KLA Corporation (NASDAQ:KLAC) Surpasses Q4 Revenue Expectations

KLA Corporation Surpasses Expectations in Q4 CY2025

KLA Corporation (NASDAQ: KLAC), a leading provider of semiconductor manufacturing equipment, posted stronger-than-anticipated results for the fourth quarter of calendar year 2025. The company achieved $3.30 billion in revenue, marking a 7.2% increase compared to the same period last year and exceeding Wall Street forecasts. Looking ahead, KLA projects next quarter’s revenue to reach $3.35 billion at the midpoint, which is 1.9% higher than analysts’ predictions. Adjusted earnings per share came in at $8.85, slightly above consensus estimates by 0.6%.

Is KLA Corporation a Good Investment Right Now?

Curious whether KLA is a smart buy at this moment?

Highlights from KLA Corporation’s Q4 CY2025

- Revenue: $3.30 billion, surpassing analyst expectations of $3.26 billion (7.2% year-over-year growth, 1.3% above estimates)

- Adjusted EPS: $8.85, compared to the anticipated $8.80 (0.6% above estimates)

- Adjusted EBITDA: $1.50 billion, beating the $1.46 billion estimate (45.6% margin, 3% above expectations)

- Q1 CY2026 Revenue Guidance: $3.35 billion at the midpoint, higher than the $3.29 billion forecast

- Q1 CY2026 Adjusted EPS Guidance: $9.08 at the midpoint, above the $8.98 analyst estimate

- Operating Margin: 40.3%, up from 32.6% a year ago

- Free Cash Flow Margin: 38.3%, an increase from 24.6% in the prior year

- Inventory Days Outstanding: 235, down from 241 last quarter

- Market Capitalization: $213.8 billion

“KLA achieved record results for revenue, non-GAAP operating income, and free cash flow in both the quarter and the full year 2025,” said Rick Wallace, KLA’s president and CEO. “Our strong performance was driven by our unique product lineup and effective execution, especially as process control becomes increasingly vital for advanced foundry, logic, and memory manufacturing. As the industry leader in process control, KLA is well positioned to benefit from these ongoing trends.”

About KLA Corporation

KLA Corporation (NASDAQ: KLAC) was established in 1997 through the merger of two top semiconductor yield management firms. Today, it stands as the premier supplier of inspection and measurement equipment for semiconductor chip production.

Examining Revenue Growth

Long-term sales growth is often a sign of a company’s strength. While any business can have a good quarter, sustained expansion over years is a hallmark of quality. Over the past five years, KLA’s sales have grown at a compound annual rate of 16%, outpacing the average for the semiconductor sector and indicating strong customer demand. However, the semiconductor industry is known for its cycles, so investors should be prepared for periods of rapid growth followed by slowdowns, which can sometimes present attractive buying opportunities.

Recent Revenue Trends

While we focus on long-term growth, it’s important to recognize that industry shifts—such as the rise of AI—can alter demand patterns. Over the last two years, KLA’s annualized revenue growth slowed to 14.8%, below its five-year average, but still reflects solid demand.

In the latest quarter, KLA reported a 7.2% year-over-year increase in revenue, with sales of $3.30 billion exceeding Wall Street’s projections by 1.3%. However, this marks the third straight quarter of slowing growth, suggesting the company may be entering a cyclical downturn. Management is forecasting a 9.4% year-over-year revenue increase for the next quarter.

Looking further ahead, analysts expect KLA’s revenue to rise by 11.8% over the next year, which is slower than recent years and may indicate some headwinds for demand. Nevertheless, the company continues to perform well in other financial metrics.

Many major companies—like Microsoft, Alphabet, Coca-Cola, and Monster Beverage—started as lesser-known growth stories that capitalized on major trends. We’ve identified a promising AI semiconductor opportunity that Wall Street has yet to fully recognize.

Product Demand and Inventory Analysis

Days Inventory Outstanding (DIO) is a key indicator for semiconductor companies, reflecting both capital requirements and the cyclical nature of the industry. Stable inventory levels often signal strong demand and pricing power, while rising DIO can be a warning sign of weakening demand and potential production cuts.

This quarter, KLA’s DIO stood at 235 days, which is four days higher than its five-year average. Although inventory levels have recently declined, they remain elevated compared to historical norms.

