Bitcoin [BTC], the world’s largest cryptocurrency, continues to face bearish pressure as its short-term downtrend remains intact.

While market sentiment increasingly points to the possibility that a local top may already be forming, Bitcoin’s relationship with traditional equity markets presents a contrasting narrative, one that strengthens the case for a potential upside reversion.

Equity markets could set the stage for Bitcoin

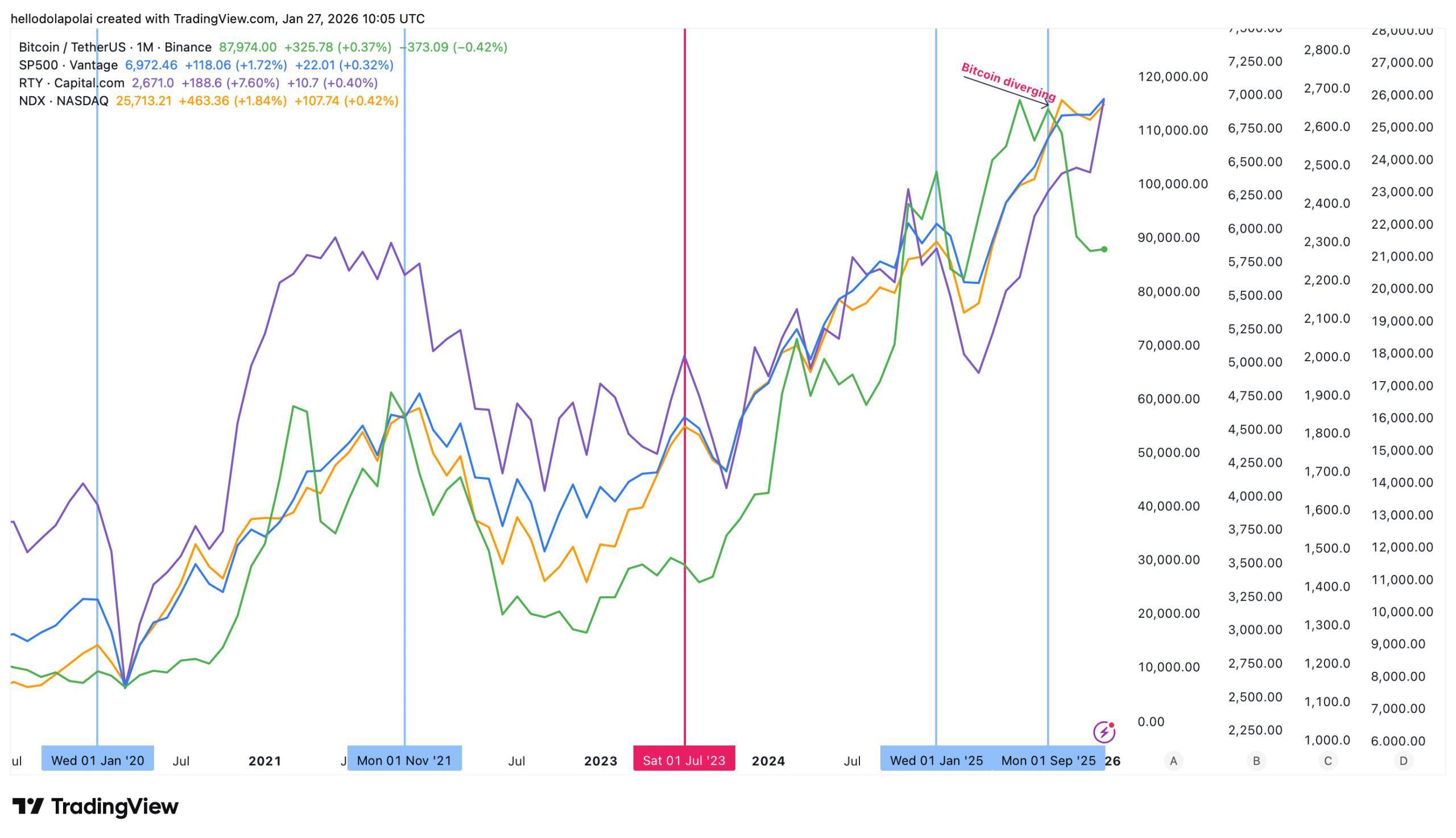

BTC and U.S. equity indices, particularly the S&P 500, Russell 2000, and Nasdaq, have historically shown a strong correlation in price movement.

In past cycles, this alignment has often resulted in both asset classes forming market tops around the same period, a pattern that has played out across four distinct cycles.

July 2023 stands out as a unique case. While these markets appeared to top around the same time, BTC recovered quickly, leaving other assets lagging for an extended period.

