Why Cummins (CMI) Stock Is Dropping Today

Cummins Shares Drop After Disappointing Earnings

Shares of Cummins (NYSE:CMI), a leading engine manufacturer, experienced a sharp 12% decline during afternoon trading following the release of its fourth-quarter financial results. Although the company exceeded revenue expectations, its profits fell well short of forecasts, which weighed heavily on investor sentiment.

Cummins reported earnings per share of $4.27, which was nearly 15% below the $5.02 anticipated by analysts. Despite this, the company’s revenue climbed 1.1% year-over-year to $8.54 billion, surpassing the projected $8.11 billion. The disappointing earnings were largely attributed to a drop in gross profit margin, which slipped to 22.9% from 25.4% in the same period last year. Investors responded negatively, focusing more on the earnings miss and shrinking margins than on the positive sales figures.

Market reactions can sometimes be exaggerated, and significant price declines may create attractive entry points for quality stocks. Considering this, is now a good time to invest in Cummins?

Market Response and Recent Volatility

Cummins stock is typically stable, with only seven instances of price swings greater than 5% over the past year. Such a significant move is unusual for the company, highlighting the impact of the recent earnings announcement on market perception.

The most notable price change in the last year occurred about two months ago, when Cummins shares rose 4.8% after the Federal Reserve lowered its benchmark interest rate by 0.25 percentage points, signaling a more supportive monetary policy stance.

This policy shift, along with dovish comments from Chair Jerome Powell and the Federal Open Market Committee (FOMC), fueled rallies in both the Dow Jones Industrial Average and the S&P 500. The market’s optimism was driven by several factors, including the Fed’s decision to expand its balance sheet through short-term bond purchases, which increased liquidity and reduced short-term Treasury yields. Additionally, the Fed’s updated language indicated a greater focus on supporting economic growth rather than solely maintaining a tight labor market. While the official forecast called for just one rate cut in the coming year, traders quickly anticipated more aggressive easing, expecting at least two reductions. This widespread belief in continued low borrowing costs and the near certainty that rate hikes were off the table boosted stock valuations and fueled a strong market rally.

Cummins Stock Performance and Long-Term Perspective

Since the start of the year, Cummins shares have gained 1.2%. However, at $528.26 per share, the stock remains 12.8% below its 52-week high of $605.63 reached in February 2026. An investor who purchased $1,000 worth of Cummins stock five years ago would now see that investment grow to $2,300.

The 1999 book Gorilla Game accurately predicted the dominance of Microsoft and Apple in the tech sector by identifying early platform leaders. Today, enterprise software companies integrating generative AI are emerging as the next industry giants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights

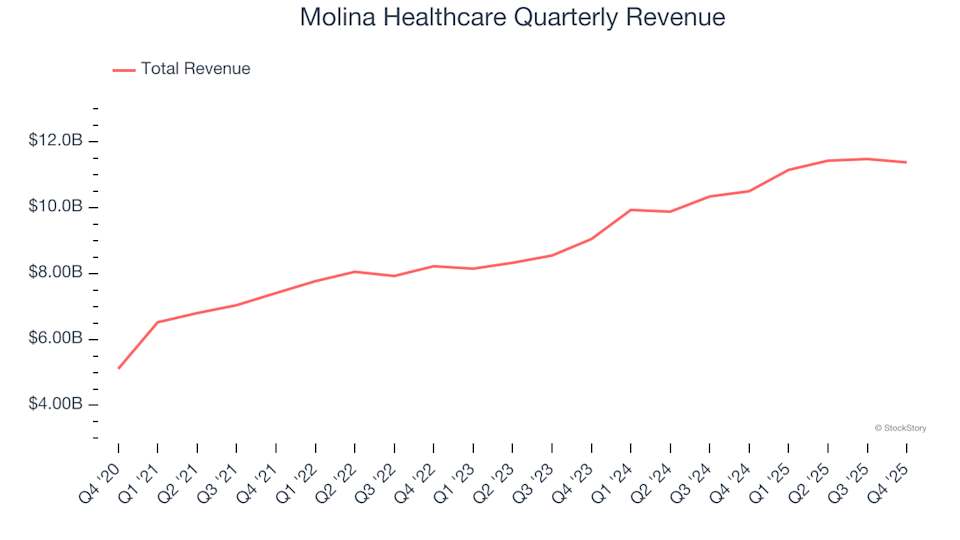

Molina Healthcare (NYSE:MOH) Reports Q4 CY2025 Revenue Surpassing Expectations, Yet Shares Fall by 33.4%

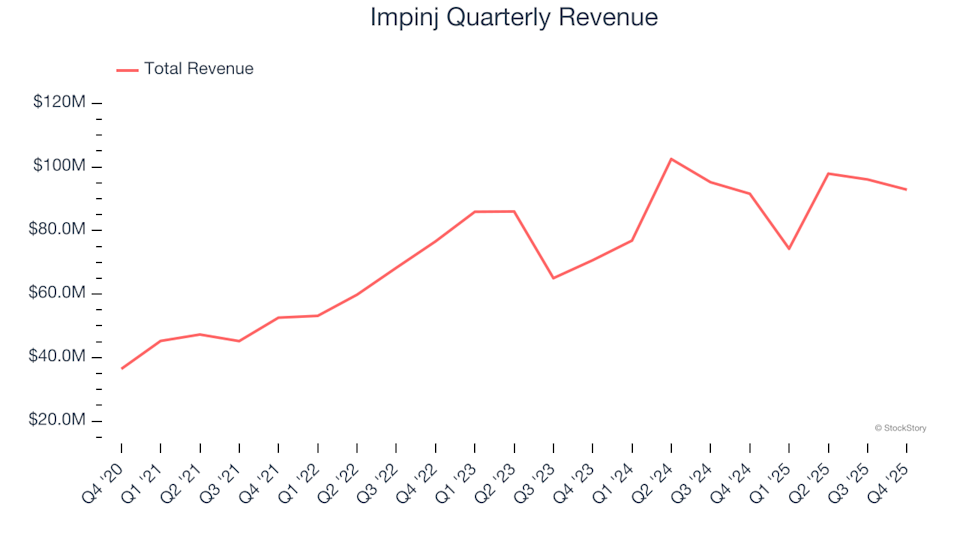

Impinj (NASDAQ:PI) Delivers Q4 Results Meeting Projections, Yet Shares Fall 18.4%