BlackRock’s GIP Partners With EQT to Pursue Acquisition of Energy Company AES

BlackRock’s GIP and EQT Reportedly Pursue Acquisition of AES Corp.

According to sources familiar with the situation, BlackRock Inc.’s Global Infrastructure Partners (GIP) has joined forces with EQT AB in an effort to purchase AES Corp., a major provider of renewable energy for companies such as Microsoft.

Insiders indicate that the two investment groups may finalize a deal to acquire AES in the coming weeks, though discussions are ongoing and there is still a possibility that negotiations could stall or collapse. The individuals providing this information requested anonymity due to the confidential nature of the talks.

Top Stories from Bloomberg

Representatives from AES, GIP, and EQT have all declined to provide statements regarding the potential transaction.

On Tuesday, AES shares surged by up to 7.7% in premarket trading in New York. The previous day, the stock finished nearly unchanged at $14.73, resulting in a market capitalization of approximately $10.5 billion. Including its debt, AES’s total value is estimated at around $43 billion, based on Bloomberg’s data.

Last year, Bloomberg News reported that AES began considering strategic alternatives, including a possible sale, after attracting interest from infrastructure-focused investors such as GIP.

Amid rising electricity needs driven by data centers supporting artificial intelligence, utility companies have become increasingly attractive targets for acquisitions. In 2023, Blackstone Inc. agreed to purchase TXNM Energy Inc., while Constellation Energy Corp. struck a deal to acquire Calpine Corp.

Headquartered in Arlington, Virginia, AES operates a diverse portfolio that includes wind and solar power, natural gas and coal facilities, as well as utility services in Indiana and Ohio.

Reporting assistance by Mark Chediak.

Popular Reads from Bloomberg Businessweek

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pre-market: Nasdaq futures up 0.45%, Palantir up nearly 12%

Pfizer Revenue Drops Due to Ongoing Decrease in Demand for Covid-19 Medications

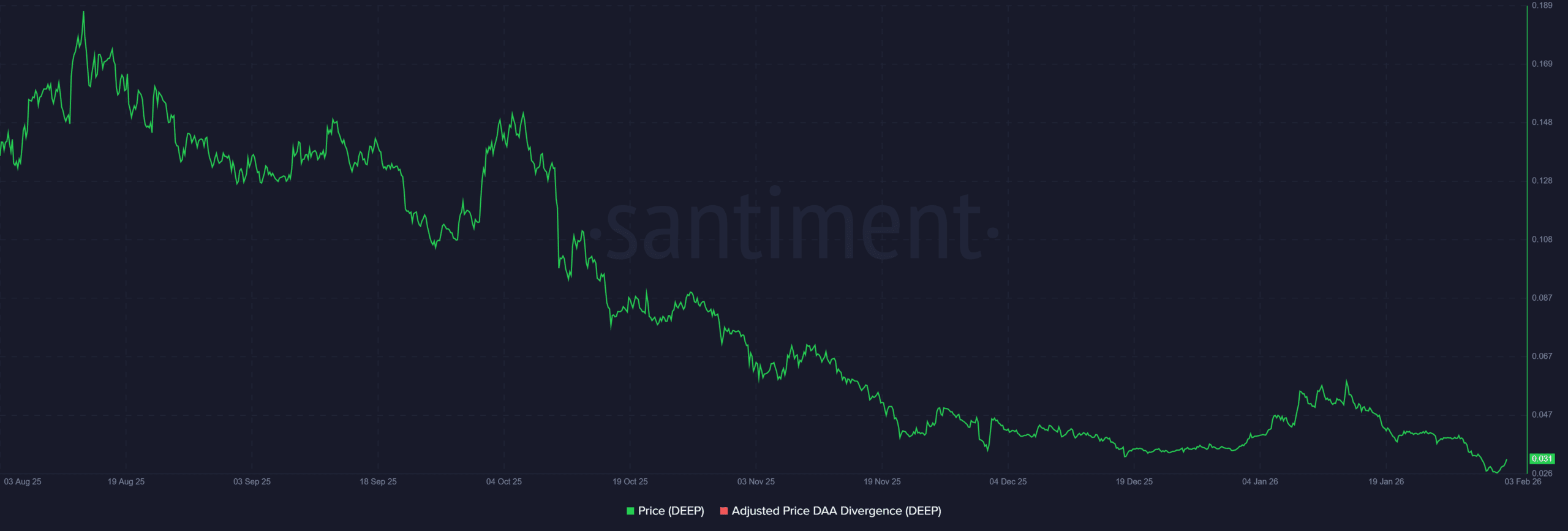

DeepBook jumps 19% in a day – Is $0.04 DEEP’s next target?

XRP at a Make-or-Break Level as Analysts Watch for Wave 4 Relief