Bitcoin markets came under renewed pressure in late January 2026 as prices slipped toward the $88,000 level, extending a decline of more than 20% from highs above $126,000 reached in late 2025. The move has been driven by tightening macro conditions, political uncertainty, and a shift in institutional positioning. While near-term price action has unsettled sentiment, the pullback has also prompted a reassessment of how capital is allocated across the Bitcoin ecosystem, including early-stage infrastructure projects such as Bitcoin Everlight.

Macroeconomic Signals Reassert Influence on Bitcoin

Bitcoin has shown increased sensitivity to traditional macro indicators as liquidity conditions tightened into early 2026. Treasury yields and interest rate expectations have played a larger role in short-term positioning, with traders adjusting exposure ahead of the Federal Open Market Committee meeting on January 27–28.

Political risk has compounded macro pressure. A January 31 US government funding deadline revived concerns over a potential shutdown, recalling the 43-day shutdown in 2025 that coincided with a sharp contraction in crypto liquidity. Additional uncertainty tied to renewed tariff rhetoric has reinforced a broader risk-off posture across global markets.

Institutional flows reflected this shift. US spot Bitcoin ETFs recorded more than $1.3 billion in net outflows during the final week of January, the largest weekly withdrawal since February 2025. The move coincided with forced liquidations in derivatives markets, amplifying downside pressure in thin trading conditions.

Bitcoin Everlight as Bitcoin-Native Infrastructure

Periods of market stress often redirect attention toward network fundamentals. Bitcoin Everlight has gained visibility as a lightweight transaction layer built to operate above Bitcoin without modifying Bitcoin’s protocol or consensus.

Everlight processes transactions through a dedicated routing layer designed to support faster confirmation and predictable micro-fees, while Bitcoin remains the final settlement layer. Transactions confirmed within Everlight can be optionally anchored back to the Bitcoin blockchain, preserving alignment with Bitcoin’s security model.

How Everlight Nodes Operate and Earn Compensation

Everlight nodes are not full Bitcoin nodes and do not store or validate the Bitcoin blockchain. Their function is limited to transaction routing, signature verification, balance checks within the Everlight layer, and enforcement of transaction ordering.

Transactions are confirmed through a quorum-based process across node clusters, enabling confirmation within seconds. Participation requires staking BTCL tokens, which establishes eligibility and determines participation tier. The network supports Light, Core, and Prime tiers, with higher tiers unlocking priority routing roles. A 14-day lock period applies to staked tokens to support predictable network behavior.

Node compensation is derived from routing micro-fees and calculated using uptime consistency, routing volume, and performance metrics such as latency and accuracy. Nodes that fail to meet required thresholds lose routing priority until performance standards are restored.

Security Reviews and Verification Standards

Bitcoin Everlight incorporates third-party security reviews and identity verification as part of its participation framework. Independent technical assessments include the and the , covering system architecture and contract logic.

Team accountability is established through the and the . These measures define responsibility for development and network operation without extending beyond the Everlight layer.

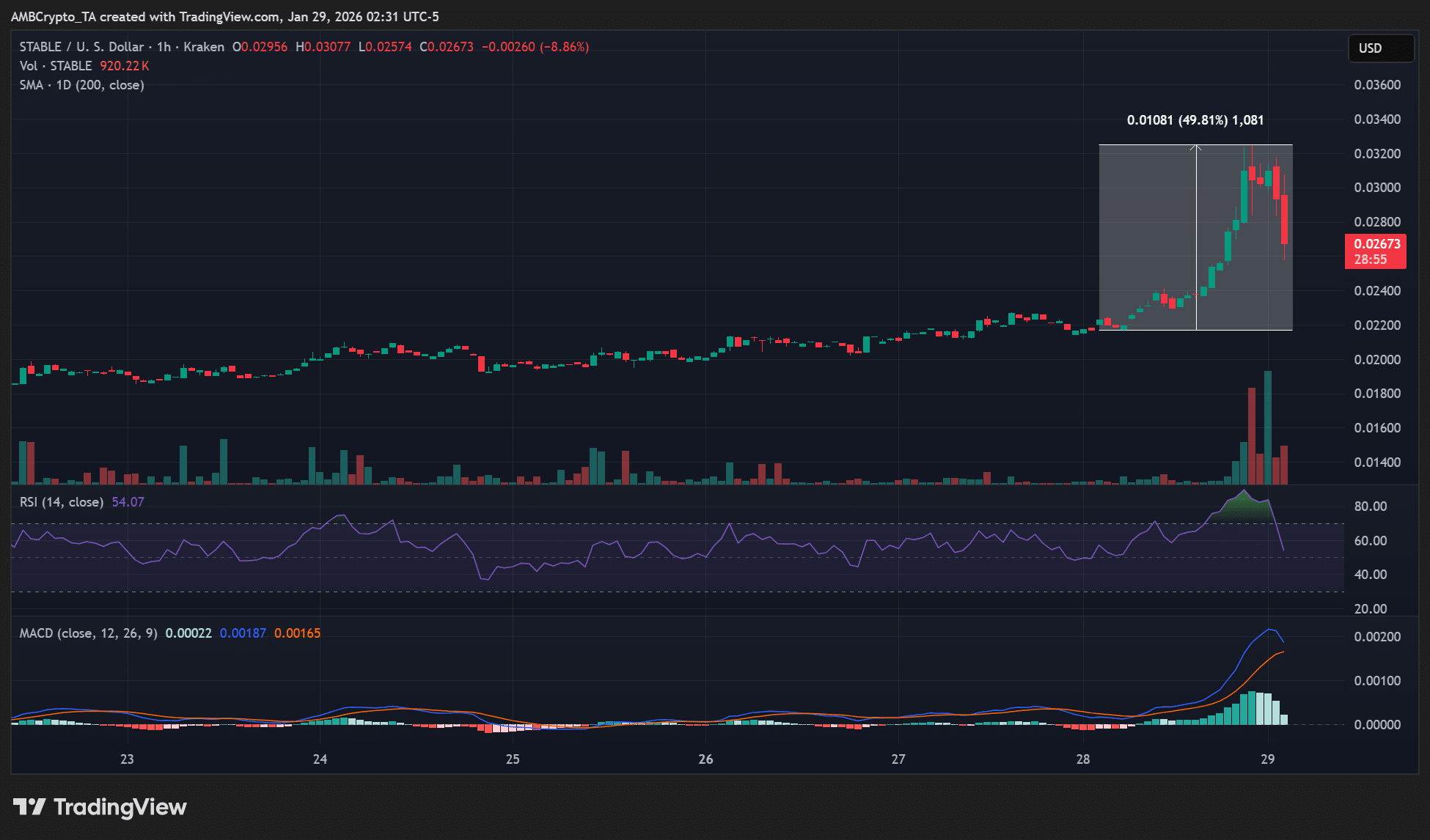

Tokenomics and Market Context

BTCL has a fixed total supply of 21,000,000,000 tokens. Allocation is defined as 45% for public sale, 20% for node rewards, 15% for liquidity, 10% for the team under vesting conditions, and 10% for ecosystem and treasury use. BTCL is used for transaction routing fees, node participation, performance incentives, and anchoring operations.

As markets reassess risk under macro and political strain, early-stage infrastructure tied to Bitcoin’s transaction activity is being examined alongside price exposure. Bitcoin Everlight is positioned within that evaluation as infrastructure designed to operate through changing market conditions without altering Bitcoin’s core protocol.