Hyperliquid [HYPE] rallied 5.15% in the past 24 hours and saw its daily trading volume increase by 53.6%, at press time. This came at a time when Bitcoin [BTC] was hovering just below the psychological $90k resistance.

Many of the major altcoins were experiencing a short-term downtrend due to the price action of the past week. Bitcoin meandered between $88.7k and $90.3k, and the altcoin market cap, excluding Ethereum [ETH], has also been moving sideways in the past five days.

Hence, the HYPE gains since Friday have been particularly interesting.

Should investors expect a trend reversal?

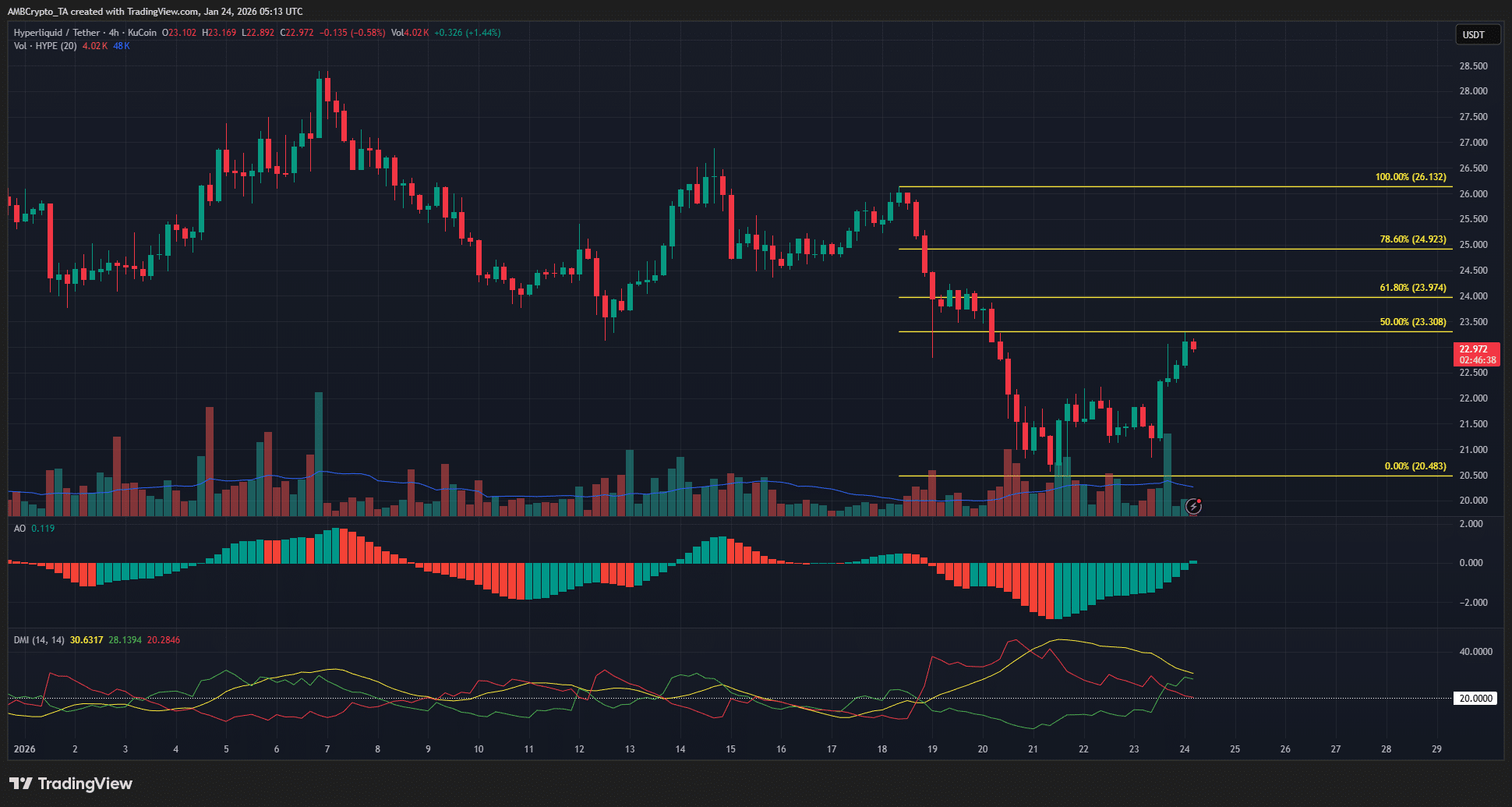

On the 4-hour timeframe, the plunge from $26.13 to $20.48 last week showed that investors should not be looking to buy just yet. The swing structure was bearish. Zooming out, even the 3-day chart showed a bearish trend since October.

