Why Palantir Technologies (PLTR) Stock Is Falling Today

Recent Developments Impacting Palantir Technologies

Palantir Technologies (NASDAQ:PLTR), a leader in data analytics, saw its stock price drop by 6.5% during the afternoon session. This decline followed heightened speculation about artificial intelligence potentially replacing traditional software, spurred by the unveiling of new AI models from Anthropic and OpenAI.

The launch of Anthropic’s Claude Opus 4.6 alongside OpenAI’s new "Frontier" agent platform has sparked debate about the future of software. These advanced AI agents are being viewed not just as tools, but as emerging operating systems that could disrupt the conventional software landscape. There is growing concern that specialized software applications may become simple features within these powerful AI models, making traditional licensing models less relevant.

The driving force behind this shift is the exceptional capability of these new AI models. Opus 4.6, for example, can autonomously review and update complex codebases, while OpenAI’s Frontier platform is designed to handle enterprise tasks directly, bypassing standard CRM and ticketing systems. By transforming complex business processes into affordable API services, these innovations threaten the recurring revenue streams of established software companies. As AI becomes capable of creating custom tools on demand, the software market is undergoing a rapid reevaluation.

Stock prices often react sharply to news, and significant declines can sometimes offer attractive entry points for investors seeking quality companies. Considering the current situation, is this a good moment to invest in Palantir Technologies?

Market Reaction and Stock Performance

Palantir’s shares are known for their volatility, with 43 instances of price swings greater than 5% over the past year. Today’s decline suggests that investors view the latest AI developments as significant, though not transformative enough to alter their overall outlook on the company.

Just 13 days ago, Palantir’s stock rose by 2.6% after a series of positive announcements, including a major contract with Hyundai in South Korea—reportedly valued in the hundreds of millions—and a new partnership to develop data centers across Europe, the Middle East, and Africa. Additionally, Citi upgraded Palantir’s stock rating, further boosting investor confidence. Historically, Palantir’s shares have tended to climb following earnings reports that surpass Wall Street expectations.

Since the start of the year, Palantir’s stock has fallen by 22.7%. At a current price of $129.79 per share, it is trading 37.4% below its 52-week high of $207.18 reached in November 2025. For perspective, an investor who put $1,000 into Palantir five years ago would now have an investment valued at $3,812.

While much of Wall Street’s attention is focused on Nvidia’s record highs, another lesser-known semiconductor company is quietly supplying a crucial AI component that industry leaders rely on.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

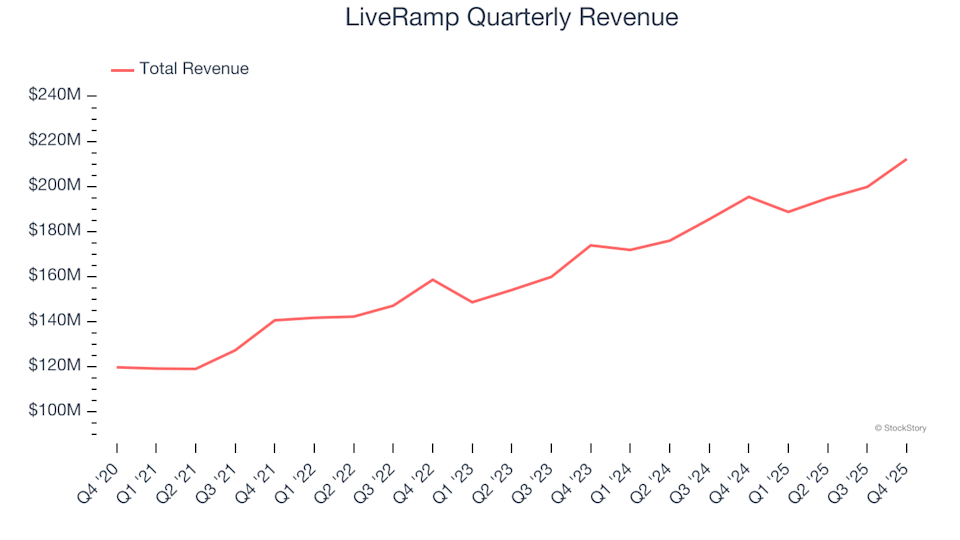

LiveRamp (NYSE:RAMP) Announces Q4 CY2025 Results Meeting Projections

Paylocity (NASDAQ:PCTY) Q4 CY2025: Revenue Surpasses Expectations

Genpact: Fourth Quarter Financial Highlights

Qualys: Fourth Quarter Financial Highlights