Bitget Daily Digest (Jan.26)|SIGN, and JUP are set for large token unlocks this week; crypto market long liquidations reached $612 million; a Spark lending whale sold 11,190 ETH

Bitget2026/01/26 02:13

By:Bitget

Today’s Outlook

1、Japan may lift its ban on crypto ETFs by 2028, with SBI and Nomura actively advancing related product development.

2、This week, Microsoft, Apple, Tesla, and Meta will release earnings reports, offering insights into the health of industries ranging from cloud computing and consumer electronics to software and digital advertising.

3、Michael Saylor once again posted Bitcoin Tracker updates, with potential disclosure of additional BTC purchases later this week.

4、Data shows that SIGN, JUP, and other tokens will see major unlocks this week.

Macro & Hot Topics

1、Analysis: Markets expect the Federal Reserve to pause rate cuts this week; any dovish or hawkish signals from Powell may influence Bitcoin’s price action.

2、Spot silver broke above $107 for the first time, gaining over $35 this month; spot gold historically surpassed the $5,000 mark.

3、Placeholder partner stated that if the crypto market falls further, they will increase allocations, and below $50,000 BTC, “Bitcoin is dead” narratives may re-emerge.

Market Performance

1、Over the past 24 hours, total crypto market liquidations reached $676 million, with long liquidations accounting for $612 million. BTC liquidations were about $194 million, while ETH liquidations were approximately $217 million.

2、U.S. equities: Dow Jones -0.58%, Nasdaq +0.28%, S&P 500 +0.03%. Additionally, CRCL (Circle) -0.03%, MSTR (Strategy) +1.32%, NVDA (NVIDIA) +1.53%.

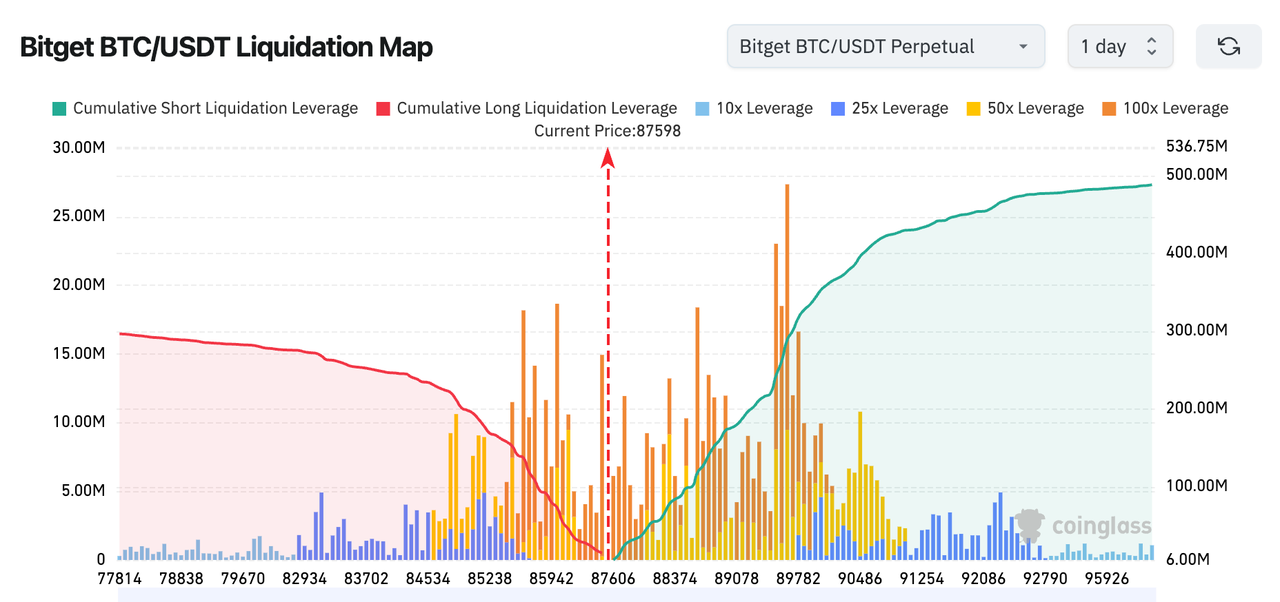

3、Bitget BTC/USDT liquidation map shows a clear liquidation gap near the current price (~87,600). Short liquidation liquidity accumulates rapidly above, creating conditions for a potential short squeeze if price is pushed higher. Long liquidations below are more dispersed and weaker, suggesting downside may be a gradual pullback, while upside breakouts could accelerate.

4、In the past 24 hours, BTC spot inflows totaled approximately $232 million, outflows about $190 million, resulting in net inflows of $42 million.

News Updates

1、CoinDesk reports that U.S. crypto asset regulation is accelerating. If the proposed crypto market structure bill passes, it will clarify federal regulatory authority over digital assets, making cryptocurrencies easier to manage, track, and trade, potentially attracting more investors and boosting token valuations.

2、Data: In 2025, stablecoin issuers generated $5 billion in revenue on Ethereum.

3、The White House official account posted that “the U.S. is already the global crypto capital,” with the CFTC set to follow up on modernization of rules and regulations.

4、Colombia’s second-largest pension fund manager, AFP Protección, plans to launch a Bitcoin exposure fund.

Project Developments

1、A “buy high, sell low” whale panic-sold 5,500 ETH over the past three days, worth $16.02 million.

2、WLFI transferred rewards from treasury USD1 holdings to Binance, totaling $40 million worth of WLFI tokens.

3、Two whale/institutional addresses are suspected to have accumulated 61,000 ETH and 20,000 ETH respectively.

4、a16z Crypto: Quantum threats are overstated; protocol governance and upgrade coordination are the biggest challenges for public blockchains.

5、Pendle Finance team–associated addresses deposited 1.8 million PENDLE into CEXs.

6、Report: Ethereum is achieving both high throughput and low fees, potentially transitioning toward a modular settlement layer. Meanwhile, an agent of the “1011 insider whale” stated that Ethereum will become the settlement layer for global capital markets, with 2026 being the “Year of RWA.”

7、Yesterday, a whale transferred $11 million worth of PUMP to Binance, with potential profits of $3.15 million if sold.

8、A Spark lending whale sold 11,190 ETH, lowering its liquidation price to $2,268.

9、The Coinbase Bitcoin premium index has remained negative for ten consecutive days, with only two positive days so far this year.

10、Seven wallets linked to the same entity purchased $21.71 million worth of $XAUT.

Disclaimer: This report is generated by AI, with human verification for information accuracy only, and does not constitute any investment advice.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Japanese yen pushes higher as intervention risks mount

101 finance•2026/01/26 05:15

TEPCO Aims for $20 Billion in Savings as Fukushima Challenges Prompt Strategic Overhaul

101 finance•2026/01/26 04:09

UMB Financial (UMBF) Q4 Earnings Preview: Key Points to Watch

101 finance•2026/01/26 03:18

Nextpower (NXT) Q4 Preview: Key Insights Before Earnings Release

101 finance•2026/01/26 03:09

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,600.59

-1.47%

Ethereum

ETH

$2,858.68

-2.87%

Tether USDt

USDT

$0.9988

+0.03%

BNB

BNB

$870.66

-1.17%

XRP

XRP

$1.87

-1.27%

USDC

USDC

$0.9998

+0.00%

Solana

SOL

$122.45

-3.29%

TRON

TRX

$0.2968

+0.35%

Dogecoin

DOGE

$0.1217

-1.19%

Cardano

ADA

$0.3468

-2.74%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now