Chainlink trades at $13.57 as CCIP v1.5 launches early 2026 after Coinbase’s $7 billion Wrapped Assets and Lido’s $33 billion wstETH chose CCIP exclusively, while Automated Compliance Engine targets institutional tokenization and CCIP transfers surged 1,972% to $7.77 billion annually.

LINK at $13.57 trades below EMAs at $15.54/$16.39/$15.76/$14.04—mixed structure. Supertrend at $20.96 signals downtrend resistance. Weekly chart shows multi-year consolidation between $12-$16 range after 2021’s $52 peak collapse.

Support holds at $12.00-$13.40. Bulls need volume above $15.76-$16.39 EMA cluster to challenge $20 psychological resistance. Break above $20.96 Supertrend flips trend toward $25-$30. Failure at current levels risks retest of $12 or lower.

Cross-Chain Interoperability Protocol v1.5 launches early 2026 with self-service token integration allowing projects to customize rate limits and pool contracts, plus zkRollup support for enhanced scalability.

Coinbase selected CCIP as exclusive bridge infrastructure for all Wrapped Assets—cbBTC, cbETH, cbDOGE, cbLTC, cbADA, cbXRP with a $7 billion aggregate market cap. Lido upgraded to CCIP for wstETH across all chains representing $33 billion total value locked.

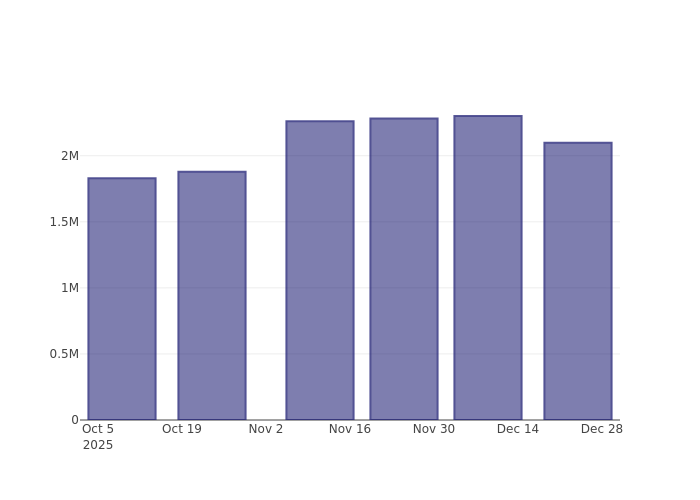

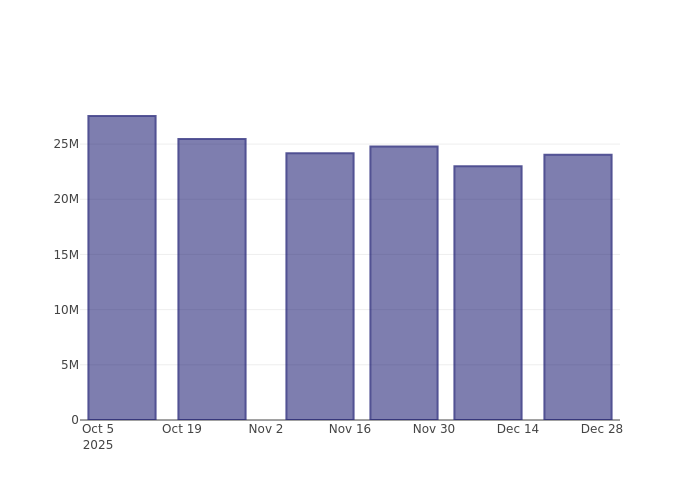

These institutional endorsements demonstrate CCIP transcended experimental status to production-grade infrastructure. CCIP transfers surged 1,972% to $7.77 billion annually, validating product-market fit.

ACE launches in 2026 integrating Chainlink’s Proof of Reserve and Chainalysis KYT tools to automate regulatory compliance for tokenized assets. By embedding KYC/AML compliance directly into smart contracts, ACE removes critical barriers preventing institutional adoption. Early access begins 2026.

Related:

Success in regulated markets like ETFs and tokenized securities could unlock exponential demand. Ondo Finance’s tokenized securities platform reached $2 billion volume and $370 million TVL using Chainlink oracles, with partnerships including Fidelity, BlackRock, and PayPal’s PYUSD demonstrating Chainlink’s role in institutional tokenization.

CRE launched in 2025 enables multi-chain, multi-oracle, multi-jurisdictional workflows. J.P. Morgan and UBS leverage CCIP for cross-chain transactions and tokenized fund workflows. This unified development environment addresses enterprise pain points around fragmented blockchain infrastructure and regulatory complexity.

Creates platform effect where institutional developers standardize on Chainlink infrastructure—switching costs increase and network effects compound. Digital Assets Sandbox launching 2026 provides banks like BNY Mellon and UBS controlled environment for tokenization trials using Chainlink services, focusing on NAV data feeds and cross-chain settlements.

Q1 2026 Data Streams expansion targets high-frequency trading applications and RWA markets with real-time pricing for derivatives.

Enables sub-second latency traditional oracle architectures can’t support—essential for perpetual futures, options, and algorithmic trading strategies. Success in institutional pilots translates to production deployments worth billions in transaction value.

Chainlink maintains largest oracle market share with more integrations and secured value than Band Protocol and API3. Each new integration makes Chainlink more valuable to subsequent adopters—self-reinforcing dominance.

The $7.77 billion CCIP transfer volume and institutional partnerships create substantial barriers to entry.

Despite fundamental strength, token value capture remains indirect. Node operators capture direct revenue from oracle services while LINK holders benefit through staking rewards (under 5% yield) and network growth rather than direct fee sharing.

This prioritizes network security over aggressive token holder incentivization. $15 billion market cap creates mid-tier positioning potentially limiting explosive multiples despite strong fundamentals.

CCIP v1.5 launch, ACE early access begins, Data Streams expansion. Break $15.76-$16.39 EMAs toward $18-$20.

Institutional pilots mature, Digital Assets Sandbox adoption metrics, bank tokenization trials. Challenge $20.96 Supertrend toward $25-$28.

ACE production deployments, CCIP transaction volumes, institutional integrations scale. Target $30-$35 if adoption accelerates.

Year-end institutional assessment, RWA tokenization momentum, staking expansion to CCIP. Analysts target the $45-$75 range with breakthrough adoption.

| Quarter | Low | High | Key Catalysts |

| Q1 | $14 | $20 | CCIP v1.5, ACE launch, Data Streams |

| Q2 | $16 | $28 | Pilot maturation, sandbox metrics |

| Q3 | $20 | $35 | ACE production, volumes, banks |

| Q4 | $25 | $45 | Institutional assessment, RWA momentum |

- Base case ($25-$35): CCIP v1.5 executes, moderate ACE adoption, institutional pilots progress steadily, Data Streams integrates with major platforms, $20 breaks toward $25-$35, patient capital required for multi-quarter adoption.

- Bull case ($45-$75): Breakthrough institutional deployments, multiple banks launch tokenization at scale using ACE, CCIP becomes undisputed cross-chain standard, RWA tokenization accelerates beyond projections, $20.96 Supertrend breaks decisively toward analyst targets.

- Bear case ($10-$16): Institutional adoption disappoints, ACE faces regulatory hurdles, CCIP competition emerges, RWA market develops slower than expected, $12 support breaks extending multi-year consolidation.

Related: