This AI semiconductor company may drive growth over the next ten years. Should you consider investing before its upcoming earnings announcement?

Arm Holdings: The Unsung Hero of the AI Era

While many investors are focused on companies manufacturing AI chips, Arm Holdings (ARM) stands out as a crucial force driving the AI transformation. Arm’s chip blueprints are at the heart of devices ranging from smartphones to massive data centers, making it a pivotal player in the future of artificial intelligence. Following a record-breaking quarter, Arm is preparing to announce its third quarter fiscal 2026 results on February 4, after the market closes.

Is now the right time to consider adding this AI chip innovator to your portfolio?

Related Updates from Barchart

Arm, with a market capitalization of $114.5 billion, develops the processor architectures that underpin the majority of electronic devices worldwide. Rather than manufacturing chips itself, Arm licenses its technology to industry giants like Apple, Nvidia, Google (Alphabet), Microsoft, and Qualcomm, who then create their own custom processors. Arm’s business model revolves around licensing fees and royalties for every chip produced using its designs.

In the second quarter of fiscal 2026, Arm posted its best results to date, fueled by surging demand for AI solutions in both edge devices and large-scale data centers. Royalty income soared to $620 million, marking a 21% year-over-year increase, while licensing revenue climbed 56% to $515 million. The company’s annualized contract value rose by 28% compared to the previous year. Adjusted earnings reached $0.39 per share, surpassing expectations.

The appetite for Arm’s compute subsystem (CSS) technology is growing rapidly. During the quarter, Arm secured three more CSS agreements, bringing the total to 19 licenses across 11 clients. The company also launched Lumex CSS, its most advanced mobile computing platform to date, engineered to enable cutting-edge AI features such as instant language translation, enhanced image processing, and smart digital assistants. Leading smartphone brands like OPPO and Vivo are expected to introduce flagship models powered by this platform later this year.

Arm’s Expanding Network of Strategic Partnerships

Arm’s data center business remains a significant growth driver. Its Neoverse platform has now surpassed one billion processors deployed globally. Major tech firms—including Nvidia (with Grace chips), Amazon (AWS Graviton), Google (Axion), and Microsoft (Cobalt)—are all building custom processors based on Arm’s architecture. This widespread adoption is boosting royalty revenues and solidifying Arm’s influence in the evolution of cloud computing.

Arm-based chips are also making inroads into new sectors. Google’s latest Pixel 10 smartphone features the Arm-powered Tensor G5 chip, delivering up to 2.6 times faster performance on Gemini models and twice the energy efficiency of previous generations. Nvidia has begun shipping its Arm-based DGX Spark system for AI applications, while Tesla’s upcoming AI5 processor, also built on Arm technology, promises up to 40 times faster AI processing. Additionally, Arm recently announced a strategic partnership with Meta to enhance AI efficiency across both consumer devices and large-scale data centers through a unified computing platform.

Looking ahead to the third quarter, Arm anticipates revenue of $1.22 billion, with a possible variance of $50 million, and expects adjusted earnings per share of $0.41, plus or minus $0.04. Management has indicated that higher revenue will enable increased investment in research and development, while still supporting profit growth. Persistent demand across cloud, edge, and connected devices aligns with Arm’s vision of making AI technology universally accessible.

For fiscal 2026, analysts project Arm’s revenue to grow by 20.9%, with earnings expected to rise by 5.6%. Currently, ARM shares trade at a premium, valued at 47 times forward earnings, with forecasts suggesting a 32.3% increase in fiscal 2027. This elevated valuation reflects investor confidence in Arm’s long-term growth, though those with lower risk tolerance may prefer to wait for a more attractive entry point.

Analyst Outlook on ARM Shares

Wall Street analysts have assigned ARM stock an overall “Moderate Buy” rating. Of the 31 analysts covering the company, 18 recommend a “Strong Buy,” one suggests a “Moderate Buy,” 11 advise holding, and one rates it as a “Strong Sell.” The consensus price target of $164.27 implies a potential 51.5% upside from current levels, while the highest estimate of $215 points to a possible 98.3% gain over the next year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is There More Room for Sandisk Stock to Climb in 2026?

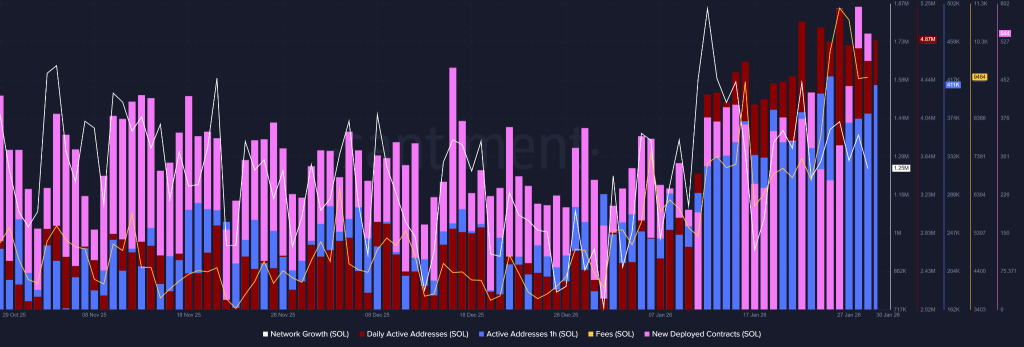

Solana Price Analysis: February Sets Up a Breakout or a Structural Failure

Toncoin Price Prediction 2026, 2027 – 2030: Will TON Price Reach $10?