Arthur J. Gallagher (NYSE:AJG) Surpasses Q4 CY2025 Projections

Arthur J. Gallagher Surpasses Q4 2025 Revenue Forecasts

Arthur J. Gallagher (NYSE:AJG), a leading insurance brokerage, announced its financial results for the fourth quarter of calendar year 2025, exceeding market expectations. The company posted revenue of $3.63 billion, marking a 35.6% increase compared to the same period last year. Adjusted earnings per share reached $2.38, coming in 1.4% above what analysts had predicted.

Q4 2025 Performance Highlights

- Total Revenue: $3.63 billion, surpassing analyst projections of $3.6 billion (35.6% year-over-year growth, 0.7% above expectations)

- Adjusted Earnings Per Share: $2.38, compared to the $2.35 consensus (1.4% higher than estimates)

- Adjusted EBITDA: $1.05 billion, slightly above the $1.04 billion forecast (margin of 28.9%, 0.6% beat)

- Market Value: $62.24 billion

“We delivered an outstanding fourth quarter and a fantastic 2025!” commented J. Patrick Gallagher, Jr., Chairman and CEO.

About Arthur J. Gallagher

Established in 1927, Arthur J. Gallagher operates in around 130 countries, offering insurance brokerage, reinsurance, consulting, and third-party claims administration services to clients worldwide.

Examining Revenue Trends

Consistent revenue growth over time is a strong indicator of a company’s quality. While short-term gains can be impressive, sustained expansion is a hallmark of industry leaders.

With $13.94 billion in revenue over the last year, Arthur J. Gallagher stands as a major player in business services. Its scale provides advantages in distribution and cost efficiency, allowing it to compete effectively and offer competitive pricing.

Over the past five years, the company’s sales have grown at a remarkable compounded annual rate of 16.5%, outpacing many peers in the sector.

While long-term growth is crucial, recent developments can also signal shifts in momentum. In the last two years, Arthur J. Gallagher’s annualized revenue growth accelerated to 18%, indicating rising demand for its offerings.

This quarter, the company achieved a notable 35.6% year-over-year revenue increase, with results exceeding Wall Street’s expectations by 0.7%.

Looking forward, analysts anticipate revenue will climb another 22.6% over the next year—a significant projection for a company of this size, suggesting that new products and services could drive further growth.

Profitability and Margins

Arthur J. Gallagher has maintained strong efficiency over the past five years, with an average operating margin of 14.7%, placing it among the more profitable firms in its field.

Its operating margin has improved by 1.4 percentage points during this period, reflecting the benefits of increased sales and operational leverage.

Compared to the same quarter last year, the company’s cost structure has remained steady, indicating ongoing operational discipline.

Earnings Per Share Analysis

Tracking earnings per share (EPS) over time helps assess whether a company’s growth translates into profitability for shareholders.

Arthur J. Gallagher’s EPS has grown at an impressive 17.7% annual rate over the past five years, mirroring its revenue trajectory and demonstrating that additional sales have been profitable.

Shorter-term analysis reveals that two-year annual EPS growth was 10.4%, trailing the 18% revenue growth rate over the same period.

Further examination shows that the company increased its share count by 20.4% over two years, which diluted per-share earnings. While taxes and interest also impact EPS, they are less indicative of core business performance.

For the fourth quarter, adjusted EPS reached $2.38, up from $2.13 a year earlier and 1.4% above analyst expectations. Wall Street forecasts full-year EPS of $10.70 for the next 12 months, representing a projected increase of 23.9%.

Summary of Q4 Results

Arthur J. Gallagher’s ability to slightly exceed revenue forecasts and deliver an EPS beat were positive takeaways from this quarter’s report. Following the announcement, shares rose 1.7% to $249.91.

Is Arthur J. Gallagher a compelling investment at this time? While recent results are important, evaluating the company’s long-term prospects and valuation is crucial before making investment decisions.

