Why Does the US Dollar Keep Falling Unstoppably?

Huitong Network, January 29— On Thursday, January 29, the US Dollar Index was trading around 96.00 during the European session, with a significantly steeper downward slope on the daily chart, indicating increasing weakness. Previously, the index had formed a temporary high around 100.3900 but then retreated after fluctuations, failing to maintain its strength. This year, it briefly rebounded to 99.4940, but lacked upward momentum and soon reversed downward, accelerating its decline. The key support at 97.00 was effectively breached, with the lowest point reaching 95.5660. Although it then slightly recovered to consolidate around the 96 mark, the overall bearish structure remained unchanged.

On Thursday, January 29, the US Dollar Index was trading around 96.00 during the European session, with a significantly steeper downward slope on the daily chart, indicating increasing weakness. Previously, the index had formed a temporary high around 100.3900 but then retreated after fluctuations, failing to maintain its strength. This year, it briefly rebounded to 99.4940, but lacked upward momentum and soon reversed downward, accelerating its decline. The key support at 97.00 was effectively breached, with the lowest point reaching 95.5660. Although it then slightly recovered to consolidate around the 96 mark, the overall bearish structure remained unchanged.

From a technical indicator perspective, the current MACD is below the zero axis, with DIFF at -0.5776, DEA at -0.2506, and the MACD histogram at -0.6539, indicating that bearish momentum continues to be released. The RSI reads 28.9140, already in the oversold zone, suggesting that the market may have a need for recovery after emotional selling in the short term. However, analysis points out that this does not mean the trend has reversed and is more likely a technical rebound during a downtrend. If there is a lack of support from fundamentals, the rebound could be limited.

At present, the 96.00 level has become a key zone for the battle between bulls and bears. If it can regain its footing above 97.00 in the future, further downward pressure may be alleviated; conversely, if the rebound is blocked, 95.5660 might once again become a focal point for short-term contention. Under the current structure, a more likely scenario is a choppy rebound to test upper resistance, rather than a direct unilateral reversal.

Global Currencies Stage a Collective Comeback

This round of dollar weakness is not an isolated phenomenon, but a widespread pattern reflected across multiple major currency pairs. The euro rose 0.3% against the dollar to 1.1990, once again approaching the psychological 1.2000 mark and hovering near weekly highs. The dollar fell sharply against the Swiss franc by 0.4% to 0.7650, continuing to probe lower levels. The Australian dollar performed even more strongly, surging 0.7% against the dollar amid hotter inflation data, touching 0.7090, which is close to a two-year high.

These changes show that the dollar’s weakness is not merely due to the strength of a single currency, but rather a concentrated manifestation of a broad-based asset reallocation in the forex market. Capital is moderately withdrawing from dollar assets and flowing into currencies and asset classes with higher relative attractiveness. Behind this shift is the market’s reassessment of the long-term pricing logic of the dollar, rather than an explanation by short-term volatility.

It is especially noteworthy that the strength of precious metals has further amplified the suppressive effect on the dollar. Gold surged 2.5% on the day, with a cumulative weekly gain exceeding 11%, and the latest price hovering around $5,550, at one point approaching the $5,600 mark during the session. Just last weekend, the market was still debating whether $5,000 would constitute strong resistance, but it has now been swiftly breached, highlighting a sharply rising demand for hedging against inflation and geopolitical uncertainty. Silver also strengthened, breaking through $120 and setting a new high. Sustained rallies in precious metals typically indicate a decline in real interest rate expectations or a rise in risk aversion—both scenarios weaken the dollar’s appeal.

Multiple Factors Combine, Dollar Faces Confidence Test

This round of dollar decline appears to be the result of a resonance of multiple factors, rather than a single event. First, the frequent changes in trade policy and tariff paths have made it difficult for the market to form stable expectations for economic growth and interest rates, prompting investors to reduce their concentration in dollar assets. Second, although geopolitical uncertainty has increased risk premiums, it has not, as in the past, automatically translated into unilateral benefits for the dollar; instead, it has prompted capital to diversify, boosting the relative value of the euro, Australian dollar, and other currencies.

In addition, the debate over the independence of Federal Reserve monetary policy is heating up, affecting market confidence in the medium to long-term inflation and interest rate framework. Once central bank credibility is damaged, the credit foundation of the currency is also impacted. Fiscal concerns should not be ignored either—the ever-increasing debt burden has led the market to reassess real purchasing power and term premiums. When capital demands higher compensation on both exchange rate and interest rate dimensions, the dollar naturally comes under pressure.

Some analysts believe that the current weakness of the dollar may not be entirely market-driven, but could be a "guided depreciation." That is, without shaking its status as the global reserve currency, a moderate devaluation is used to ease trade deficits and fiscal pressure, while avoiding violent turmoil in capital markets. During the Plaza Accord period in 1985, the dollar underwent a coordinated adjustment, depreciating by about 40% in total. However, circumstances are very different today: the global economy is more diversified, capital flows are more sensitive, and debt levels are higher—the relevant ratio has exceeded 120% of GDP. Against this backdrop, any ambiguous policy statement could be pre-emptively traded by the market, intensifying volatility.