Summary of KLA Corporation’s Q4 Performance

KLA’s revenue outlook for the upcoming quarter exceeded analyst expectations, and the company also managed to reduce its inventory levels. While these are positive developments, the market appeared to expect even more, as shares fell 3.7% to $1,628 immediately following the earnings release.

Should you consider investing in KLA? While quarterly results are important, long-term fundamentals and valuation play a much larger role in investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why LivLive ($LIVE) Is the Best New Crypto Presale to Join vs BlockSack, Coldware, Hexydog, and Little Pepe

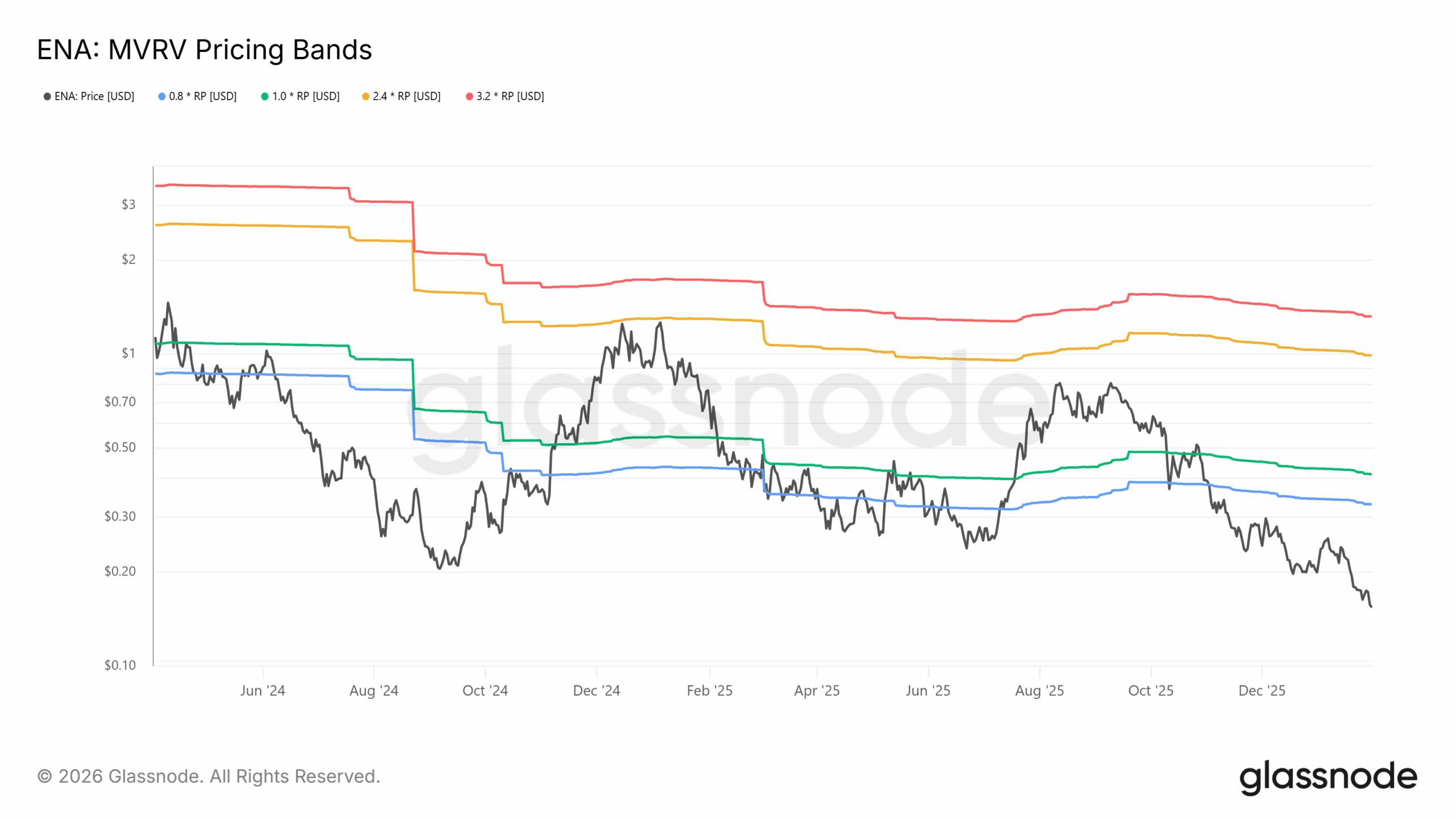

Ethena hits all-time low: Why isn’t USDe adoption helping ENA?

