A $3 Billion Motive to Invest in This Unique Rare Earths Stock

USA Rare Earth Secures Major Backing from U.S. Government

USA Rare Earth (USAR), a critical minerals startup based in Oklahoma, has received significant support from the U.S. government at a pivotal moment. The company recently finalized a groundbreaking $1.6 billion agreement with the Commerce Department, which includes both federal loans and equity participation.

- This government partnership is complemented by a $1.5 billion private funding round that was heavily oversubscribed, bringing USAR’s total available capital to approximately $3.1 billion to advance its mine-to-magnet operations.

This development coincides with President Donald Trump’s introduction of Project Vault, a new strategic minerals reserve aimed at safeguarding American industries from future supply disruptions.

Related Updates from Barchart

Reducing Dependence on China

This initiative is part of a larger movement to revitalize the U.S. critical minerals sector. Currently, China dominates nearly 60% of rare earth mining and over 90% of magnet production worldwide, creating a bottleneck that threatens both American economic and national security.

Barbara Humpton, CEO of USA Rare Earth, emphasized the urgency: “Establishing a reliable domestic supply chain for these materials is essential, and our company is making rapid progress toward that goal,” she said during a recent analyst call.

The government’s financial package is structured as follows:

- $277 million in direct federal incentives and a $1.3 billion senior secured loan.

- In return, the Commerce Department will receive 16.1 million common shares and 17.6 million warrants, potentially giving taxpayers an 8% to 16% ownership stake, depending on warrant exercise.

Funding Structure and Oversight

Unlike traditional grants, this funding is not provided upfront. Instead, USA Rare Earth will receive funds in stages, contingent on meeting specific operational milestones between 2026 and 2028.

Humpton explained to CNBC that the Commerce Department designed this approach to ensure public investment follows private sector commitments, minimizing taxpayer risk.

Chief Financial Officer Rob Steele noted that most of the funding is expected to be distributed during the current administration, provided the company meets its goals. This milestone-based system ensures continued government support only if USAR delivers as promised.

Building a Complete Rare Earth Supply Chain

USA Rare Earth is developing an integrated mine-to-magnet platform, covering several critical stages:

- Mining: The Round Top deposit in Sierra Blanca, Texas, contains 15 of the 17 rare earth elements, with a particular abundance of heavy rare earths like dysprosium and terbium, as well as gallium, hafnium, and zirconium—key materials for semiconductor production. Originally slated for 2030, commercial output is now expected by late 2028, thanks to successful pilot extraction tests.

- Metals Production: Through its acquisition of Less Common Metals (LCM) in November, USAR now controls the only proven producer of both light and heavy rare earth metals outside China. LCM is building a new facility in Lacq, France, with a planned annual capacity of 3,750 metric tons, supported by the French government.

- Magnet Manufacturing: The company’s Stillwater, Oklahoma plant is set to begin commissioning this quarter, aiming for 10,000 metric tons of annual magnet production by June 2030.

“We’ve validated the extraction process and are now scaling up our demonstration facility,” Humpton told CNBC. “Early this year, we’ll be processing samples from the site and sharing results.”

Strong Financial Outlook

Steele outlined an ambitious growth plan, projecting the company will reach key financial milestones ahead of expectations:

- Gross profit breakeven anticipated in 2027, EBITDA breakeven in 2028, and positive cash flow by 2029.

- By 2030, USAR forecasts $2.6 billion in revenue, $1.2 billion in EBITDA, and $900 million in free cash flow.

- These projections are based on neodymium-praseodymium oxide prices of about $125 per kilogram, exceeding the $110 price floor secured by MP Materials in its Pentagon contract.

- Unlike some competitors, USAR’s agreement does not include price floors or guaranteed offtake arrangements.

Steele explained that the minerals USAR produces are in severe shortage outside China and are essential for industries such as semiconductors, aerospace, and defense. For example, dysprosium currently sells for $900 per kilogram, terbium for $3,500, and hafnium for $1,500. Last year, non-Chinese sources supplied only a fraction of the global demand for dysprosium, which stands at around 2,000 metric tons annually.

Remaining Hurdles and Growing Momentum

USAR still needs to secure an additional $600 million in funding beyond what has already been announced. Steele expressed confidence that this will come from strategic or institutional investors, given the project’s attractive returns.

The company has also warned investors about potential execution risks in its SEC filings. Although the Round Top project has long attracted interest, it has yet to achieve commercial production, and there is a possibility of delays or operational challenges.

