Cencora (COR) Shares Rise, Here’s the Reason

Cencora's Stock Surges After Strong Earnings and Upgraded Outlook

Cencora (NYSE:COR), a major healthcare distributor, saw its shares climb by 7.1% during afternoon trading following the release of its first-quarter financial results, which surpassed profit forecasts and included an improved outlook for the full year.

In the latest quarter, Cencora reported adjusted earnings per share of $4.08, exceeding analysts’ expectations of $4.04. While revenue reached $85.93 billion—just shy of the anticipated $86.03 billion—the company’s upward revision of its fiscal 2026 guidance captured investor attention. Cencora now projects consolidated revenue growth between 7% and 9%, and expects consolidated operating income to increase by 11.5% to 13.5%. These updates reflect both the company’s recent performance and the successful acquisition of OneOncology.

Market Reaction and Recent Stock Movements

Cencora’s stock typically experiences low volatility, with only two instances in the past year where price swings exceeded 5%. Today’s notable jump suggests that investors view the latest developments as significant, though not necessarily transformative for the company’s long-term prospects.

One of the most notable movements in the past year occurred five months ago, when Cencora’s shares rose 4.5%. This rally followed news that competitor McKesson had raised its long-term earnings growth outlook, which lifted sentiment across the pharmaceutical distribution industry. During its Investor Day, McKesson increased its long-term Adjusted Earnings per Diluted Share growth target to 13%-16%, up from 12%-14%. This optimistic projection from a key industry player appeared to boost confidence in the sector as a whole, including for Cencora.

Since the start of the year, Cencora’s stock has gained 4.3%. Currently trading at $353.35 per share, it is approaching its 52-week high of $374.75, set in November 2025. An investor who purchased $1,000 worth of Cencora shares five years ago would now see that investment grow to $3,221.

Industry Trends and Future Opportunities

Back in 1999, the book Gorilla Game accurately predicted that Microsoft and Apple would become dominant forces in technology by identifying early platform leaders. Today, enterprise software companies integrating generative AI are emerging as the next industry giants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights

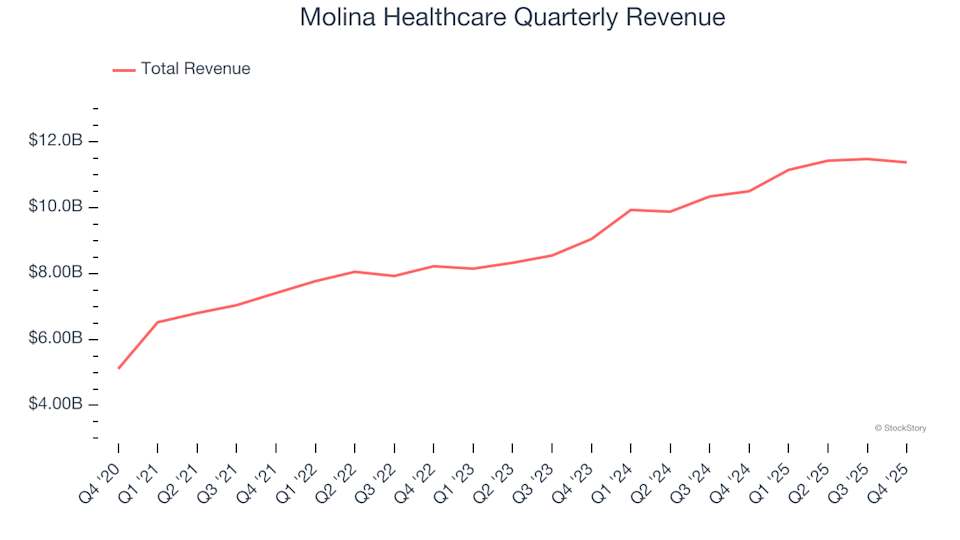

Molina Healthcare (NYSE:MOH) Reports Q4 CY2025 Revenue Surpassing Expectations, Yet Shares Fall by 33.4%

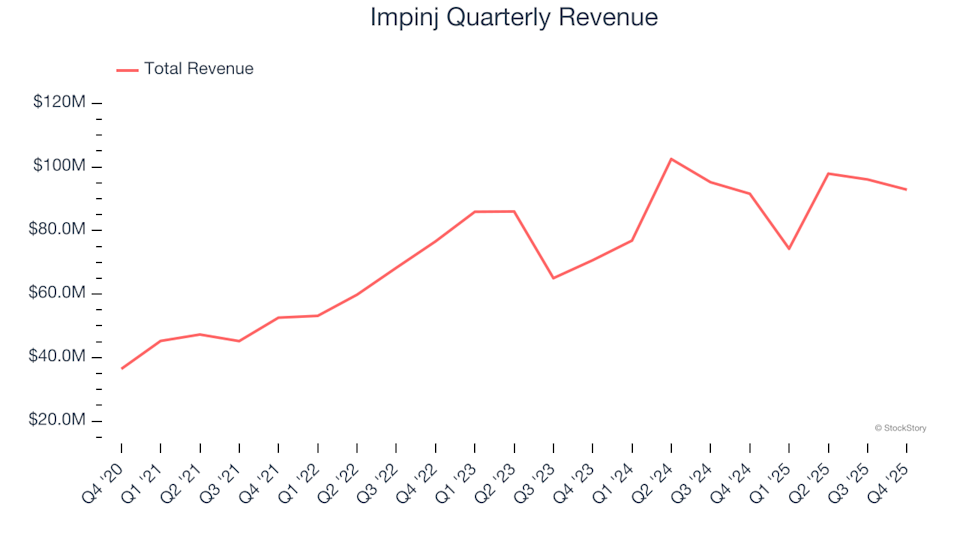

Impinj (NASDAQ:PI) Delivers Q4 Results Meeting Projections, Yet Shares Fall 18.4%