This cycle, however, is unfolding differently. Since September 2025, price action has diverged. Bitcoin has trended lower, while equities have maintained their bullish momentum.

In relative terms, BTC is down roughly 30%, while the S&P 500 has gained 6.32%, the Russell 2000 has advanced 13.27%, and the Nasdaq is up 7.74%.

This divergence places Bitcoin in a position of relative underperformance. Historically, such gaps have often narrowed over time, implying that Bitcoin could attempt to close the difference through upward price movement as capital continues to build.

While not guaranteed, the setup remains notable.

Can Bitcoin close the gap?

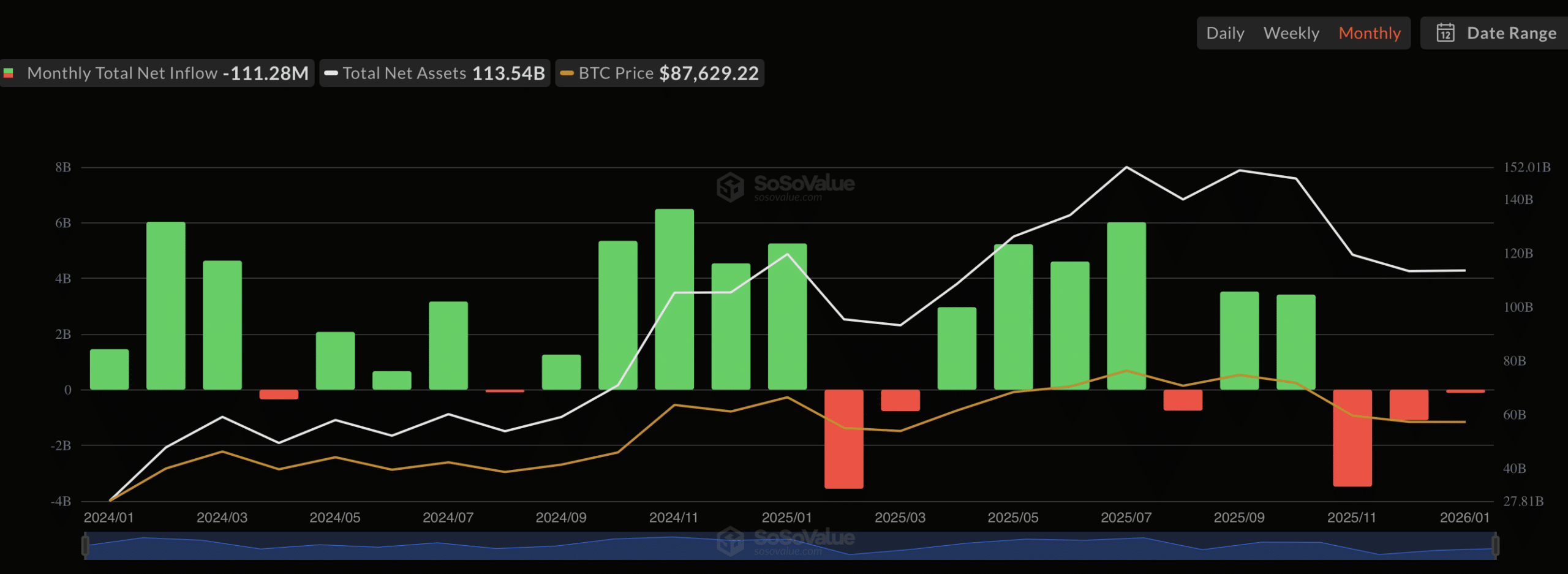

Liquidity outflows remain Bitcoin’s primary challenge, and the market must reverse this trend to support a sustained recovery.

Capital outflows have dominated for several months. Looking at U.S. spot Bitcoin exchange-traded funds as a reference, investors have sold approximately $4.68 billion worth of Bitcoin between November and the present period.

Despite this sustained selling, BTC’s price has held up relatively well. Since November 2025, when the asset recorded its first monthly net sales in two months, Bitcoin has declined from $91,200 to around $88,300 at the time of writing.

Market participants have absorbed much of this selling pressure, with Bitcoin’s value declining by roughly $2,900 despite the scale of outflows.

Bitcoin’s hashrate has also remained elevated during this period of price weakness. Historically, a rising hashrate reflects sustained network demand, as miners expand operations to meet participation levels.

Miner behavior further supports this view. Over recent days, miner-associated wallets have added more than 400 Bitcoin to their reserves, indicating a preference for accumulation rather than distribution. This dynamic supports Bitcoin’s short- to near-term price stability.

