Bank of Japan keeps rates unchanged; Takata advocates raising to 1%, Ueda suggests future increases

1. Bank of Japan Keeps Interest Rates Unchanged

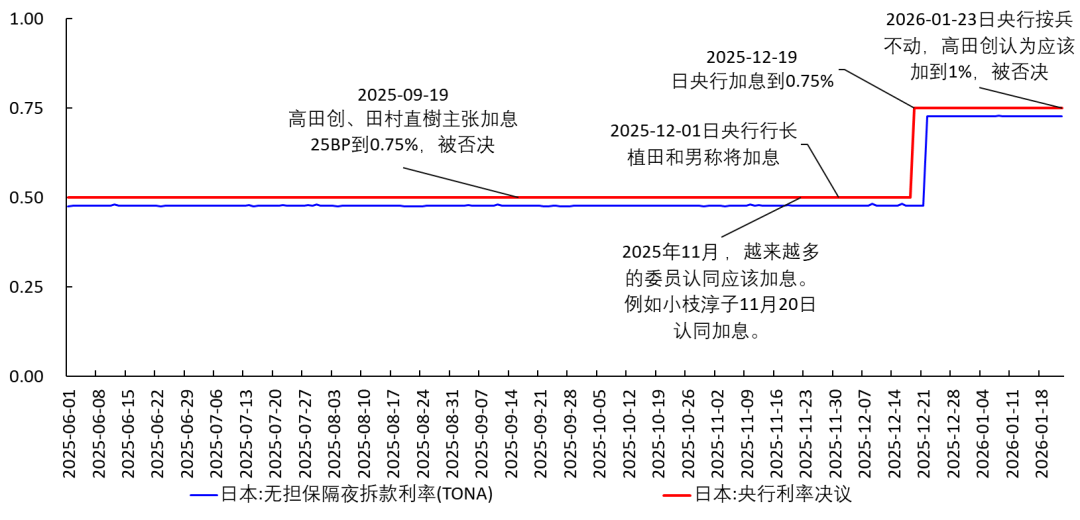

Today (January 23, 2026) at noon, the Bank of Japan released the Policy Board and Monetary Policy Meeting Resolution, announcing that it would maintain the policy interest rate (unsecured overnight call rate) fluctuating around 0.75%, meaning no rate hike.

This decision was not unexpected. Previously, on December 19, 2025, the Bank of Japan had just raised interest rates (), and by convention, a period of observation is required before deciding the next action. It has only been a little over a month since then, and Japan’s economic fundamentals have not changed significantly.

2. Hajime Takata Opposes Again, Believes Rate Should Increase to 1%

Among the nine members participating in the vote, eight were in favor and one was opposed. Hajime Takata held the dissenting opinion. He believes that "The price stability target" (Note: meaning a long-term stable inflation at 2%) has been largely achieved, and with overseas economies in a recovery phase, domestic Japanese prices are facing upward risks. Therefore, he proposed a 25BP rate hike to 1.0%. However, the proposal was opposed by the majority and thus rejected.

This is also not surprising. As I mentioned before, Hajime Takata is quite forward-looking.At the policy meeting on September 18-19, 2025, everyone advocated against a rate hike, except Hajime Takata and Naoki Tamura, who advocated for a hike, but were rejected (). Since November 2025, other committee members gradually agreed with the need for hikes, for example,.

Figure 1 The Bank of Japan's Interest Rate Hike Process

Going forward, as overseas economies gradually return to growth, the growth rate is expected to steadily increase. With the dual effects of the impact of rising food prices (especially rice, etc.) gradually fading and government measures to tackle rising prices, the year-on-year increase in the consumer price index (excluding fresh food) is expected to narrow to below 2% in the first half of the next fiscal year. Thereafter, as economic growth accelerates and labor shortages become more pronounced, the medium- to long-term expected inflation rate will also rise accordingly. Based on this, the basic inflation rate and the increase in the consumer price index (excluding fresh food) are expected to gradually rise and, in the latter half of the Outlook Report’s forecast period, reach a level roughly in line with the “price stability target”(Note).

The note at the end reads:Committee member Hajime Takata believes that, regarding the inflation outlook, including the basic inflation rate, consumer prices have basically reached the level of the "price stability target"; while member Tamura opposes this, arguing that the outlook for the basic inflation rate will only approximately meet the "price stability target" in the latter half of the forecast period.

3. Kazuo Ueda Signals Further Rate Hikes

In the afternoon, Bank of Japan Governor Kazuo Ueda held a press conference. Key points are as follows:

[1] Underlying inflation will continue to rise moderately; the financial environment remains accommodative after the December rate hike(Note: Because Japan’s real interest rate is very low, below the natural rate.)

[2] Recently, long-term interest rates have risen rapidly. The Bank of Japan will conduct bond operations under special circumstances and may take measures to stabilize yield curves.(Note: What special operations? Basically, the Bank of Japan will enter the market to buy bonds and push yields down.)

[3] If the economy develops as expected, rate hikes will continue. The impact of hikes on the real economy and prices is subject to a time lag and will be closely monitored.

[4] Monitoring changes in prices in April(Note: He is actually waiting for the results of the “spring wage negotiations”), but this is just one factor influencing decisions. It is not necessary to wait for the final data on the impact of the December rate hike before acting. Appropriate monetary policy will be implemented to avoid lagging behind the situation.

[5] The exact level of the neutral rate is unclear.(Note: This has always been the Bank of Japan’s stance, see .)

[6] As the underlying inflation rate approaches 2%, even slight fluctuations in the exchange rate must be monitored. The Bank of Japan will pay greater attention to core inflation in policy decisions. It is not yet time to consider whether the “price stability target” has been achieved.(Note: As mentioned earlier, Hajime Takata believes the “price stability target” has already been achieved.)

[7] Exchange rates are determined by multiple factors, not just interest rate differentials. Yen depreciation may push up import costs and imported inflation.

[8] Consumption tax cuts are a matter for the government and parliament; a reduction in food consumption tax has not yet been officially decided. For the government, winning market confidence through a commitment to fiscal health is crucial; today’s policy outlook does not assume a consumption tax cut.

After Ueda’s speech, the yen exchange rate fluctuated sharply.

Figure 2 Yen/USD Exchange Rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What To Be Aware Of Before Dollar General Announces Its Earnings

The surge in Sand has caused short sellers to lose $3 billion

Morning Minute: PwC Reports That Crypto Adoption Has Reached an Irreversible Stage

Russia to offer ‘simple licensing’ for crypto exchanges and custodians