The findings confirm that HYPE’s longer‑term trend remains bearish. Recent gains reflect a price bounce toward key Fibonacci retracement levels, with short‑term bullish targets at $23.97 and $24.92.

A break above $26.13 would be required to shift the swing structure into bullish territory. Meanwhile, the Awesome Oscillator signaled a momentum shift on the 4‑hour chart, and the DMI suggested last week’s downtrend is beginning to ease.

Arguing the bearish case

It is possible that the 50% retracement level at $23.31 rebuffs HYPE bulls. The past two weekends saw sideways price action for Bitcoin and most altcoins, with the early hours of Monday bringing high volatility.

It is possible that such volatility would drag HYPE prices lower, but this scenario appeared less likely.

Why traders must wait to sell the bounce

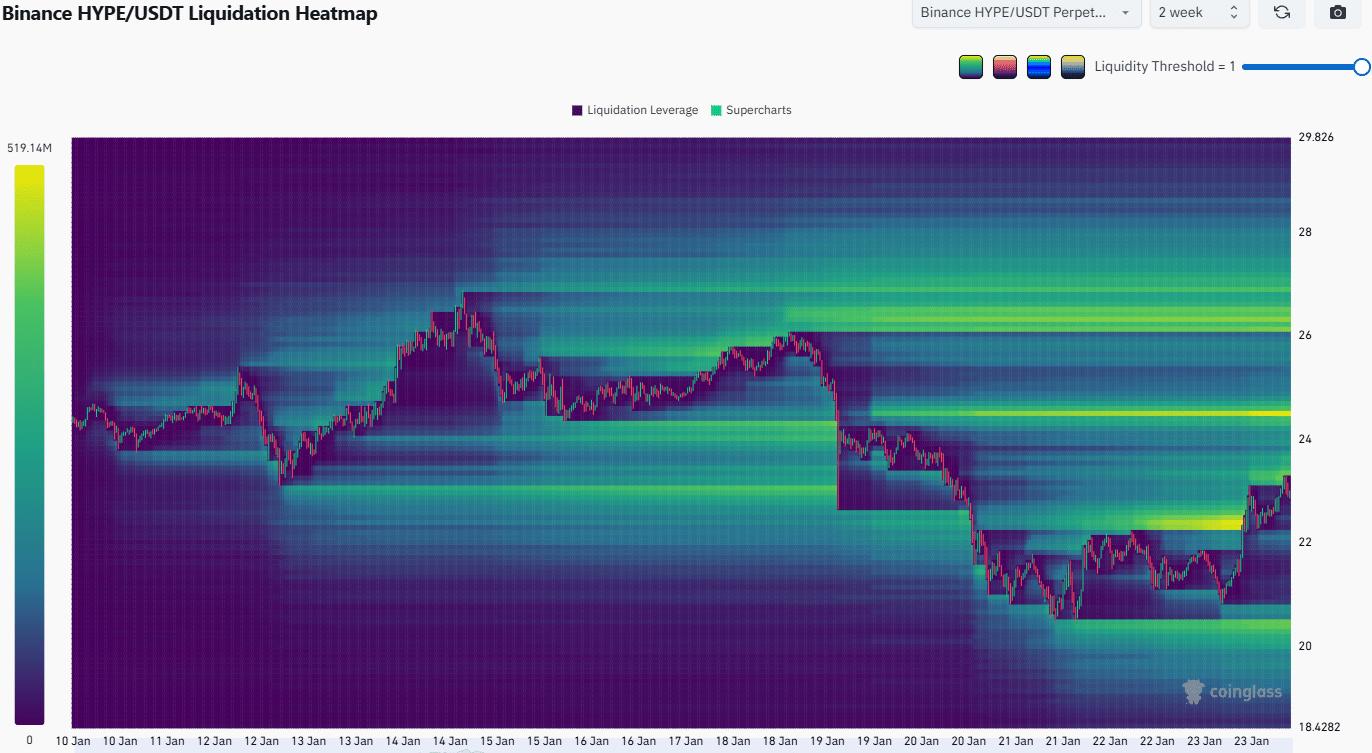

The 2-week liquidation heatmap showed a dense cluster of short liquidations around $24.5. Another magnetic zone was at $26.3-$26.6. To the south, the $22.1 area was a potential short-term liquidity target.

This meant that traders can wait for HYPE to sweep these liquidity targets. A lower timeframe bearish trend shift from these areas of interest would align with the higher timeframe downtrend, giving short sellers opportunities.

Final Thoughts

- The Hyperliquid price gains in the past 24 hours signaled relative strength against the wider market, which was stagnant.

- Monday could bring high volatility, and traders should also remember that the higher timeframe HYPE trend was bearish.