PTC (PTC) Q4 Preview: Key Information to Know Before Earnings Release

PTC Set to Announce Earnings: What Investors Should Watch

PTC, a leader in product design software and listed on NASDAQ, is scheduled to release its earnings report this Wednesday after market close. Here’s a summary of what to look out for ahead of the announcement.

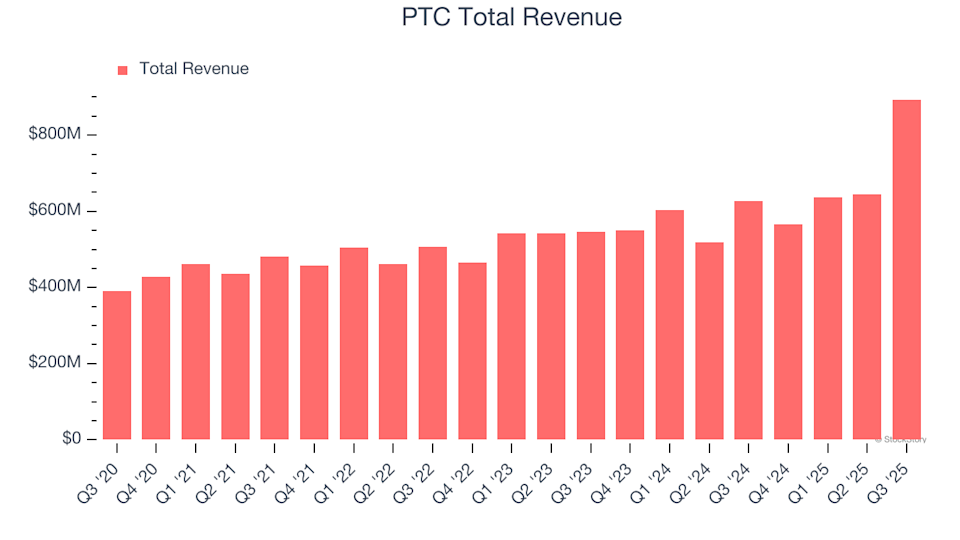

In the previous quarter, PTC delivered a standout performance, surpassing analyst revenue forecasts by 18.7% with reported revenue reaching $893.8 million—a 42.7% increase compared to the same period last year. The company not only exceeded expectations for billings but also posted a significant beat on EBITDA estimates.

Should You Consider PTC Before Earnings?

Wondering if PTC is a buy or sell ahead of its earnings release?

Current Quarter Expectations

Analysts are forecasting that PTC’s revenue will climb 12.1% year over year to $633.7 million this quarter, a notable improvement from the 2.7% growth seen in the same quarter last year. Adjusted earnings per share are projected to be $1.56.

Analyst Sentiment and Track Record

Over the past month, most analysts have maintained their forecasts for PTC, indicating confidence in the company’s direction as it approaches its earnings report. Notably, PTC has only missed Wall Street’s revenue projections once in the last two years, typically outperforming expectations by an average of 5%.

Industry Peers: Recent Results

Several companies in the vertical software sector have already shared their Q4 results, offering some insight into market trends. Dolby Laboratories saw its revenue dip by 2.9% year over year but still outperformed analyst estimates by 4.4%. Meanwhile, Agilysys posted a 15.6% revenue increase, exceeding expectations by 1.4%. Following these announcements, Dolby’s stock rose by 1.8%, whereas Agilysys experienced a 20% decline.

For a deeper dive, read our full breakdown of Dolby Laboratories’ results and Agilysys’ performance.

Market Overview and PTC’s Position

While the excitement following Trump’s November victory initially boosted major indices, concerns over possible tariffs have led to a market reversal in 2025. Despite some strong showings among vertical software companies, the sector as a whole has lagged, with share prices dropping an average of 12.2% over the past month. PTC’s stock has declined by 9.3% during this period, and analysts currently have an average price target of $205.61, compared to its present price of $156.93.

Spotlight on Thematic Investing

At StockStory, we recognize the value of investing in powerful trends. Companies like Microsoft, Alphabet, Coca-Cola, and Monster Beverage have all benefited from major growth drivers. In this spirit, we’ve identified a lesser-known, profitable growth stock riding the wave of AI innovation—available to you for free through this link.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

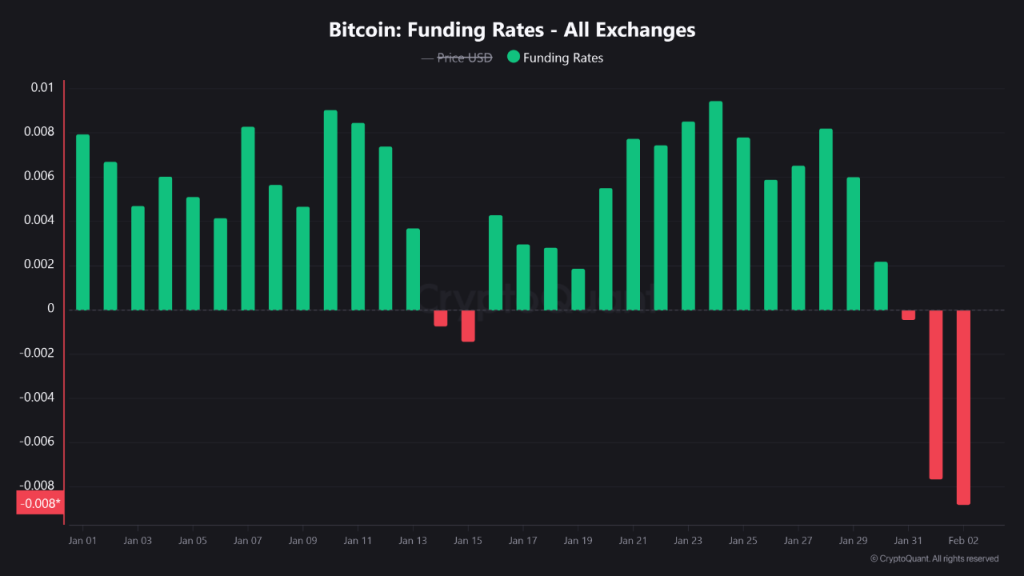

Bitcoin rebounds above $78,500; no basis for long-term rally yet: analysts

Is HBAR Price Finding a Floor Despite Market Weakness?

BTC Price Enters a Reset Phase After $74,500 Crash Shakes Market Structure

DBS Bank Ethereum Accumulation Skyrockets: Strategic $5.8M Transfer Signals Major Institutional Move