Medium-Term Outlook Uncertain, Choppy Downtrend May Dominate

Looking ahead, whether the US Dollar Index can stabilize will depend on whether several core variables reverse. In the short term, the RSI has entered oversold territory, and there is indeed a possibility of a technical rebound, but the MACD remains bearish, limiting the extent and sustainability of a rebound. The real test lies in whether policy expectations can stabilize, the interest rate path can become clear, and whether cross-asset hedging demand will continue to drive up gold and other safe-haven assets.

If the euro continues to challenge above 1.2000 against the dollar, the dollar remains weak against the Swiss franc, the Australian dollar maintains its high level, and gold continues to move upward with high volatility, then the dollar's recovery will face greater resistance and is likely to return to a downward channel after a rebound. Analysts believe that unless there is a fundamental reversal of key variables, the dollar is more likely to exhibit a pattern of "repeated fluctuations with a downward shift in focus," rather than a rapid rebound after a sharp drop.

This “ebbing” of the dollar is both a recalibration of fundamental expectations and a profound restructuring of global capital across risk and duration dimensions. It serves as a reminder to the market: there is no eternally strong currency—only ever-changing pricing logic.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bella Protocol Expands AI Capabilities Through Strategic PinGoAI Collaboration

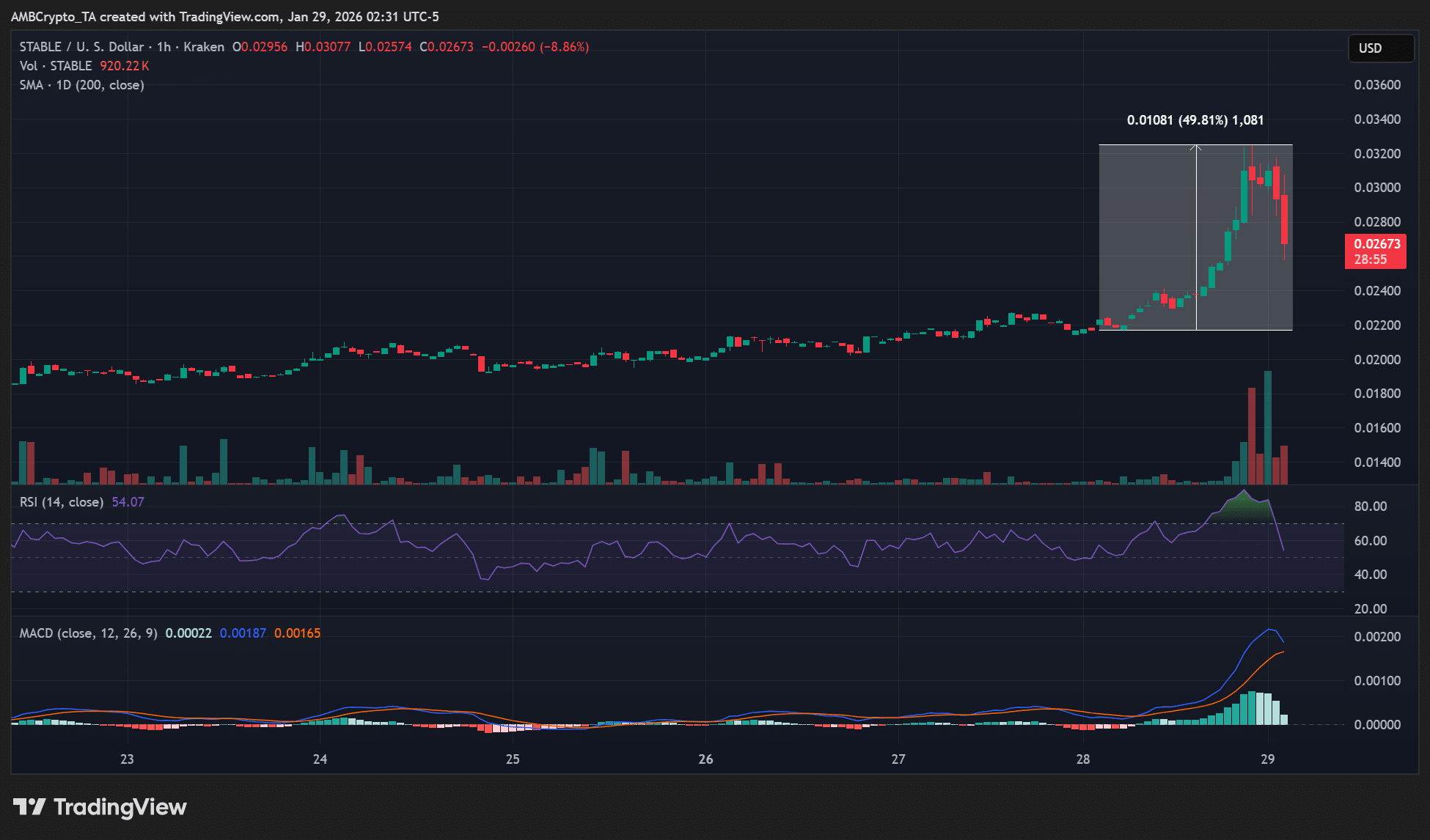

Why is STABLE’s price up today? Tether’s USAT, network upgrade & more

Mortgage rates remained unchanged this week since the Fed maintained its current policy

Vitalik Buterin and the Ethereum Foundation make plans to bring back the DAO