Industry Perspective

Technology continues to transform every sector, fueling demand for solutions that support software development, infrastructure monitoring, and seamless content delivery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why LivLive ($LIVE) Is the Best New Crypto Presale to Join vs BlockSack, Coldware, Hexydog, and Little Pepe

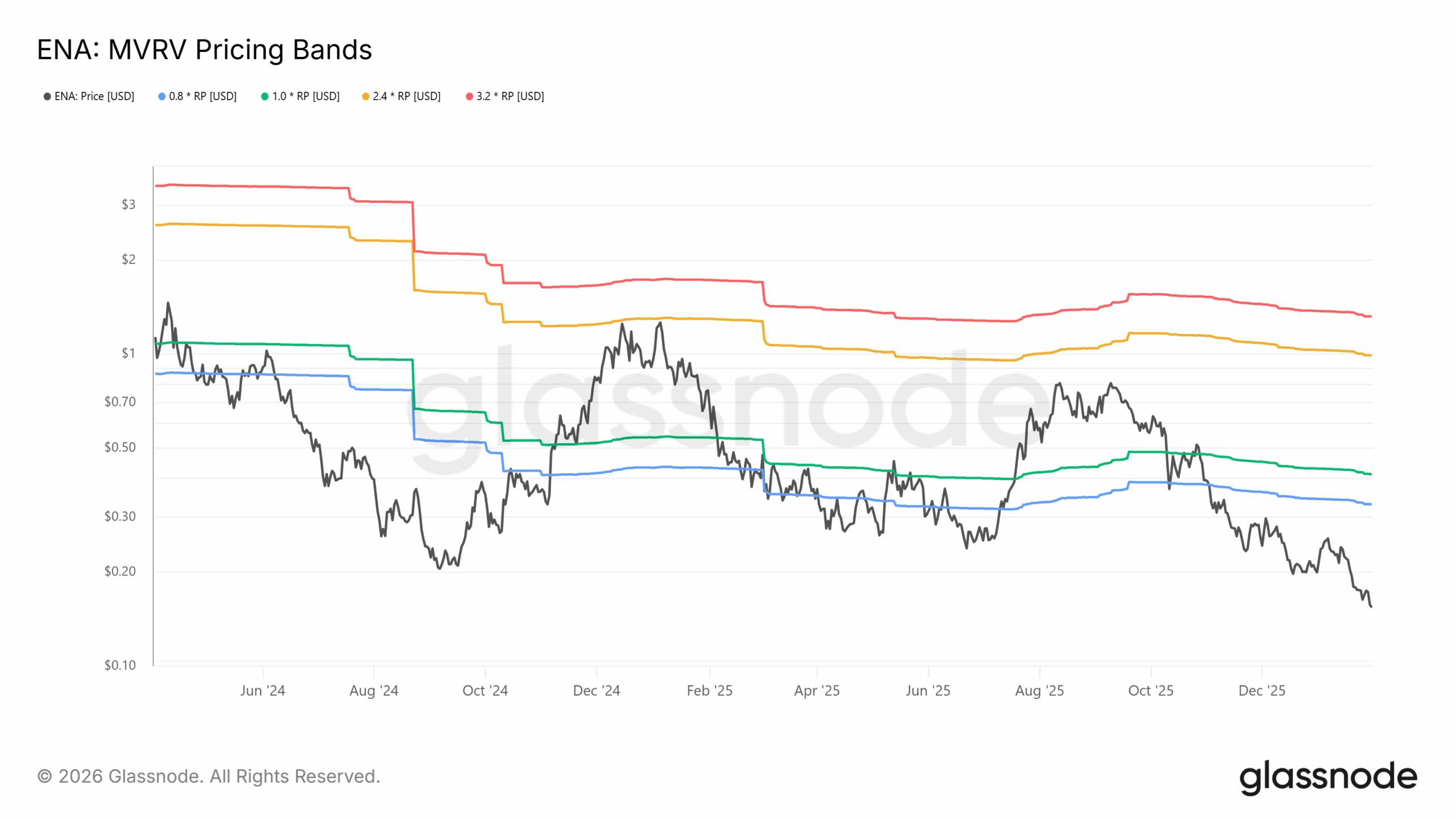

Ethena hits all-time low: Why isn’t USDe adoption helping ENA?