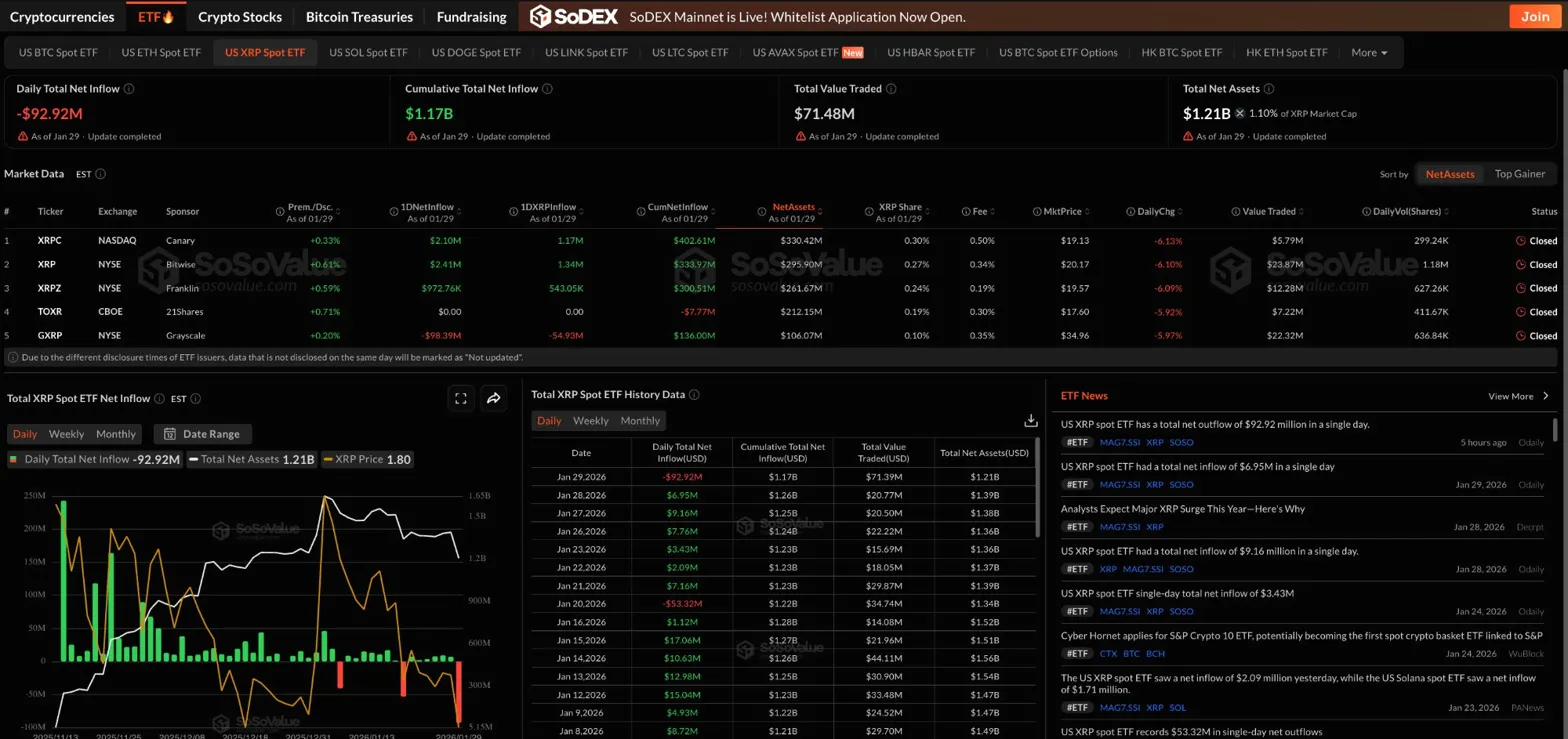

XRP Price Prediction: $92M ETF Outflows Trigger Breakdown To Critical $1.73 Support

Bitcoin And Ether ETFs Record $1.82 Billion Outflows During Precious Metals Rally