Stablecoin liquidity remains a key risk

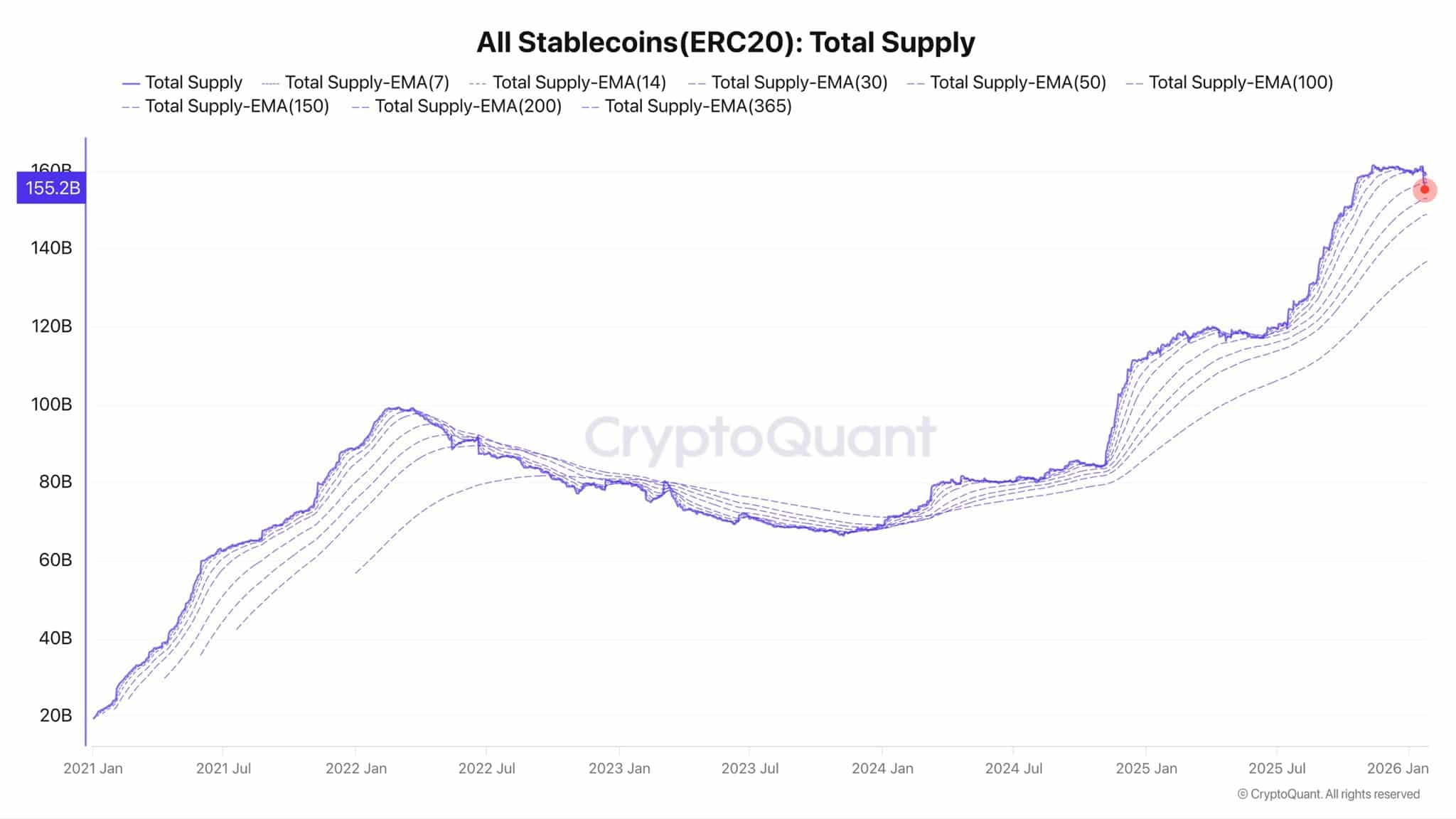

A major downside risk persists in the form of declining stablecoin liquidity.

Data from CryptoQuant shows a $7 billion outflow from ERC-20-based stablecoins, with total supply falling from $162 billion to $155 billion over a short period.

The last comparable outflow occurred during the 2021 Terra-Luna collapse, a period that preceded a sharp decline in Bitcoin’s price.

Outflows of this magnitude typically reflect reduced risk appetite across the broader crypto market. With Bitcoin positioned at the center of that ecosystem, sustained stablecoin redemptions continue to place pressure on its near-term outlook.

Final Thoughts

- Bitcoin’s historical correlation with equities indicates the asset could be positioned for a catch-up move.

- The market continues to absorb selling pressure, though a $7 billion stablecoin outflow remains a key downside risk.