Why are software stocks plummeting as AI brings a wave of uncertainty to the industry

AI Sparks Uncertainty in Software Sector

In recent months, software company shares have experienced significant declines as concerns mount that artificial intelligence could disrupt established software business models.

Within the S&P 500, software firms have collectively fallen about 18% over the past half-year, even as the broader index has gained 9% during the same period. Notable declines include SAP, which has dropped 30%, while Salesforce and ServiceNow have lost approximately 20% and 40%, respectively.

According to Jefferies analyst Charles Brennan, "Investor confidence in software is at a low point, with AI introducing a wave of uncertainty across the industry."

Two Major Concerns for Software Companies

This uncertainty stems from two main issues. First, investors fear that clients of software-as-a-service (SaaS) providers may begin building their own solutions using AI tools from large language model companies like Anthropic, reducing their dependence on established vendors such as Salesforce. The launch of Anthropic’s autonomous assistant, Claude Cowork, has heightened these worries.

Second, there is apprehension that AI is making it easier for new enterprise software startups—such as Aurasell and Artisan AI—to enter the market. These AI-focused newcomers could directly challenge the advantages that legacy firms have long enjoyed.

Industry Response: Embracing Agentic AI

Established software companies are moving quickly to introduce agentic AI solutions, aiming to develop tools that not only provide answers but also take actions. Their goal is to protect their core platforms from emerging competitors. However, products like Microsoft’s Copilot, Salesforce’s Agentforce, and Snowflake Intelligence are still in the early stages of adoption.

Macquarie analyst Steve Koenig noted, “SaaS providers are fully committed to agentic AI and are investing heavily, but uptake among customers remains slow.”

He added, “There’s a gap between what enterprise software companies are promising and the current reality of agentic AI in practice.”

Mixed Signals from Earnings Calls

During recent earnings calls for Microsoft (MSFT), ServiceNow, and SAP, company leaders highlighted the benefits AI brings to their businesses. ServiceNow CEO Bill McDermott emphasized that “AI doesn’t replace enterprise software—it relies on it.”

Despite these reassurances, shares of these companies, along with other enterprise software providers like Salesforce, Snowflake (SNOW), Intuit (INTU), and Datadog (DDOG), continued to slide on Thursday.

Are Established Firms Really at Risk?

Futurum analyst David Nicholson shares the view of software executives, arguing that replacing established companies is not so simple. He points out that strict requirements around data management, security, and regulatory compliance make it much harder for newcomers—or for businesses developing their own solutions—than many investors realize.

“We’re underestimating how cautious real businesses are when it comes to making sweeping changes and relying on AI,” Nicholson said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The big lessons from Big Tech's big earnings week

Anatomy of bitcoin's plunge this week: The dollar's bottom was BTC's top

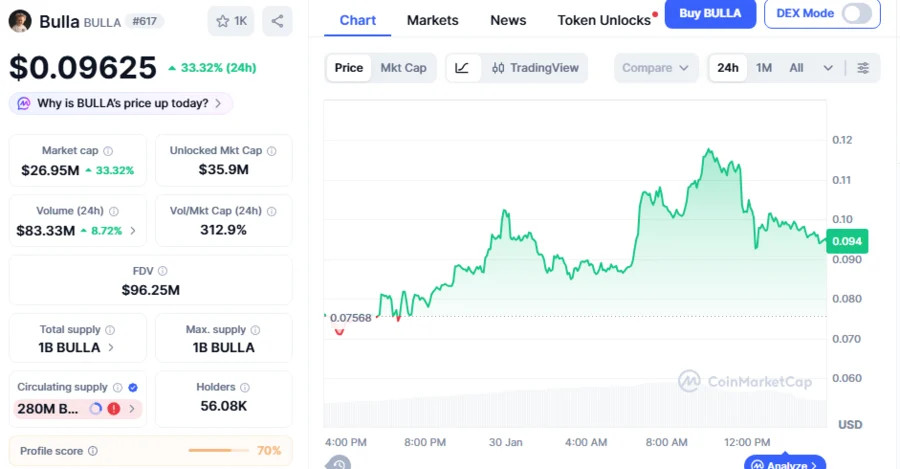

BULLA Price Climbs 315% This Week, Falling Wedge Breakout Primes to Push Price To $0.125 Target: Analyst

Dear Western Digital Shareholders, Save the Date: February 3