Why CrowdStrike (CRWD) Stock Is Plummeting Today

Recent Developments Impacting CrowdStrike

Shares of CrowdStrike (NASDAQ:CRWD), a leading cybersecurity company, dropped by 7.2% during the afternoon trading session. This decline followed heightened discussions about artificial intelligence potentially replacing traditional software, spurred by the unveiling of new AI models from Anthropic and OpenAI.

The concurrent launches of Anthropic's Claude Opus 4.6 and OpenAI's "Frontier" agent platform have sparked fears that autonomous AI agents are evolving beyond simple tools to become comprehensive operating systems. This shift could mean that many specialized software solutions may be reduced to features within these advanced AI models, challenging the relevance of traditional software licensing based on user seats.

The main driver behind these concerns is the remarkable capability of the latest AI models. For example, Opus 4.6 can independently review and update intricate codebases, while OpenAI's Frontier platform can handle enterprise tasks without relying on conventional CRM or ticketing systems. By transforming complex business processes into affordable API services, these innovations threaten the recurring revenue streams of established software providers. As AI increasingly creates custom tools on demand, investors are rapidly reassessing the value of the entire software sector.

Market reactions to such news can be extreme, and significant price drops sometimes present attractive opportunities to invest in strong companies. If you’re considering whether now is a good time to invest in CrowdStrike,

Market Sentiment and Recent Stock Movements

CrowdStrike’s stock price is known for its volatility, having experienced 16 swings of more than 5% over the past year. Today’s decline suggests investors view the latest AI developments as significant, but not as a fundamental threat to the company’s long-term prospects.

Just ten days ago, CrowdStrike’s shares rose by 3.4% after analysts continued to upgrade their outlook on the company. Notably, Rahul Chopra from Berenberg upgraded the stock from Hold to Buy, citing its attractive valuation and highlighting CrowdStrike as one of the few software firms capable of maintaining industry-leading growth, thanks to its unified platform. Berenberg also saw the current share price as a favorable entry point for investors. Additionally, the market has been responding to CrowdStrike’s expansion into Identity Security, including its recent agreements to acquire SGNL (for approximately $740 million) and Seraphic Security. Analysts believe these acquisitions address important product gaps and strengthen CrowdStrike’s competitive position against rivals like Palo Alto Networks.

Performance Overview and Industry Insights

Since the start of the year, CrowdStrike’s stock has fallen by 16.2%. At $380.30 per share, it currently trades 31.8% below its 52-week high of $557.53, reached in November 2025. Investors who purchased $1,000 worth of CrowdStrike shares five years ago would now see their investment grow to $1,701.

While much attention is focused on Nvidia’s record highs, a lesser-known semiconductor company is quietly excelling in a crucial area of AI technology that industry leaders depend on.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights

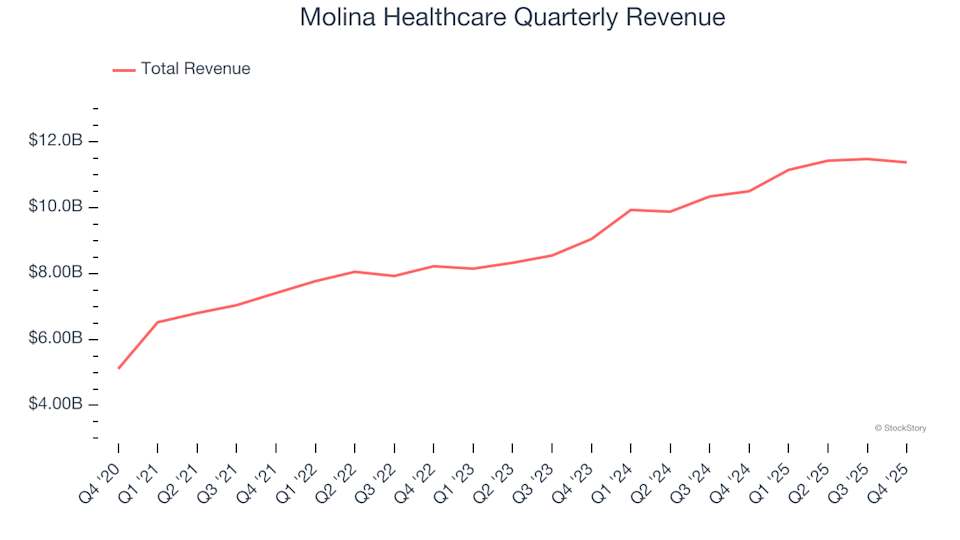

Molina Healthcare (NYSE:MOH) Reports Q4 CY2025 Revenue Surpassing Expectations, Yet Shares Fall by 33.4%

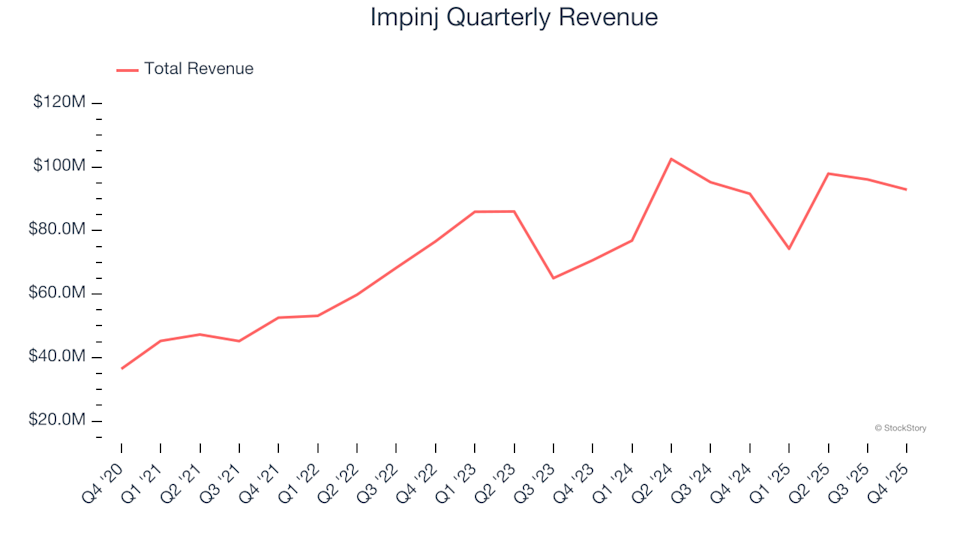

Impinj (NASDAQ:PI) Delivers Q4 Results Meeting Projections, Yet Shares Fall 18.4%