Corpay (CPAY) Shares Rise—Here’s What’s Driving the Increase

Corpay Surges After Impressive Earnings Report

Corpay (NYSE:CPAY), a leader in business payment solutions, saw its stock price climb 11.8% during afternoon trading following the release of its fourth-quarter financial results, which exceeded market expectations. The company also shared an optimistic forecast for 2026, further boosting investor confidence.

For the quarter, Corpay reported a 20.7% year-over-year increase in revenue, reaching $1.25 billion and slightly surpassing analyst predictions. Adjusted earnings came in at $6.04 per share, outpacing estimates as well. Looking ahead, Corpay anticipates full-year 2026 revenue between $5.215 billion and $5.315 billion, and expects adjusted earnings per share to range from $25.50 to $26.50. Both midpoints of these projections are above Wall Street’s consensus.

Market Reaction and Analyst Insights

Corpay’s stock typically experiences limited volatility, with only eight instances of price swings greater than 5% over the past year. This recent surge is unusual for the company and highlights the significant impact of the latest news on investor sentiment.

The last notable price movement occurred 15 days ago, when Corpay shares rose 2.9% after Jefferies increased its price target from $335 to $370 while reiterating a Buy recommendation.

This upward revision reflected analysts’ positive outlook for Corpay’s prospects. FactSet data shows that the company holds an average analyst rating of “overweight” and a mean price target of $359.57. Additionally, Corpay recently published a report highlighting the gap between finance teams’ desire for automation and their reliance on manual processes. The company’s Corpay Complete platform aims to bridge this divide by integrating payments, expense management, and supplier oversight.

Since the start of the year, Corpay shares have gained 11.5%. At $335.04 per share, the stock remains 14% below its 52-week peak of $389.55, reached in February 2025. An investor who purchased $1,000 of Corpay stock five years ago would now see that investment grow to $1,302.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights

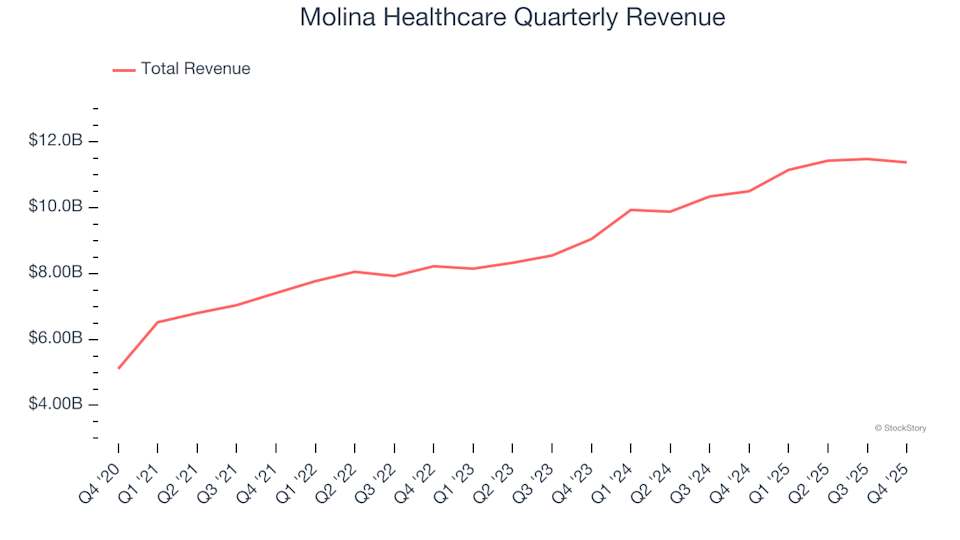

Molina Healthcare (NYSE:MOH) Reports Q4 CY2025 Revenue Surpassing Expectations, Yet Shares Fall by 33.4%

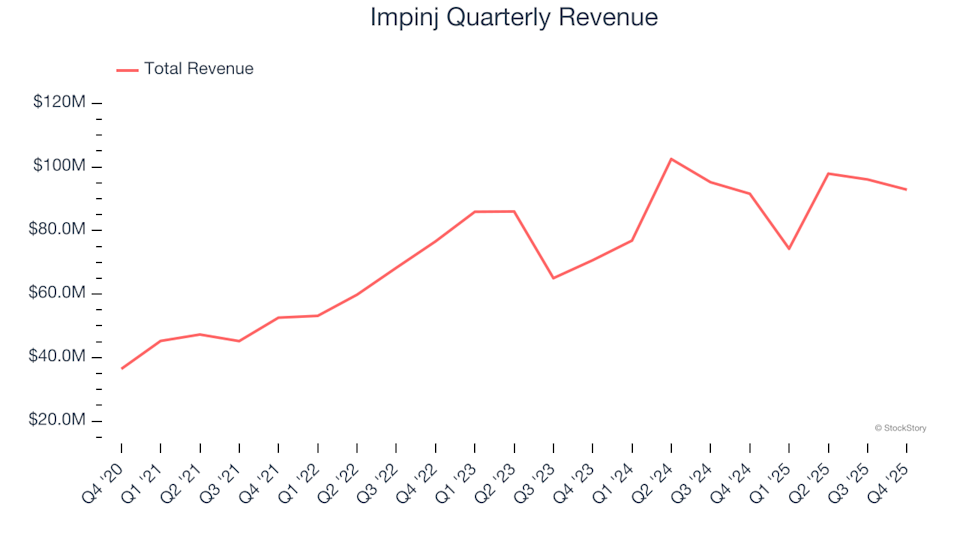

Impinj (NASDAQ:PI) Delivers Q4 Results Meeting Projections, Yet Shares Fall 18.4%