Billions lost from ‘shadow banks’ as AI raises risk of mass defaults

AI Sparks Billions in Losses for Shadow Banking Sector

Concerns that artificial intelligence could lead to a surge in loan defaults among software companies have caused massive losses for shadow banks, with billions wiped from their value.

This week, leading American lenders with significant exposure to the technology industry have seen their market value drop by over $2 billion (£1.4 billion). Investors are worried that AI-driven solutions may put pressure on borrowers’ finances, potentially leaving them unable to meet their debt obligations.

The sell-off in software stocks intensified after Anthropic, a Silicon Valley AI company valued at $350 billion, introduced a new legal and accounting feature for its Claude chatbot. This innovation threatens to disrupt established software providers.

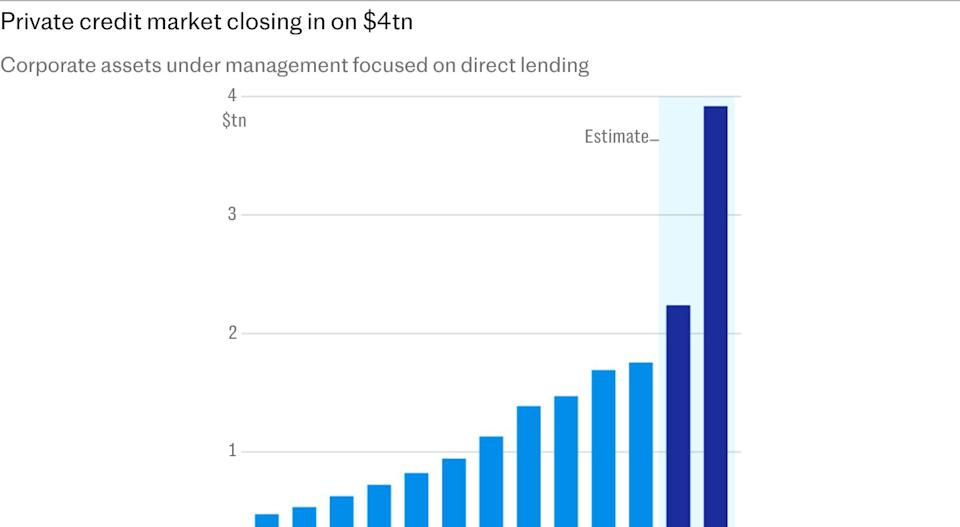

While the immediate impact has been felt in software shares, investor anxiety is mounting over the $2 trillion shadow banking industry’s vulnerability, given its extensive lending to tech firms.

The S&P Business Development Companies index, which monitors 44 private credit funds, has lost around $2.2 billion in value since Monday amid fears of turmoil in the software sector.

Hercules Capital, a private lender managing $5.5 billion, experienced the steepest decline, with its shares tumbling 8.4%. The fund has significant exposure to software and technology companies that could be affected by AI advancements.

Blue Owl Capital, a major player in private credit, also suffered, with its share price dropping 6.9%. Its tech-focused fund, Blue Owl Technology Finance, fell by 6.6% as well.

Blue Owl’s emphasis on software investments has heightened investor concerns.

AI Disruption Raises Alarms in Private Credit

Shadow banking has come under increased scrutiny following the collapse of two large US firms, Tricolor and First Brands, last year. These failures raised questions about the sector’s lending standards.

After these incidents, JP Morgan CEO Jamie Dimon warned that many more hidden risks—or “cockroaches”—could be lurking within private credit funds.

UBS has projected that AI-related disruptions could push default rates in private credit up to 13%.

The bank estimates that between 25% and 33% of the private credit market is at risk from AI, especially among companies connected to technology services.

Anthropic’s latest offering is a plugin for its Claude Cowork platform, designed to assist with legal, marketing, finance, data analysis, and customer support tasks.

Unlike traditional chatbots, these advanced AI “agents” can perform complex tasks with minimal input, automatically generating documents and presentations by accessing data stored on a user’s device.

Software Sector Faces Existential Threat

In the UK, shares of companies specializing in routine business software—such as SAP, Sage, and Relx—have seen sharp declines. These firms develop tools for accounting, legal work, data entry, and digital marketing, all of which are now threatened by AI-driven automation.

Investor Sentiment and Industry Outlook

Apprehension about the sector’s ability to deliver strong returns has been growing alongside advancements in artificial intelligence, even before Anthropic’s latest tool was announced.

At a conference in Toronto last autumn, John Zito, co-president of Apollo Asset Management, cautioned that the greatest risk for private company investors wasn’t tariffs, interest rates, or inflation, but rather the decline of the software industry itself.

Isaac Kim, former head of technology private equity at Elliot Investment Management, echoed this sentiment in a recent LinkedIn post, stating, “Technology private equity, as it exists today, is finished. In much of enterprise software, AI is replacing outdated systems, and the days of guaranteed 5% to 10% growth are over.”

The S&P Business Development Companies index, which tracks firms that pool private credit loans, is a key benchmark for the direct lending market. This week, the index hit multi-year lows as investors reassessed their software exposure.

Recently, The Telegraph reported that the private credit sector is under scrutiny by regulators amid concerns that risky lending could trigger a broader financial crisis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$100M Backed ZKP Crypto Goes Viral Over Mutuum Finance & Bitcoin Hyper in February [Best Crypto to Buy Now]

![$100M Backed ZKP Crypto Goes Viral Over Mutuum Finance & Bitcoin Hyper in February [Best Crypto to Buy Now]](https://img.bgstatic.com/spider-data/cf133517c38c398cb05d6abc39d9c1ed1770314441360.jpg)

Anthropic releases AI upgrade as market punishes software stocks

Bitcoin's rising leveraged position points to continued dip buying, but may not yet signal price bottom

Here is what industry veterans are saying as bitcoin tumbles below $70,000