in:

Firstly, its evaluation criteria only consider current industry status and revenue, disregarding a multi-dimensional assessment. Whether it is infrastructure like Microsoft, Apple, Amazon Web Services, or payment giants like Visa, Mastercard, qw's high ratings are mainly due to their strong revenue models. This clearly oversimplifies and superficializes the moat of a corporate giant's business. Moreover, Apple's global market share is not dominant, and payment giants like Visa are also facing challenges such as market contraction and declining regional business.

Secondly, it overlooks the complexity and uniqueness of blockchain projects and crypto assets compared to traditional internet businesses. As challengers to the fiat system, cryptocurrency and blockchain technology, as well as subsequent public chains and crypto projects, are based on the inherent "anonymity" and "node-based" nature of decentralized networks, which traditional revenue-driven businesses often cannot achieve.

Therefore, personally, I believe that the moat of a public blockchain business mainly lies in 7 aspects, including:

1. Technological Philosophy. This is also the greatest strength and differentiating factor of networks like Bitcoin, Ethereum, Solana, and numerous other public chain projects. As long as there is human vigilance against centralized systems, authoritarian governments, and fiat systems, and an acceptance of sovereign individuality and related concepts, the true demand for decentralized networks will persist;

2. Founder Charm. Satoshi Nakamoto, after inventing Bitcoin and ensuring the smooth operation of the Bitcoin network, disappeared without a trace, holding billions of dollars in assets yet unmoved. From a passionate World of Warcraft player who suffered at the hands of a game company to a co-founder of Ethereum, Vitalik courageously embarked on his decentralized spiritual journey. Solana's founder, Toly, and others were elite professionals in American tech giants, yet unsatisfied, they embarked on their path of building the "capital internet." Not to mention the various major public chains built on the legacy of the Meta Libra network using the Move language. The personal charm and charisma of founders are crucial in the crypto industry. Countless crypto projects have been favored by VCs, embraced by communities, and flooded with funds due to their founders, but also faded into obscurity due to founder resignations or accidents. A good founder is where the true essence of a public chain or a crypto project lies;

3. Developers and User Network. At this point, as emphasized by the Metcalfe Effect and Lindy Effect, the stronger the network effect of the same thing and the longer it exists, the more sustainable it is. The developer and user network is the cornerstone of public chains and many cryptocurrency projects because developers can be considered the first users of a crypto public chain or project and the most long-lasting users;

4. Application Ecosystem. If a tree only has roots but no branches, it will also find it hard to survive, and the same goes for crypto projects. Therefore, a rich and self-sustaining application ecosystem that generates synergies is crucial. Public chains like Ethereum and Solana have been able to survive through crypto winters because of the various application projects that have been consistently developed. Furthermore, the more robust the application ecosystem, the more sustainable the public chain's growth and contribution;

5. Token Market Value. If the aforementioned points are the inner core and foundation of a "moat," then the token market value is the external form and brand image of a public chain and a crypto project. Only when you "appear expensive," will more people believe you "have a lot of money," and you are a "land of opportunity," both individually and as a project;

6. External Openness. In addition to building its internal ecosystem, public chains and other crypto projects need to maintain openness and operability with the external environment, exchanging value with the outside world. Therefore, external openness is also crucial. Taking public chains like Ethereum and Solana as examples, their convenience and scalability lie in their bridging with traditional finance, user funds inflow and outflow, and various industries through payment, lending, and other gateways;

7. Long-Term Roadmap. A truly solid moat not only plays a supporting role in the short term but also needs continuous updates, innovation, and vitality in the long term. For public chains, a long-term roadmap is both a guiding star indicator and a powerful lever to encourage continuous development and innovation within and outside the ecosystem. Ethereum's success is closely related to its long-term roadmap planning.

Based on the elements above, a public chain can move from zero to one, from nothing to something, gradually pass through the period of rapid growth, and enter a mature iterative period. Correspondingly, liquidity and user stickiness naturally follow suit.

Conclusion: The Crypto Industry Has Not Yet Reached the "Talent Showdown" Stage

Recently, Moore Threads, known as the "Chinese version of NVIDIA," successfully landed on the Hong Kong stock market, achieving a milestone of 300 billion RMB on its first day of trading; shortly after, its stock price skyrocketed, reaching another astonishing breakthrough of over 400 billion RMB market cap today.

Compared to Ethereum, which took 10 years to finally reach a market cap of $300 billion, in just a few days, the Moore's Law thread has covered only 1/7 of the former's journey. And compared to the trillion-dollar market cap giants of the US stock market, the crypto industry is truly David to their Goliath.

This also inevitably makes us ponder once again that, with a funding scale and user involvement scale much smaller than those of the traditional financial industry and the internet industry today, we are far from the "talent competition" stage. The only pain point in the current crypto industry is that we do not yet have enough people, the attracted funds are not large enough, and the involved industries are not broad enough. Instead of worrying about those macro, broad "moats," perhaps what we should think about more is how cryptocurrencies can more quickly, at a lower cost, and more conveniently meet the real needs of a broader market user base.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."