Eli Lilly (LLY) Q4 Preview: Key Information To Know Before Earnings Release

Eli Lilly Set to Announce Earnings: What Investors Should Know

This Wednesday, before the opening bell, Eli Lilly (NYSE:LLY), a leading global pharmaceutical company, is scheduled to release its latest earnings report. Here’s a preview of what the market is anticipating.

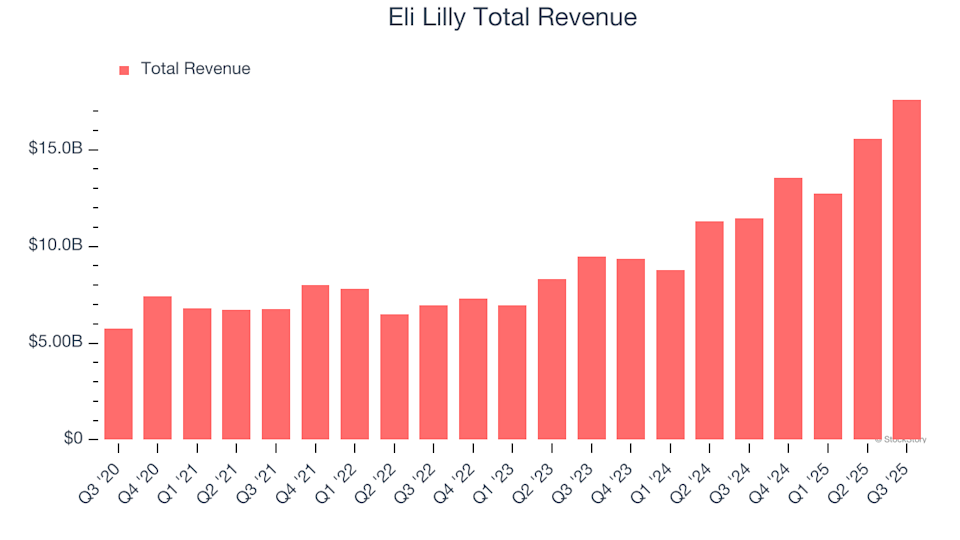

In the previous quarter, Eli Lilly delivered impressive results, surpassing revenue forecasts by 9.7%. The company posted $17.6 billion in revenue, marking a remarkable 53.9% increase compared to the same period last year. Not only did Eli Lilly outperform analyst expectations, but it also provided full-year revenue guidance that was higher than what experts had projected.

Should You Buy or Sell Eli Lilly Ahead of Earnings?

Curious about whether Eli Lilly is a good investment as earnings approach?

Expectations for This Quarter

For the upcoming quarter, analysts predict Eli Lilly’s revenue will reach $17.96 billion, representing a 32.8% year-over-year increase. This growth rate is slower than the 44.7% jump seen in the same quarter last year. Adjusted earnings per share are projected to be $6.93.

Analyst Sentiment and Recent Performance

Over the past month, most analysts have maintained their forecasts for Eli Lilly, indicating confidence in the company’s trajectory as it heads into earnings. However, it’s worth noting that Eli Lilly has missed Wall Street’s revenue expectations three times in the last two years.

Market Context and Stock Performance

As the first major pharmaceutical company to report this season, Eli Lilly’s results will set the tone for the sector. So far, investor sentiment has remained steady, with both Eli Lilly’s share price and the broader pharmaceutical sector holding flat over the past month. Currently, the average analyst price target for Eli Lilly stands at $1,150, compared to its recent trading price of $1,048.

Spotlight on Thematic Investing

At StockStory, we recognize the value of investing in major trends. Companies like Microsoft (MSFT), Alphabet (GOOG), Coca-Cola (KO), and Monster Beverage (MNST) have all benefited from powerful growth drivers. In line with this approach, we’ve uncovered an emerging, profitable growth stock riding the wave of AI innovation—and you can access this recommendation for free.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

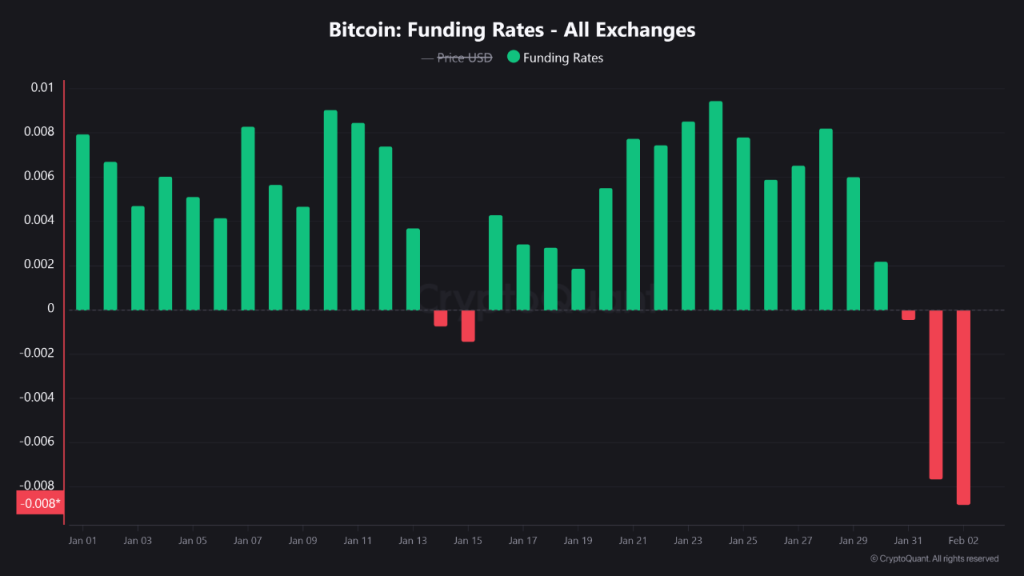

Bitcoin rebounds above $78,500; no basis for long-term rally yet: analysts

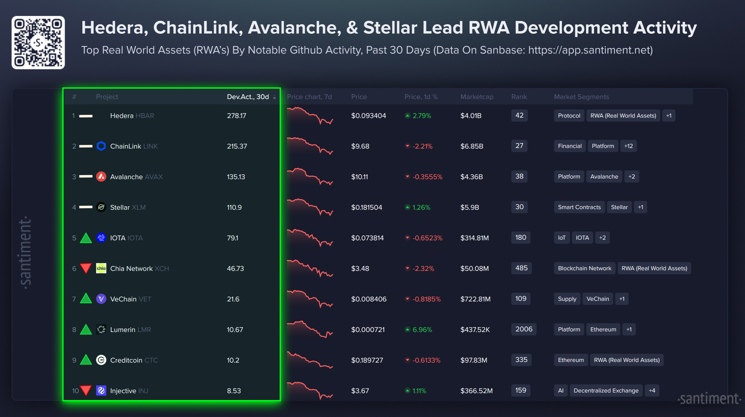

Is HBAR Price Finding a Floor Despite Market Weakness?

BTC Price Enters a Reset Phase After $74,500 Crash Shakes Market Structure

DBS Bank Ethereum Accumulation Skyrockets: Strategic $5.8M Transfer Signals Major Institutional Move