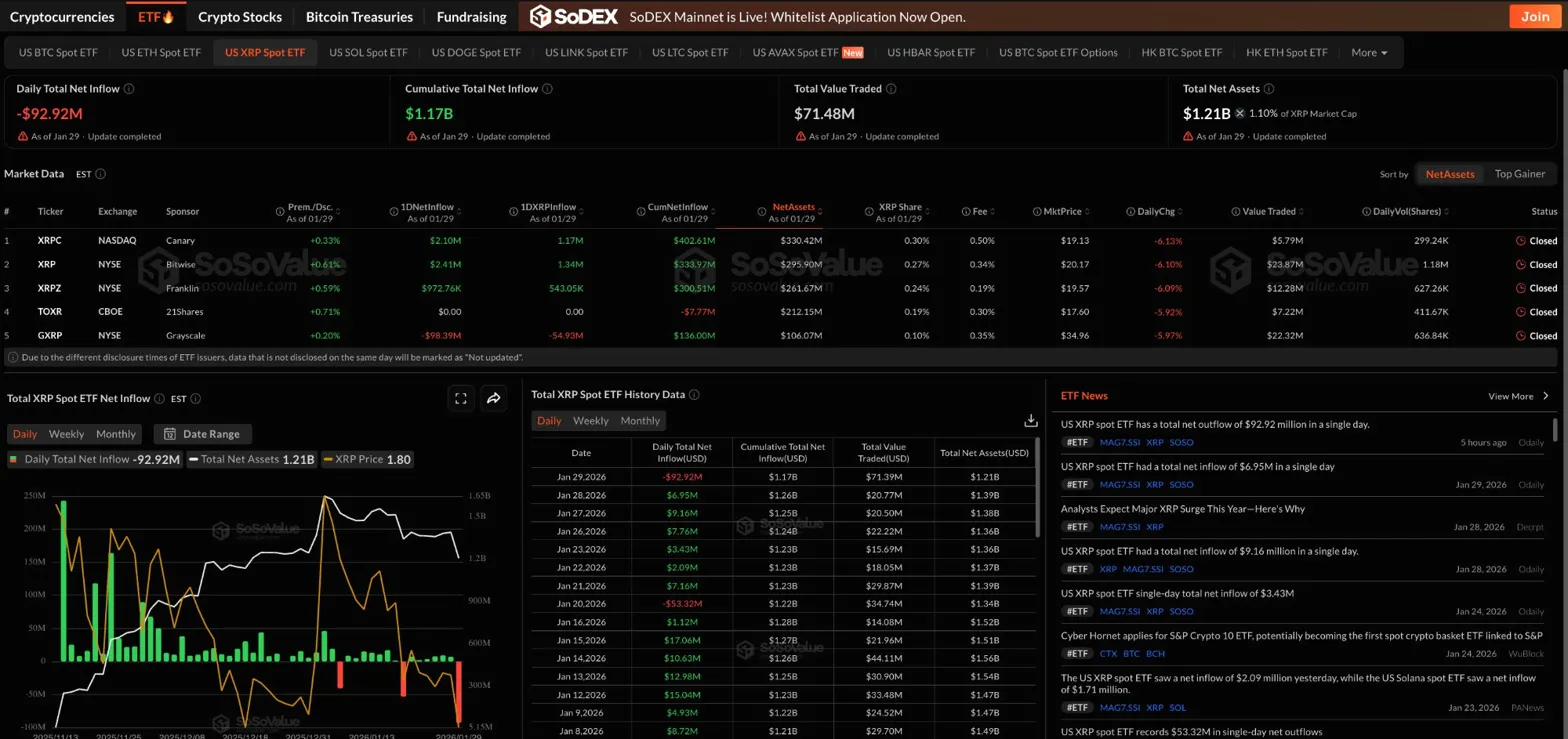

XRP Price Prediction: $92M ETF Outflows Trigger Breakdown To Critical $1.73 Support

Bitcoin And Ether ETFs Record $1.82 Billion Outflows During Precious Metals Rally