Amazon faces consequences after $200 billion AI investment surge

Amazon's Massive AI Investment Triggers Stock Drop

Amazon, under the leadership of Jeff Bezos, reported a 31% increase in profits last year, reaching $77.7 billion.

On Thursday evening, Amazon's stock experienced a sharp decline, extending a broader sell-off in the tech sector. This came after the company revealed plans to boost its AI infrastructure spending by $200 billion.

CEO Andy Jassy announced that Amazon's capital expenditures would rise by approximately 60% this year as its cloud division, AWS, works to maintain its competitive edge.

This announcement followed Google's disclosure that it would double its AI investment to $185 billion, intensifying the competition among tech giants.

Amazon's shares dropped by up to 10% in after-hours trading, erasing nearly $250 billion from its market capitalization.

While Amazon's annual revenue climbed 12% to $717 billion, the company warned that higher expenses could lead to lower profits in the first quarter of 2026. In recent months, Mr. Jassy has eliminated tens of thousands of positions at Amazon, resulting in $730 million in severance costs.

"Given the strong demand for our current services and emerging opportunities in AI, semiconductors, robotics, and satellite technology, we plan to invest about $200 billion in capital expenditures across Amazon in 2026. We anticipate these investments will yield significant long-term returns," said Mr. Jassy.

During a call with investors, Jassy attributed the increased spending to "exceptionally high demand" for AWS, Amazon's cloud platform.

He added, "Clients are eager to use AWS for both core and AI-related workloads, and we're scaling up capacity as quickly as possible to meet this demand."

Escalating AI Arms Race Among Tech Leaders

Major technology firms are ramping up investments in data centers, artificial intelligence, chip manufacturing, and energy infrastructure as they vie for dominance in the rapidly evolving AI landscape.

Publicly traded tech companies are projected to allocate around $500 billion to AI initiatives in 2026, with private enterprises like OpenAI and Anthropic expected to contribute billions more.

Amazon's commitment to AI spending now exceeds that of Microsoft, whose shares have fallen over 20% since its latest earnings report, resulting in a loss of roughly $1 trillion in market value.

Sam Altman, CEO of OpenAI, has stated that his company anticipates investing $500 billion in AI by 2030.

Meta, another major competitor, indicated its capital expenditures could nearly double to between $115 billion and $135 billion, a move that also led to a significant drop in its share price.

Investor Concerns and Market Impact

The surge in AI-related spending has raised concerns among investors, who worry that the returns on these massive investments may not meet expectations.

These anxieties have contributed to declines across all three major U.S. stock indices, with the Nasdaq Composite, Dow Jones Industrial Average, and S&P 500 each closing more than 1% lower on Thursday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan's biggest banks ready to increase JGB holdings despite growing losses

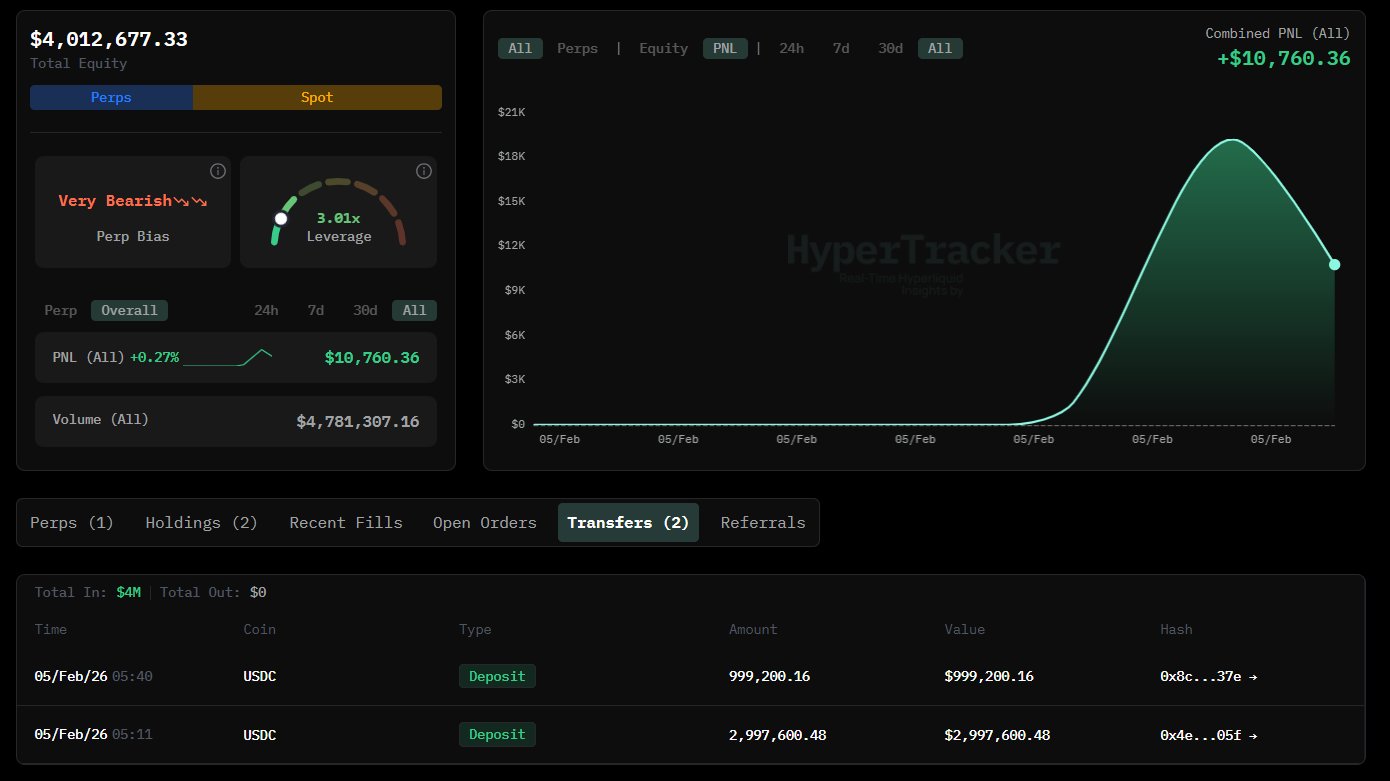

$4mln Hyperliquid whale opens 3x SOL short – Trouble ahead for Solana?

Affirm unveils a new artificial intelligence solution designed for retailers