Nevertheless, Humpton remains optimistic, highlighting the company’s steady progress from simulation to pilot testing. The involvement of engineering firms Fluor and WSP is expected to help speed up construction.

Analyst Perspectives on USAR Stock

Among six analysts covering USAR, five rate the stock as a “Strong Buy,” while one suggests a “Hold.” The average price target is $37, well above the current price of $23.53.

For those interested in the rare earth sector, USAR’s substantial funding announcement demonstrates the U.S. government’s commitment to rebuilding domestic capacity for critical minerals.

Whether USAR can deliver on its ambitious schedule will determine if it becomes a key player in America’s rare earth supply chain alongside MP Materials.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights

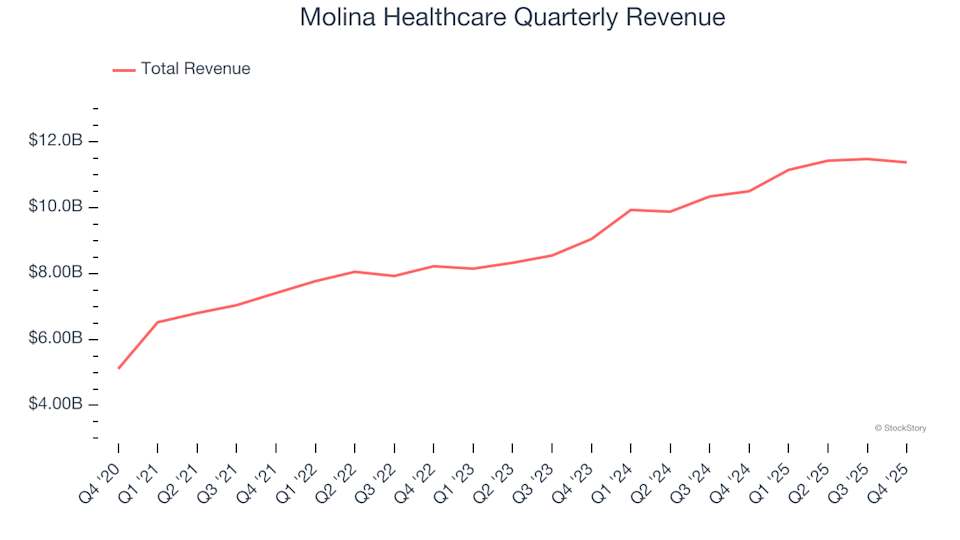

Molina Healthcare (NYSE:MOH) Reports Q4 CY2025 Revenue Surpassing Expectations, Yet Shares Fall by 33.4%

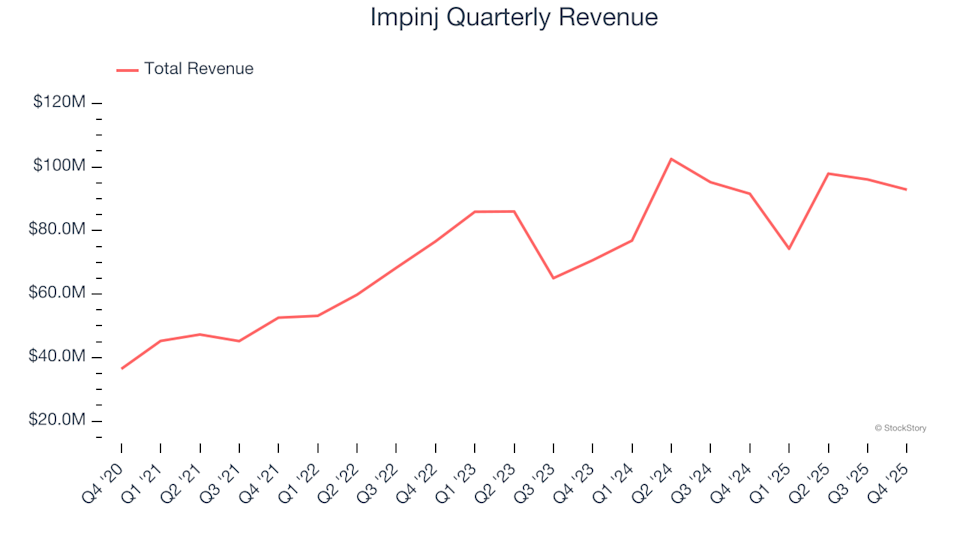

Impinj (NASDAQ:PI) Delivers Q4 Results Meeting Projections, Yet Shares Fall 18.4%