Do Wall Street analysts have a positive outlook on Zoetis shares?

Zoetis Inc.: A Closer Look at Performance and Analyst Sentiment

Zoetis Inc. (ZTS), valued at approximately $56.3 billion, stands as a global leader in animal health. The company, headquartered in Parsippany, New Jersey, specializes in the research, development, production, and distribution of a wide array of medicines, vaccines, diagnostic tools, and precision health solutions for both livestock and pets.

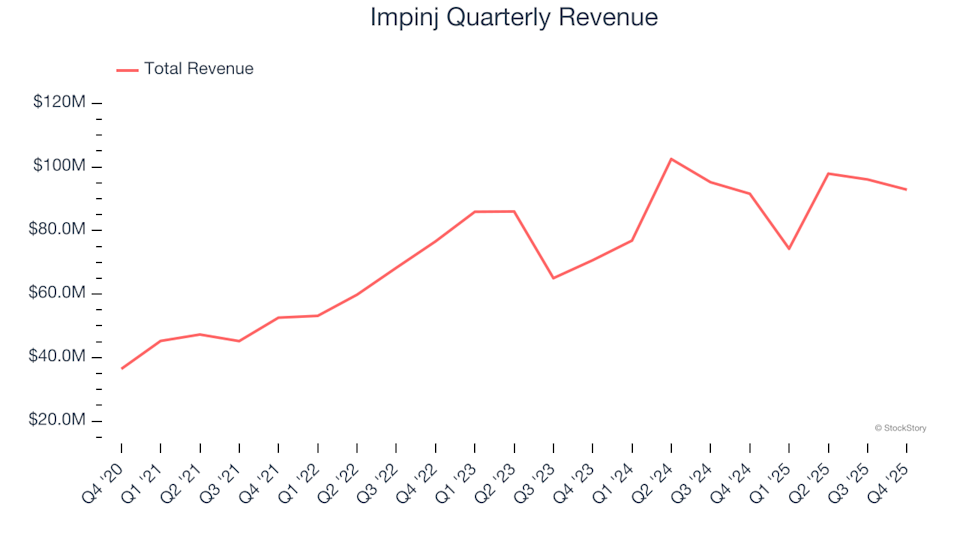

Over the past year, Zoetis shares have lagged behind the broader market. The stock has dropped 27.5% in the last 52 weeks, while the S&P 500 Index ($SPX) advanced by 12.2%. Despite this, ZTS has managed a modest 1.3% gain so far this year, whereas the S&P 500 has seen a slight decrease.

Related Updates from Barchart

When compared to the State Street Health Care Select Sector SPDR ETF (XLV), Zoetis has also underperformed. XLV gained 5.4% over the last year and is up 1.1% year-to-date.

Several factors have contributed to Zoetis’ recent stock decline. Concerns about the safety and sales slowdown of key companion-animal products—major revenue contributors—have dampened investor confidence. These products have faced increased regulatory attention, resulting in slower growth. Additionally, rising competition and a lack of significant new product launches in the near term have weighed on the share price.

In the third quarter of 2025, Zoetis posted revenue of around $2.4 billion, reflecting a modest 1% increase compared to the same period last year.

Looking ahead, analysts project Zoetis’ earnings per share (EPS) to rise by 7.1% year-over-year to $6.34 for fiscal 2025. The company has a strong track record of exceeding earnings expectations, having outperformed consensus estimates in each of the last four quarters.

Of the 17 analysts tracking Zoetis, the consensus is a “Moderate Buy.” This includes eight “Strong Buy” recommendations, one “Moderate Buy,” and eight “Hold” ratings.

This outlook is less optimistic than it was three months ago, when there were 11 “Strong Buy” ratings and the consensus was a “Strong Buy.”

On January 22, 2026, Piper Sandler’s David Westenberg downgraded Zoetis from “Overweight” to “Neutral” and reduced the price target from $190 to $135.

The average analyst price target stands at $152.27, which is about 20.2% above the current share price. The highest target on Wall Street is $200, suggesting a potential upside of 57.8%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights

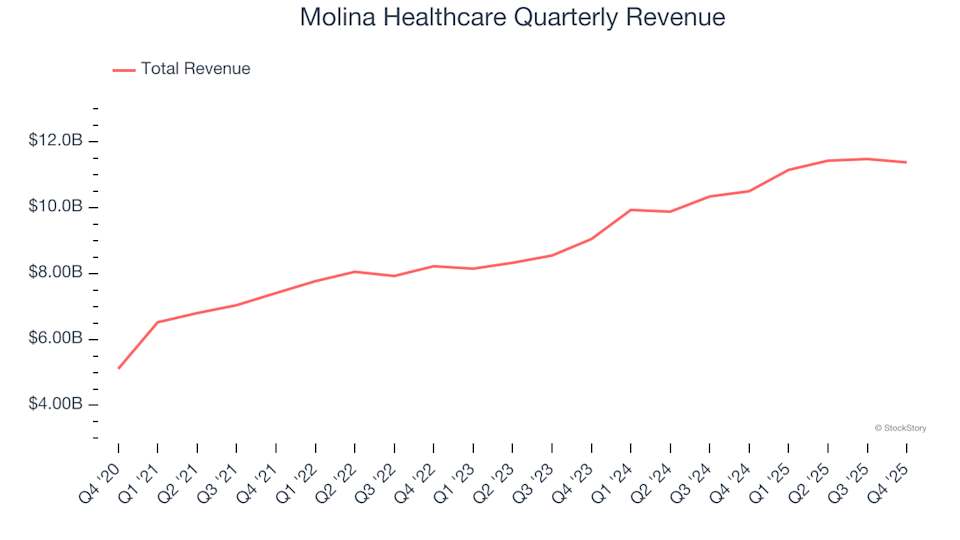

Molina Healthcare (NYSE:MOH) Reports Q4 CY2025 Revenue Surpassing Expectations, Yet Shares Fall by 33.4%

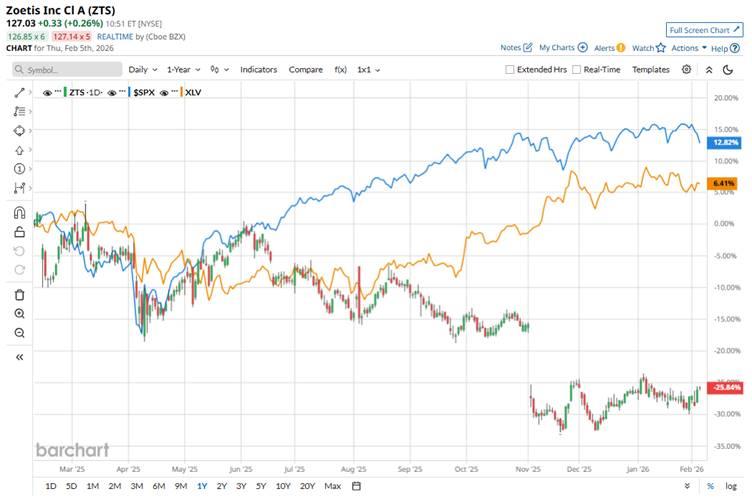

Impinj (NASDAQ:PI) Delivers Q4 Results Meeting Projections, Yet Shares Fall 18.4%