Arm shares rise as analysts downplay risks from smartphone demand

Arm Holdings (NASDAQ: ARM) shares rose today after the company reported mixed but overall positive third-quarter results, along with an optimistic AI-driven outlook. However, investors are still weighing its lower-than-expected licensing revenue and industry headwinds. Below are key news items that may impact the stock's performance.

Positive Sentiment:

Q3 results beat expectations—ARM reported earnings per share of $0.43 and revenue of $1.24 billion, both surpassing market expectations and showing strong year-over-year growth, which boosted market sentiment.

Source: Why Arm Holdings Stock Is Up Today

Optimistic Q4 guidance—The company expects fourth-quarter revenue and earnings per share to exceed market expectations, citing continued demand for Arm architecture in AI data centers. This forward-looking outlook has reinforced positive expectations for AI-related revenue.

Source: Arm Expects Quarterly Revenue to Exceed Expectations

Analyst rating upgrade—New Street Research upgraded ARM to "Buy," strengthening bullish analyst attention and likely supporting short-term buying pressure.

Source: New Street Upgrades ARM Rating

Neutral Sentiment:

Mixed analyst price target adjustments—Several institutions (Wells Fargo, Mizuho Securities, Rosenblatt) lowered their price targets, but most maintained Outperform/Overweight/Buy ratings. Overall, analysts remain positive, though valuation views are more conservative.

Source: Analyst Price Target Adjustments

Negative Sentiment:

Licensing revenue slightly below expectations—Licensing revenue came in just under expectations, causing the stock to fall in after-hours trading. Licensing is a high-margin and performance-sensitive business line, so investors are closely watching its profit sustainability.

Source: Licensing Revenue Miss Triggers Stock Drop

Smartphone market faces headwinds—Memory shortages and reduced production by original equipment manufacturers could limit next year's smartphone shipments and royalty growth, directly threatening ARM's royalty income stream.

Source: Memory Shortages Pressure Chipmakers

Mixed market reaction to guidance and margins—Some commentary described the Q4 guidance as "in line with expectations." Although overall revenue beat expectations, this has dampened market enthusiasm.

Source: Arm Guidance Called In Line with Expectations

Investor takeaway: Despite licensing revenue slightly missing expectations and facing headwinds in the smartphone/memory market, positive sentiment driven by AI demand and better-than-expected results/optimistic guidance prevails, pushing the stock price higher. Future trends will depend on upcoming commentary (Arm Everywhere event) and analyst responses to the licensing business and smartphone trends.

Editor: Zhang Jun SF065

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights

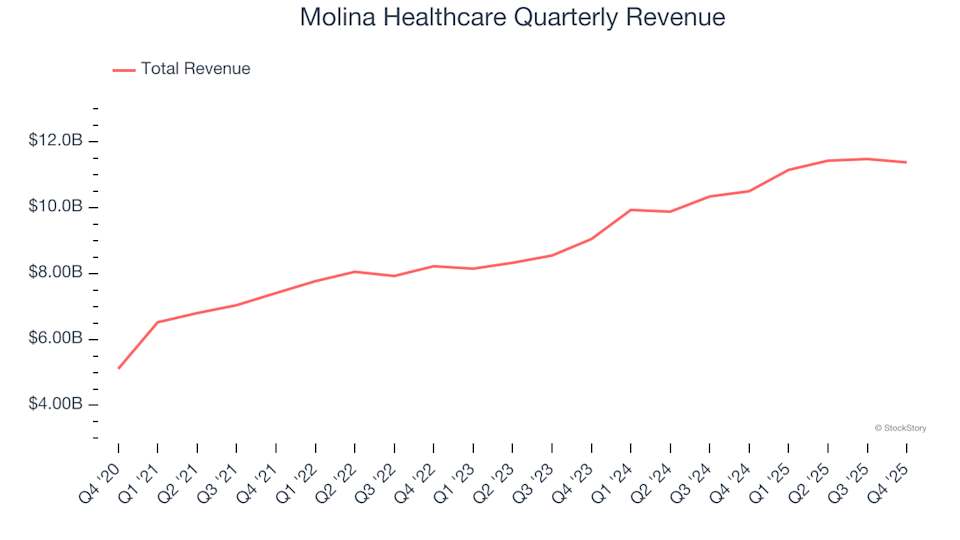

Molina Healthcare (NYSE:MOH) Reports Q4 CY2025 Revenue Surpassing Expectations, Yet Shares Fall by 33.4%

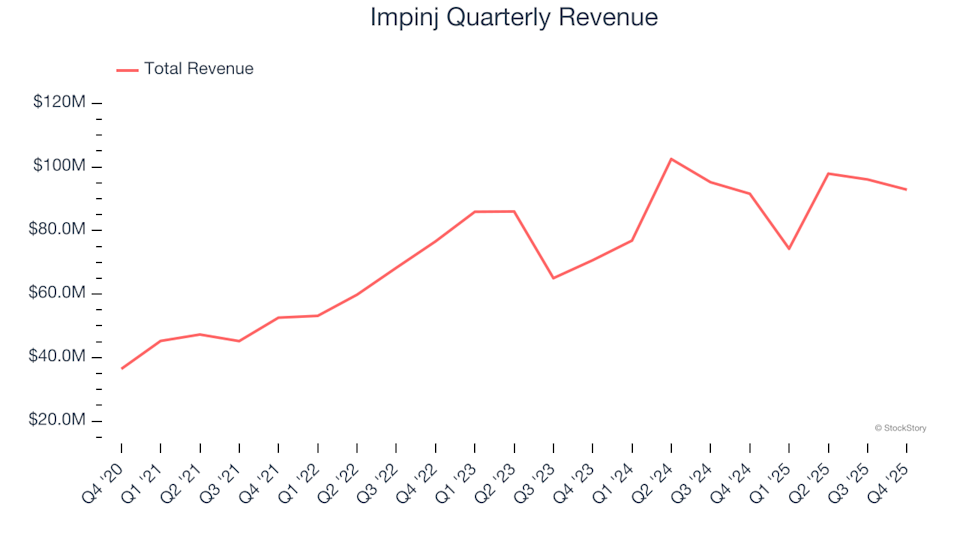

Impinj (NASDAQ:PI) Delivers Q4 Results Meeting Projections, Yet Shares Fall 18.4%